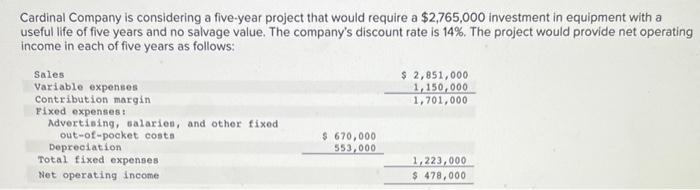

Question: Cardinal Company is considering a five-year project that would require a $2,765,000 investment in equipment with a useful life of five years and no salvage

Cardinal Company is considering a five-year project that would require a $2,765,000 investment in equipment with a useful life of five years and no salvage value. The company's discount rate is 14%. The project would provide net operating income in each of five years as follows: 8. What is the project's simple rate of return for each of the five years? (Round your answer to 2 decimal places.) 13. Assume a postaudit showed that all estimates (including total sales) were exactly correct except for the variable expense ratio, which actually turned out to be 50%. What was the project's actual net present value? (Negative amount should be indicated by a minus sign. Round intermediate calculations and final answer to the nearest whole dollar amount.) 14. Assume a postaudit showed that all estimates (including total sales) were exactly correct except for the variable expense ratio, Which actually turned out to be 50%. What was the project's actual payback period? (Round your answer to 2 decimal places.) 15. Assume a postaudit showed that all estimates (including total sales) were exactly correct except for the variable expense ratio, which actually turned out to be 50%. What was the project's actual simple rate of return? (Round your answer to 2 decimal places.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts