Question: Carol is going to begin saving for a new car in 5 years. She plans to set aside $400 every month starting at the

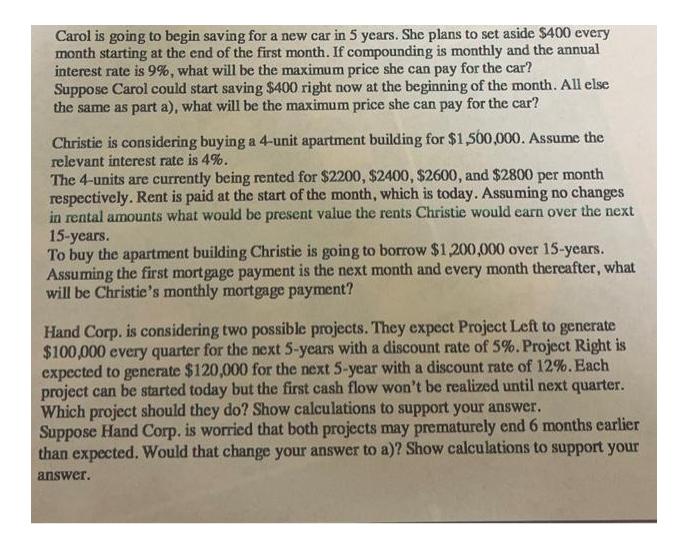

Carol is going to begin saving for a new car in 5 years. She plans to set aside $400 every month starting at the end of the first month. If compounding is monthly and the annual interest rate is 9%, what will be the maximum price she can pay for the car? Suppose Carol could start saving $400 right now at the beginning of the month. All else the same as part a), what will be the maximum price she can pay for the car? Christie is considering buying a 4-unit apartment building for $1,500,000. Assume the relevant interest rate is 4%. The 4-units are currently being rented for $2200, $2400, $2600, and $2800 per month respectively. Rent is paid at the start of the month, which is today. Assuming no changes in rental amounts what would be present value the rents Christie would earn over the next 15-years. To buy the apartment building Christie is going to borrow $1,200,000 over 15-years. Assuming the first mortgage payment is the next month and every month thereafter, what will be Christie's monthly mortgage payment? Hand Corp. is considering two possible projects. They expect Project Left to generate $100,000 every quarter for the next 5-years with a discount rate of 5%. Project Right is expected to generate $120,000 for the next 5-year with a discount rate of 12%. Each project can be started today but the first cash flow won't be realized until next quarter. Which project should they do? Show calculations to support your answer. Suppose Hand Corp. is worried that both projects may prematurely end 6 months earlier than expected. Would that change your answer to a)? Show calculations to support your answer.

Step by Step Solution

3.47 Rating (157 Votes )

There are 3 Steps involved in it

a Carol is going to begin saving for a new car in 5 years She plans to set aside 400 every month starting at the end of the first month If compounding is monthly and the annual interest rate is 9 what ... View full answer

Get step-by-step solutions from verified subject matter experts