Question: CARES Problem 8-66 (LO 8-3) (Static) Alice is single and self-employed in 2020. Her net business profit on her Schedule C for the year is

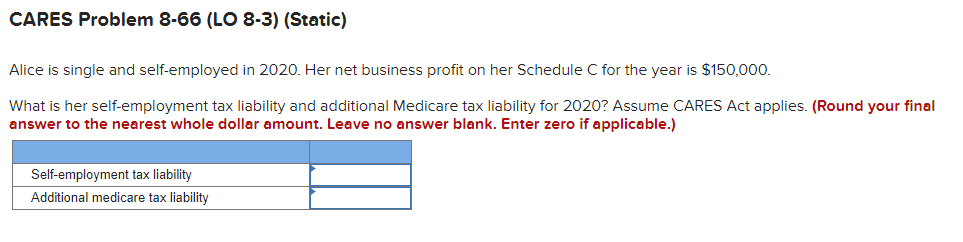

CARES Problem 8-66 (LO 8-3) (Static) Alice is single and self-employed in 2020. Her net business profit on her Schedule C for the year is $150,000. What is her self-employment tax liability and additional Medicare tax liability for 2020? Assume CARES Act applies. (Round your final answer to the nearest whole dollar amount. Leave no answer blank. Enter zero if applicable.) Self-employment tax liability Additional medicare tax liability

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts