Question: Carefully read BKM11 edn Chapter 13, section 13.3 regarding Fama-French three factor model and the section on multi-factor models in the lecture to answer the

Carefully read BKM11 edn Chapter 13, section 13.3 regarding Fama-French three factor model and the section on multi-factor models in the lecture to answer the following questions:

a. What are the risk factors incorporated in the Fama and French three factor models? How are they measured?

b. Why do we not subtract the risk-free rate from SMB or HML? Why do we subtract the risk-free rate from Rm?

c. Cahart (1997) incorporated a forth factor so called "momentum" into the Fama-French three factor model. Fama and French (2018) reluctantly include the momentum factor into their five factor model to create the six factor model. Define "momentum" and describe how it is measured in both cases.

d. Fama and French (2015) introduce the five-factor model. What is the difference in the way the SMB and HML factors are measured in the three-factor model and the fivefactor model?

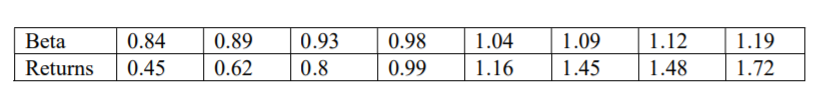

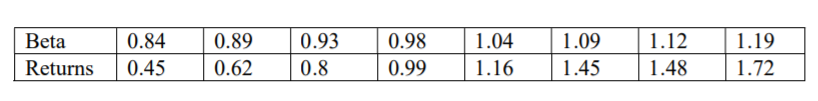

e. Suppose I sort stocks into portfolios by their betas to detect any new return pattern and document the results in the below table. Is there any evidence suggesting a new 'anomaly' (i.e. return pattern not explained by existing asset pricing models) with respect to the CAPM?

?

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts