Question: CASE 1 (35 points) The most recent financial statements for Maryland Corporation follow. Sales for 2021 are projected to increase by 15 percent. Assets, costs,

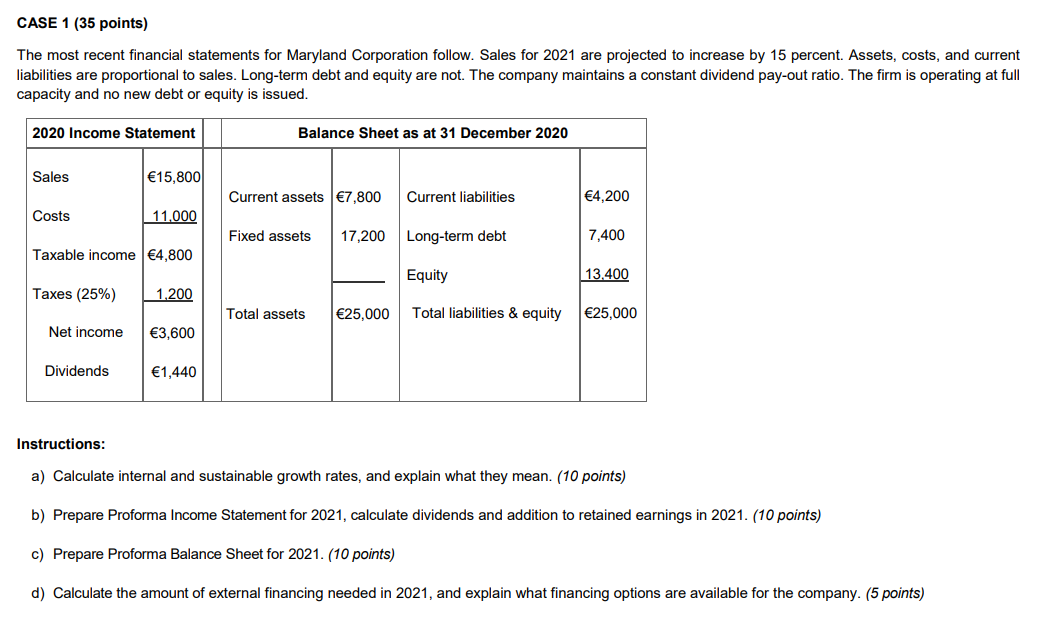

CASE 1 (35 points) The most recent financial statements for Maryland Corporation follow. Sales for 2021 are projected to increase by 15 percent. Assets, costs, and current liabilities are proportional to sales. Long-term debt and equity are not. The company maintains a constant dividend pay-out ratio. The firm is operating at full capacity and no new debt or equity is issued. 2020 Income Statement Balance Sheet as at 31 December 2020 Sales 15,800 Current assets 7,800 Current liabilities 4,200 Costs 11.000 Fixed assets 17,200 Long-term debt 7,400 Taxable income 4,800 Equity 13.400 Taxes (25%) 1.200 Total assets 25,000 Total liabilities & equity 25,000 Net income 3,600 Dividends 1,440 Instructions: a) Calculate internal and sustainable growth rates, and explain what they mean. (10 points) b) Prepare Proforma Income Statement for 2021, calculate dividends and addition to retained earnings in 2021. (10 points) c) Prepare Proforma Balance Sheet for 2021. (10 points) d) Calculate the amount of external financing needed in 2021, and explain what financing options are available for the company. (5 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts