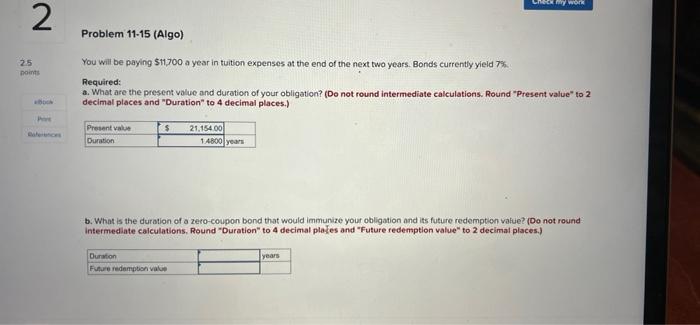

Question: CARRY WON 2 Problem 11-15 (Algo) 25 DO You will be paying $11.700 a year in tuition expenses at the end of the next two

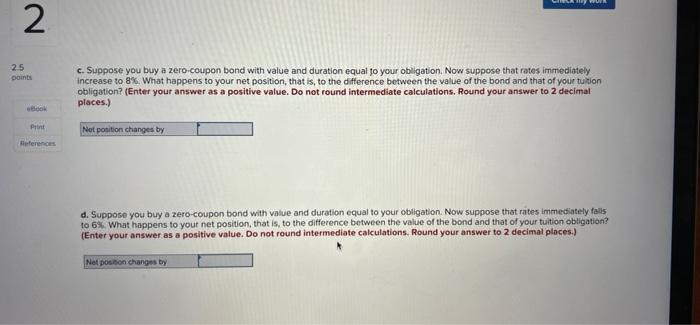

CARRY WON 2 Problem 11-15 (Algo) 25 DO You will be paying $11.700 a year in tuition expenses at the end of the next two years. Bonds currently yield 7% Required: a. What are the present value and duration of your obligation? (Do not round intermediate calculations. Round "Present value to 2 decimal places and "Duration" to 4 decimal places.) $ Present value Duration 21.154.00 1.4800 years b. What is the duration of a zero-coupon bond that would immunize your obligation and its future redemption value? (Do not round Intermediate calculations, Round "Duration" to 4 decimal plates and "Future redemption value to 2 decimal places.) years Duration Future redemption value INN 2 2.5 points c. Suppose you buy a zero-coupon bond with value and duration equal to your obligation. Now suppose that rates immediately increase to 8%. What happens to your net position, that is, to the difference between the value of the bond and that of your tuition obligation? (Enter your answer as a positive value. Do not round intermediate calculations. Round your answer to 2 decimal places.) Print Net position changes by References d. Suppose you buy a zero-coupon bond with value and duration equal to your obligation. Now suppose that rates immediately falls to 6% What happens to your net position, that is, to the difference between the value of the bond and that of your tuition obligation? (Enter your answer as a positive value. Do not round intermediate calculations. Round your answer to 2 decimal places.) Net position changes by

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts