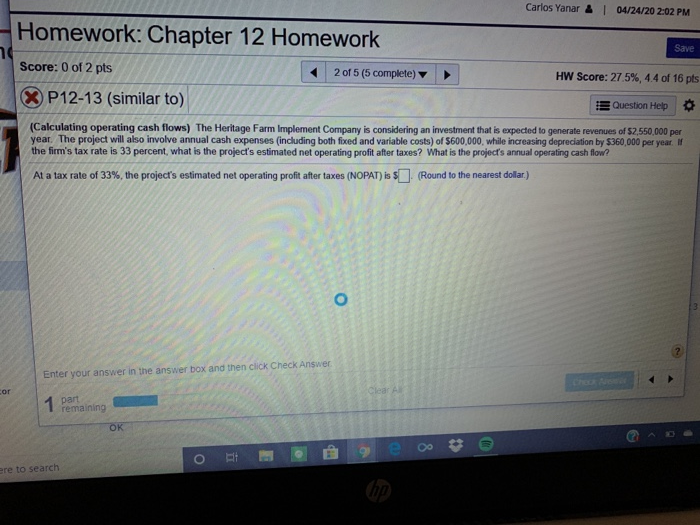

Question: Carlos Yanar & | 04/24/20 2:02 PM Save Homework: Chapter 12 Homework Score: 0 of 2 pts 2 of 5 (5 complete) X P12-13 (similar

Carlos Yanar & | 04/24/20 2:02 PM Save Homework: Chapter 12 Homework Score: 0 of 2 pts 2 of 5 (5 complete) X P12-13 (similar to) HW Score: 27.5%, 4.4 of 16 pts Question Help Calculating operating cash flows) The Heritage Farm Implement Company is considering an investment that is expected to generate revenues of $2.550.000 per year. The project will also involve annual cash expenses (including both foxed and variable costs) of $600,000, while increasing depreciation by $360,000 per year the firm's tax rate is 33 percent, what is the project's estimated net operating profit after taxes? What is the projects annual operating cash flow At a tax rate of 33%, the project's estimated net operating profit after taxes (NOPAT) I (Round to the nearest dolar) Enter your answer in the answer box and then click Check Answer Apart 1 remaining o 9 e ooo re to search

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts