Question: Cascade Containers is organized into two divisions - Manufacturing and Distribution. Manufacturing produces a product that can be quality control reasons. Manufacturing currently sells 5,700

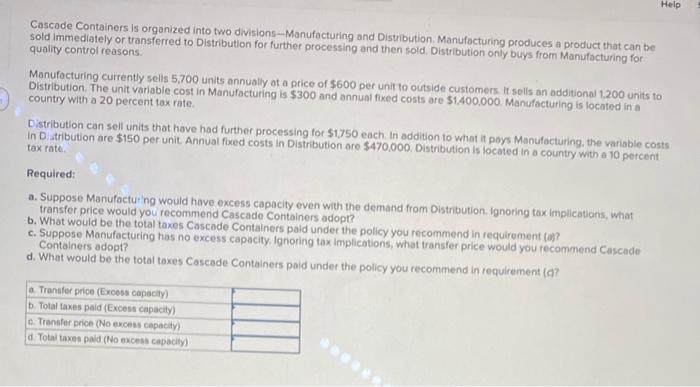

Cascade Containers is organized into two divisions - Manufacturing and Distribution. Manufacturing produces a product that can be quality control reasons. Manufacturing currently sells 5,700 units annually ot a price of $600 per unit to outside customers. it sells an additional 1.200 units to Distribution. The unit variable cost in Manufacturing is $300 and annual fixed costs are $1,400,000. Manufacturing is located in a country with a 20 percent tax rate. Distribution can sell units that have had further processing for $1,750 each. In addition to what it poys Manufocturing, the variable costs In D atribution are $150 per unit. Annual fixed costs in Distribution are $470.000. Distribution is located in a country with a 10 percent tax rate. Required: a. Suppose Manufacturing would have excess capacity even with the demand from Distribution. Ignoring tax implications, what transfer price would you recommend Cascade Containers adopt? b. What would be the total taxes Cascade Containers paid under the policy you recommend in requirement (o)? c. Suppose Manufacturing has no excess capacity. Ignoring tax implications, what transfer price would you recomenend Cascade Containers adopt? d. What would be the total taxes Cascade Containers poid under the policy you recommend in requirement (a

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts