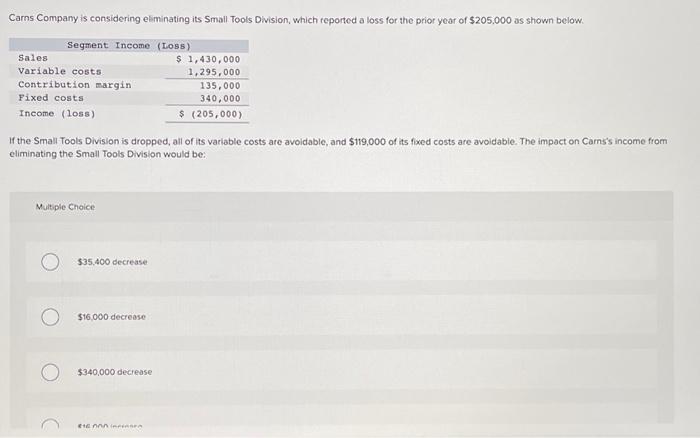

Question: Carns Company is considering elminating its Small Tools Division, which reported a loss for the prior year of $205.000 as shown below. If the Small

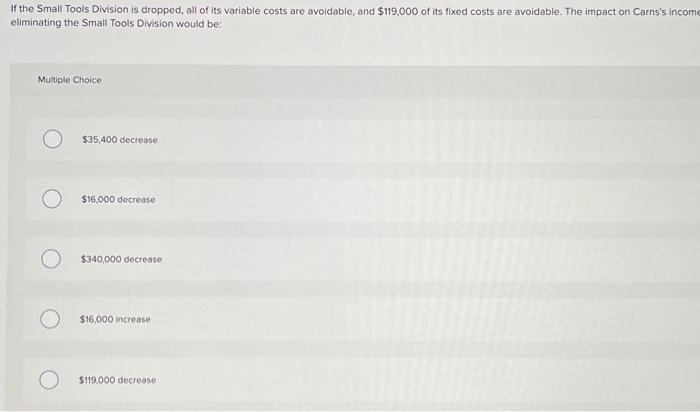

Carns Company is considering elminating its Small Tools Division, which reported a loss for the prior year of $205.000 as shown below. If the Small Tools Division is dropped, all of its variable costs are avoidable, and $119,000 of its foxed costs are avoidabie. The impact on Carns's income from eliminating the Small Tools Division would be: Multiple Choice 535,400decrease $16,000 decrease $340,000 decrease dten hnu in+inners If the Small Tools Division is dropped, all of its variable costs are avoidable, and $119,000 of its fixed costs are avoidable. The impact on Carns's incom eliminating the Small Tools Division would be: Multiple Choice $35,400 decrease $16.000 decrease $340,000 decrease $16,000 increase $119.000 decrease

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts