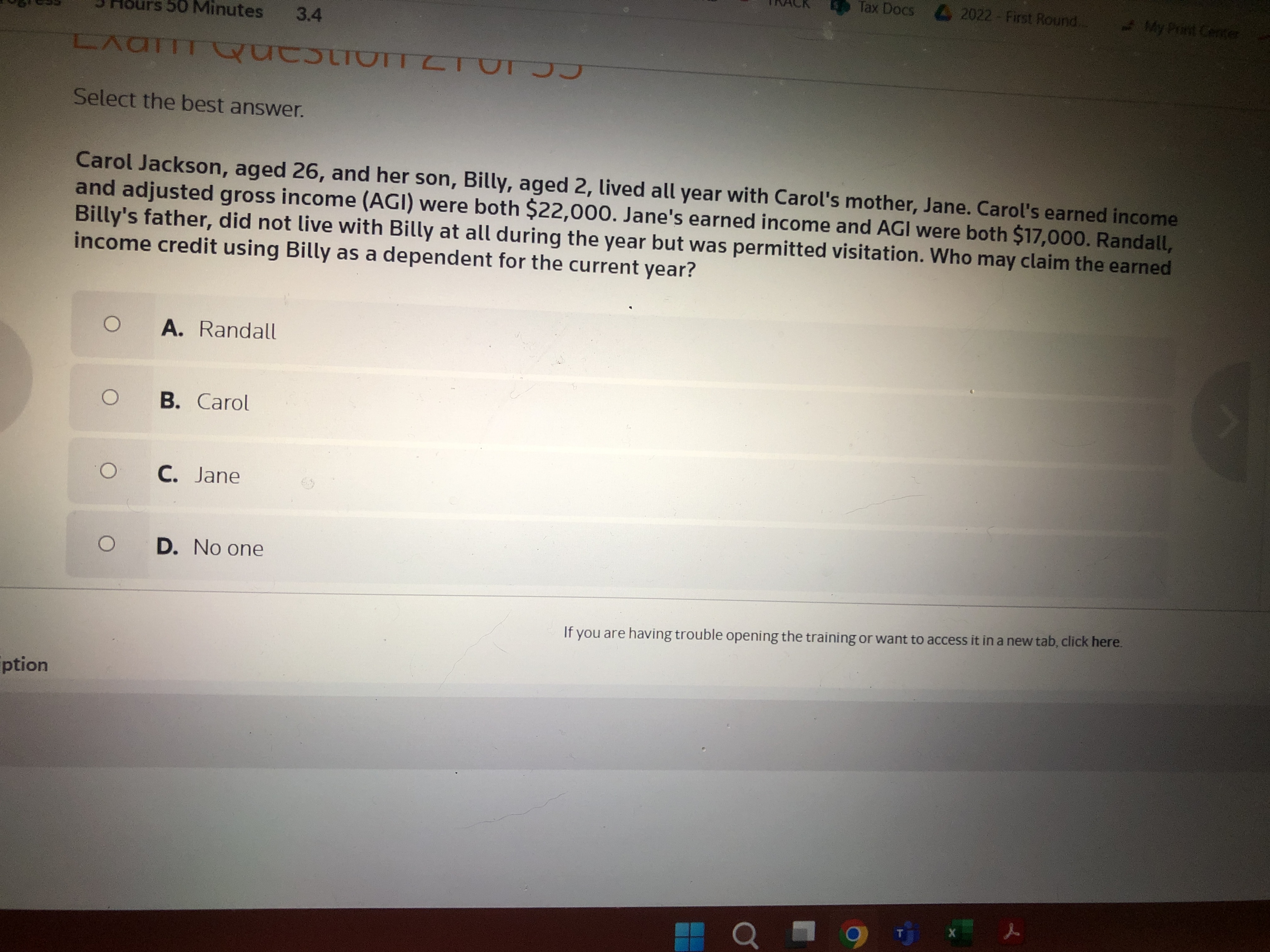

Question: Carol Jackson, aged 2 6 , and her son, Billy, aged 2 , lived all year with Carol's mother, Jane. Carol's earned income and adjusted

Carol Jackson, aged and her son, Billy, aged lived all year with Carol's mother, Jane. Carol's earned income

and adjusted gross income were both $ Jane's earned income and AGI were both $ Randall,

Billy's father, did not live with Billy all during the year but was permitted visitation. Who may claim the earned

income credit using Billy a dependent for the current year?

Randall

Carol

Jane

one

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock