Question: card1995 data is on https://www.ssc.wisc.edu/~bhansen/econometrics/ please answer a,b,c,d,e,f Always use heteroskedasticity-robust standard errors and test statistics. (e) can be replaced with the Staiger-Stock procedure. Exercise

card1995 data is on https://www.ssc.wisc.edu/~bhansen/econometrics/

please answer a,b,c,d,e,f

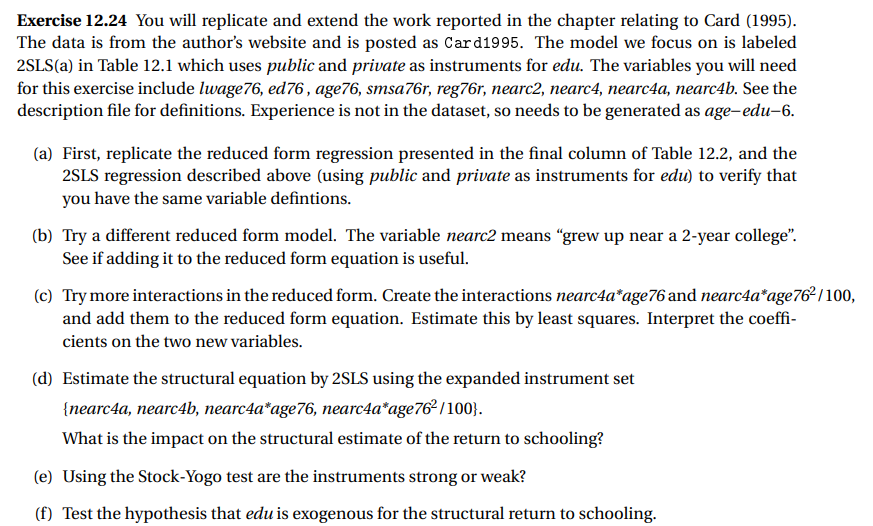

Always use heteroskedasticity-robust standard errors and test statistics. (e) can be replaced with the Staiger-Stock procedure. Exercise 12.24 You will replicate and extend the work reported in the chapter relating to Card (1995). The data is from the author's website and is posted as Card1995. The model we focus on is labeled 2SLS(a) in Table 12.1 which uses public and private as instruments for edu. The variables you will need for this exercise include lwage76, ed76, age76, smsa76r, reg76r, nearc2, nearc4, nearc4a, nearc4b. See the description file for definitions. Experience is not in the dataset, so needs to be generated as age-edu-6. (a) First, replicate the reduced form regression presented in the final column of Table 12.2, and the 2SLS regression described above (using public and private as instruments for edu ) to verify that you have the same variable defintions. (b) Try a different reduced form model. The variable nearc2 means "grew up near a 2-year college". See if adding it to the reduced form equation is useful. (c) Try more interactions in the reduced form. Create the interactions nearc4a*age76 and nearc4a*age 762/1 and add them to the reduced form equation. Estimate this by least squares. Interpret the coefficients on the two new variables. (d) Estimate the structural equation by 2SLS using the expanded instrument set \{nearc4a, nearc4b, nearc4a*age76, nearc4a*age 762/100}. What is the impact on the structural estimate of the return to schooling? (e) Using the Stock-Yogo test are the instruments strong or weak? (f) Test the hypothesis that edu is exogenous for the structural return to schooling. Always use heteroskedasticity-robust standard errors and test statistics. (e) can be replaced with the Staiger-Stock procedure. Exercise 12.24 You will replicate and extend the work reported in the chapter relating to Card (1995). The data is from the author's website and is posted as Card1995. The model we focus on is labeled 2SLS(a) in Table 12.1 which uses public and private as instruments for edu. The variables you will need for this exercise include lwage76, ed76, age76, smsa76r, reg76r, nearc2, nearc4, nearc4a, nearc4b. See the description file for definitions. Experience is not in the dataset, so needs to be generated as age-edu-6. (a) First, replicate the reduced form regression presented in the final column of Table 12.2, and the 2SLS regression described above (using public and private as instruments for edu ) to verify that you have the same variable defintions. (b) Try a different reduced form model. The variable nearc2 means "grew up near a 2-year college". See if adding it to the reduced form equation is useful. (c) Try more interactions in the reduced form. Create the interactions nearc4a*age76 and nearc4a*age 762/1 and add them to the reduced form equation. Estimate this by least squares. Interpret the coefficients on the two new variables. (d) Estimate the structural equation by 2SLS using the expanded instrument set \{nearc4a, nearc4b, nearc4a*age76, nearc4a*age 762/100}. What is the impact on the structural estimate of the return to schooling? (e) Using the Stock-Yogo test are the instruments strong or weak? (f) Test the hypothesis that edu is exogenous for the structural return to schooling

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts