Question: Carlton holds undeveloped land for investment. His adjusted basis in the land is ( $ 2 0 0 , 0 0 0

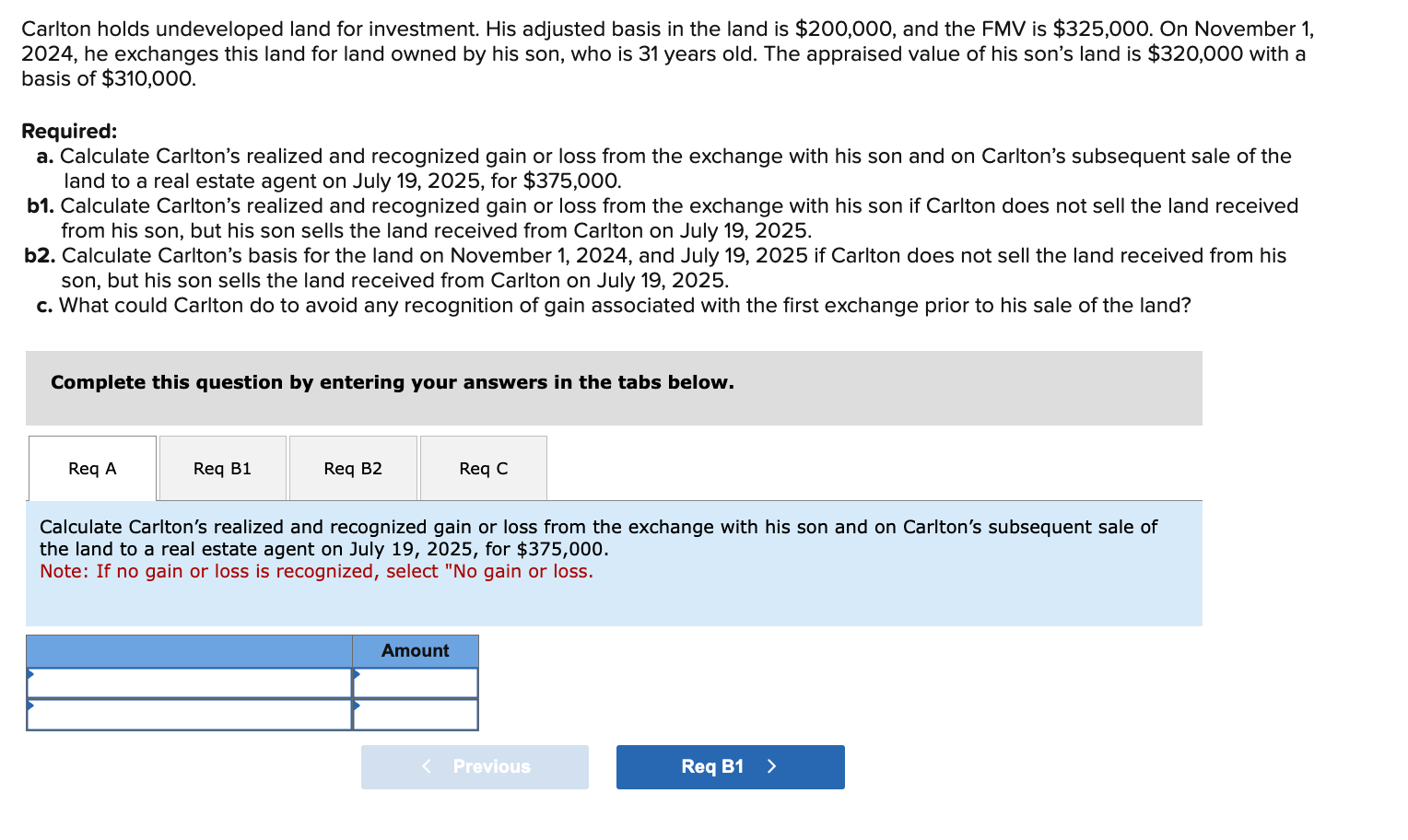

Carlton holds undeveloped land for investment. His adjusted basis in the land is $ and the FMV is $ On November he exchanges this land for land owned by his son, who is years old. The appraised value of his son's land is $ with a basis of $ Required: a Calculate Carlton's realized and recognized gain or loss from the exchange with his son and on Carlton's subsequent sale of the land to a real estate agent on July for $ b Calculate Carlton's realized and recognized gain or loss from the exchange with his son if Carlton does not sell the land received from his son, but his son sells the land received from Carlton on July b Calculate Carlton's basis for the land on November and July if Carlton does not sell the land received from his son, but his son sells the land received from Carlton on July c What could Carlton do to avoid any recognition of gain associated with the first exchange prior to his sale of the land? Complete this question by entering your answers in the tabs below. Calculate Carlton's realized and recognized gain or loss from the exchange with his son and on Carlton's subsequent sale of the land to a real estate agent on July for $ Note: If no gain or loss is recognized, select No gain or loss. Amount Complete this question by entering your answers in the tabs below.

Req B

Calculate Carlton's realized and recognized gain or loss from the exchange with his son if Carlton does not sell the land received from his son, but his son sells the land received from Carlton on July

Note: If no gain or loss is recognized, select No gain or loss. Complete this question by entering your answers in the tabs below.

Req B

Calculate Carlton's basis for the land on November and July if Carlton does not sell the land received from his son, but his son sells the land received from Carlton on July Complete this question by entering your answers in the tabs below.

Req A

Req B

Req B

What could Carlton do to avoid any recognition of gain associated with the first exchange prior to his sale of the land?

Carlton's decision

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock