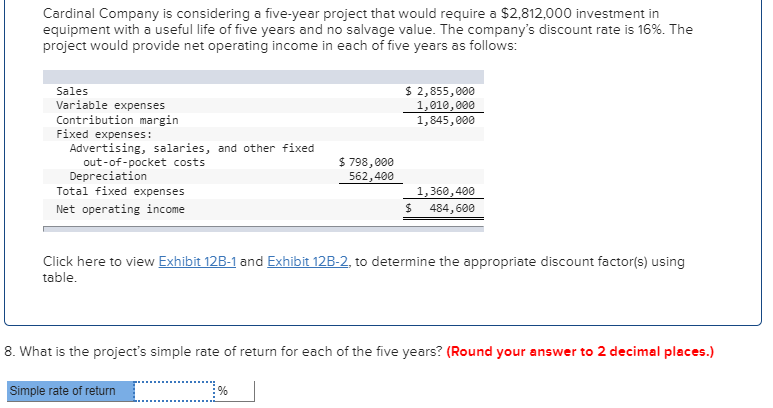

Question: Cardinal Company is considering a five-year project that would require a $2,812,000 investment in equipment with a useful life of five years and no salvage

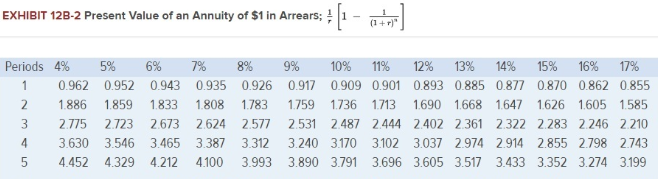

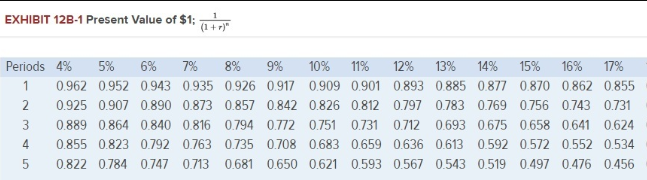

Cardinal Company is considering a five-year project that would require a $2,812,000 investment in equipment with a useful life of five years and no salvage value. The company's discount rate is 16%. The project would provide net operating income in each of five years as follows: $ 2,855,000 1,010,000 1,845,000 Sales Variable expenses Contribution margin Fixed expenses: Advertising, salaries, and other fixed out-of-pocket costs Depreciation Total fixed expenses Net operating income $ 798,000 562,400 1,360,400 484,600 $ Click here to view Exhibit 12B-1 and Exhibit 12B-2, to determine the appropriate discount factor(s) using table. 8. What is the project's simple rate of return for each of the five years? (Round your answer to 2 decimal places.) Simple rate of return % EXHIBIT 128-2 Present Value of an Annuity of S1 in Arrears; 4 1 - utol Periods 4% 1 0.962 2 1886 3 2.775 4 3.630 5 4.452 5% 6% 0.952 0.943 1.859 1.833 2.723 2673 3.546 3.465 4.329 4.212 7% 0.935 1.808 2.624 3.387 4.100 8% 0.926 1.783 2.577 3.312 3.993 9% 10% 11% 12% 13% 14% 15% 16% 17% 0.917 0.909 0.901 0.893 0.885 0.877 0.870 0.862 0.855 1759 1736 1.713 1.690 1.668 1647 1626 1.605 1585 2.531 2.487 2444 2.402 2361 2.322 2283 2246 2210 3.240 3.170 3102 3.037 2.974 2.914 2.855 2.798 2743 3.890 3.791 3.696 3.605 3.517 3.433 3.352 3.274 3.199 EXHIBIT 12B-1 Present Value of $1: 17 Periods 4% 5% 6% 7% 8% 9% 10% 11% 12% 13% 14% 15% 16% 17% 1 0.962 0.952 0.943 0.935 0.926 0.917 0.909 0.901 0.893 0.885 0.877 0.870 0.862 0.855 2 0.925 0.907 0.890 0.873 0.857 0.842 0.826 0.812 0.797 0.783 0.769 0.756 0.743 0.731 3 0.889 0.864 0.840 0.816 0.794 0.772 0.751 0.731 0.712 0.693 0.675 0.658 0.641 0.624 4 0.855 0.823 0.792 0.763 0.735 0.708 0.683 0.659 0.636 0.613 0.592 0.572 0.552 0.534 5 0.822 0.784 0.747 0.713 0.681 0.650 0.621 0.593 0.567 0.543 0.519 0.497 0.476 0.456

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts