Question: Cardinal Company is considering a five-year project that would require a $2,890,000 investment in equipment with a useful life of five years and no salvage

Cardinal Company is considering a five-year project that would require a $2,890,000 investment in equipment with a useful life of five years and no salvage value. The companys discount rate is 12%. The project would provide net operating income in each of five years as follows:

| Sales | $ | 2,739,000 | ||

| Variable expenses | 1,100,000 | |||

| Contribution margin | 1,639,000 | |||

| Fixed expenses: | ||||

| Advertising, salaries, and other fixed out-of-pocket costs | $ | 641,000 | ||

| Depreciation | 578,000 | |||

| Total fixed expenses | 1,219,000 | |||

| Net operating income | $ | 420,000 | ||

13. Assume a postaudit showed that all estimates (including total sales) were exactly correct except for the variable expense ratio, which actually turned out to be 50%. What was the projects actual net present value?

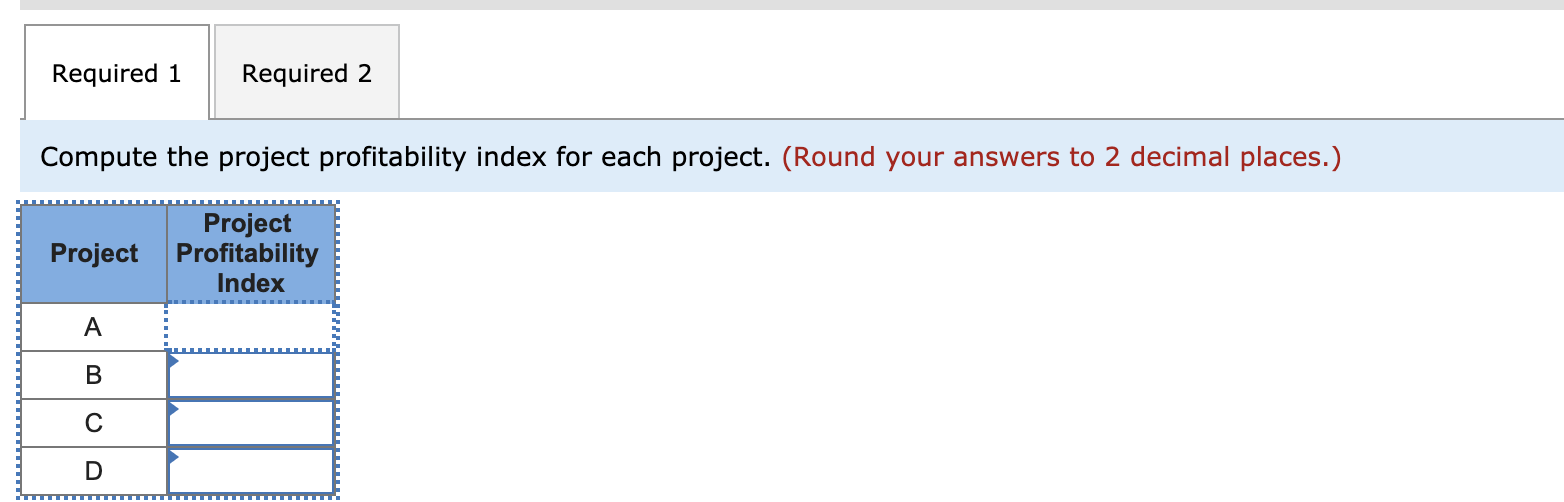

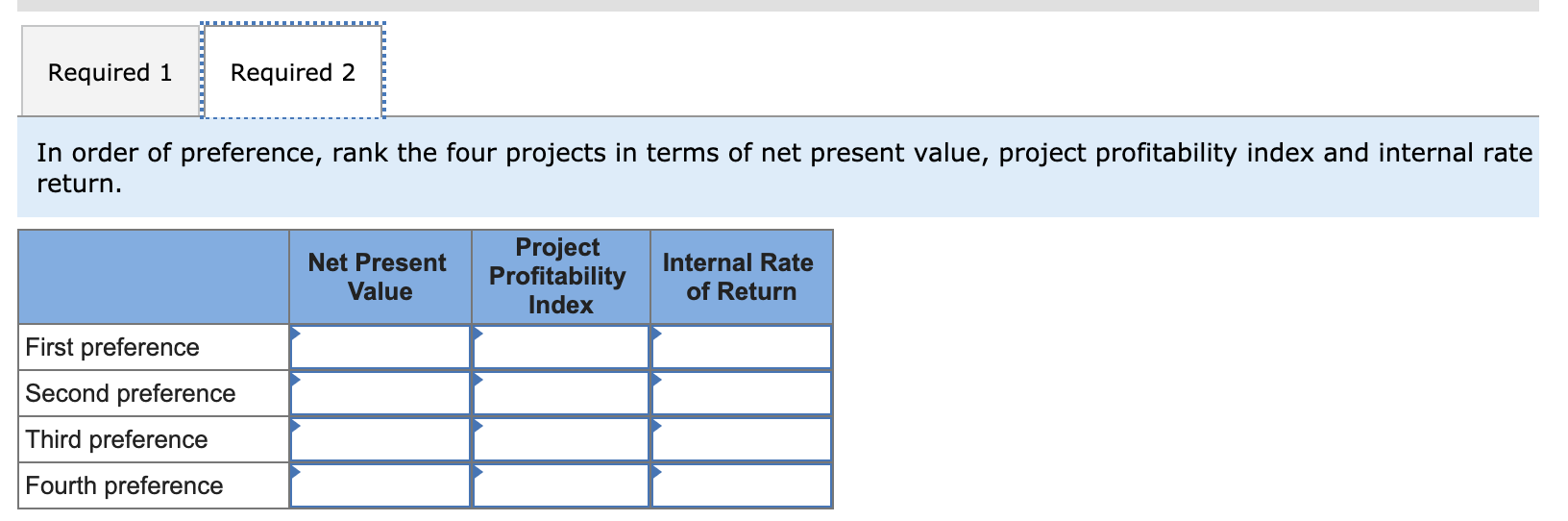

Oxford Company has limited funds available for investment and must ration the funds among four competing projects. Selected information on the four projects follows:

| Project | Investment Required | Net Present Value | Life of the Project (years) | Internal Rate of Return | ||||

| A | $ | 930,000 | $ | 318,343 | 6 | 21 | % | |

| B | $ | 710,000 | $ | 207,045 | 11 | 16 | % | |

| C | $ | 630,000 | $ | 195,081 | 6 | 20 | % | |

| D | $ | 830,000 | $ | 225,079 | 4 | 22 | % | |

The net present values above have been computed using a 10% discount rate. The company wants your assistance in determining which project to accept first, second, and so forth.

Required:

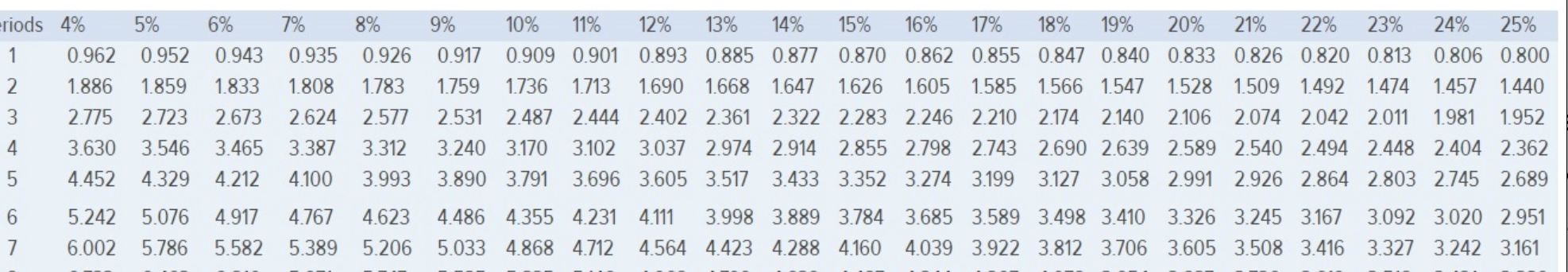

6% 7% 8% 5% 0.952 0.943 0.926 1.783 1.859 eriods 4% 1 0.962 2 1.886 3 2.775 4 3.630 5 4.452 2.723 1.833 2.673 3.465 4.212 9% 10% 11% 12% 13% 14% 15% 16% 17% 18% 19% 20% 21% 22% 23% 24% 25% 0.917 0.909 0.901 0.893 0.885 0.877 0.870 0.862 0.855 0.847 0.840 0.833 0.826 0.820 0.813 0.806 0.800 1.759 1.736 1.713 1.690 1.668 1.647 1.626 1.605 1.585 1.566 1.547 1.528 1.509 1492 1.474 1.457 1.440 2.531 2.487 2.444 2.402 2.361 2.322 2.283 2.246 2.210 2.174 2.140 2.106 2.074 2.042 2.011 1.981 1.952 3.240 3.170 3.102 3.037 2.974 2.914 2.855 2.798 2.743 2.690 2.639 2.589 2.540 2.494 2.448 2.404 2.362 3.890 3.791 3.696 3.605 3.517 3.433 3.352 3.274 3.199 3.127 3.058 2.991 2.926 2.864 2.803 2.745 2.689 0.935 1.808 2.624 3.387 4.100 3.546 2.577 3.312 3.993 4.329 6 5.242 6.002 5.076 5.786 4.917 5.582 4.767 5.389 4.623 5.206 4.486 4.355 4.231 4.111 3.998 3.889 3.784 3.685 3.589 3.498 3.410 3.326 3.245 3.167 5.033 4.868 4.712 4.564 4.423 4.288 4.160 4.039 3.922 3.812 3.706 3.605 3.508 3.416 3.092 3.020 2.951 3.327 3.242 3.161 7 Required 1 Required 2 Compute the project profitability index for each project. (Round your answers to 2 decimal places.) Project Project Profitability Index A B C D Required 1 Required 2 In order of preference, rank the four projects in terms of net present value, project profitability index and internal rate return. Net Present Value Project Profitability Index Internal Rate of Return First preference Second preference Third preference Fourth preference

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts