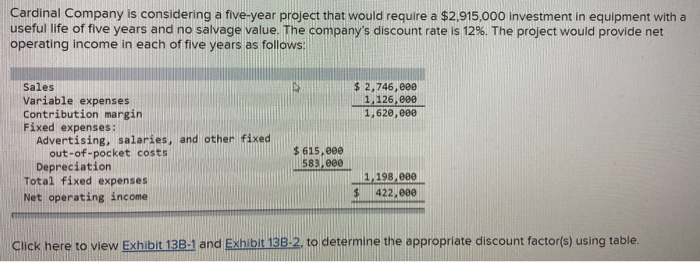

Question: Cardinal Company is considering a five-year project that would require a $2,915,000 investment in equipment with a useful life of five years and no salvage

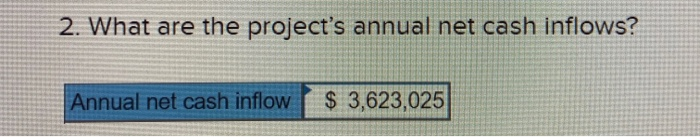

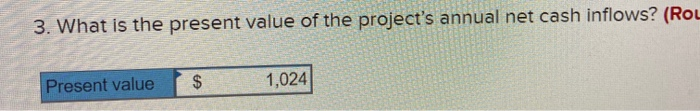

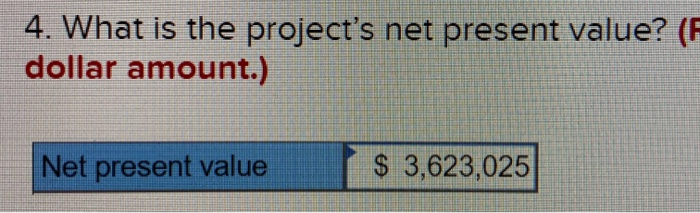

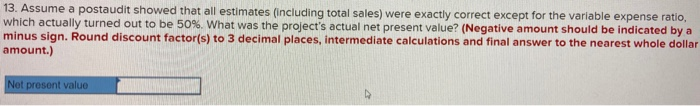

Cardinal Company is considering a five-year project that would require a $2,915,000 investment in equipment with a useful life of five years and no salvage value. The company's discount rate is 12%. The project would provide net operating income in each of five years as follows: $ 2,746, eee 1,126, eee 1,620,000 Sales Variable expenses Contribution margin Fixed expenses: Advertising, salaries, and other fixed out-of-pocket costs Depreciation Total fixed expenses Net operating income $ 615, eee 583,000 1,198,000 422,000 Click here to view Exhibit 13B-1 and Exhibit 130-2. to determine the appropriate discount factor(s) using table, 2. What are the project's annual net cash inflows? Annual net cash inflow $ 3,623,025 3. What is the present value of the project's annual net cash inflows? (Rou Present value $ 1,024 4. What is the project's net present value? (G dollar amount.) Net present value $ 3,623,025 9. If the company's discount rate was 14% instead of 12%, would you expect the project's net present value to be higher, lower, or the same? Higher Lower Same 11. If the equipment had a salvage value of $300,000 at the end of five years, would you expect the project's net present value to be higher, lower, or the same? Higher Lower Same 13. Assume a postaudit showed that all estimates (including total sales) were exactly correct except for the variable expense ratio, which actually turned out to be 50%. What was the project's actual net present value? (Negative amount should be indicated by a minus sign. Round discount factor(s) to 3 decimal places, intermediate calculations and final answer to the nearest whole dollar amount.) Not present value

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts