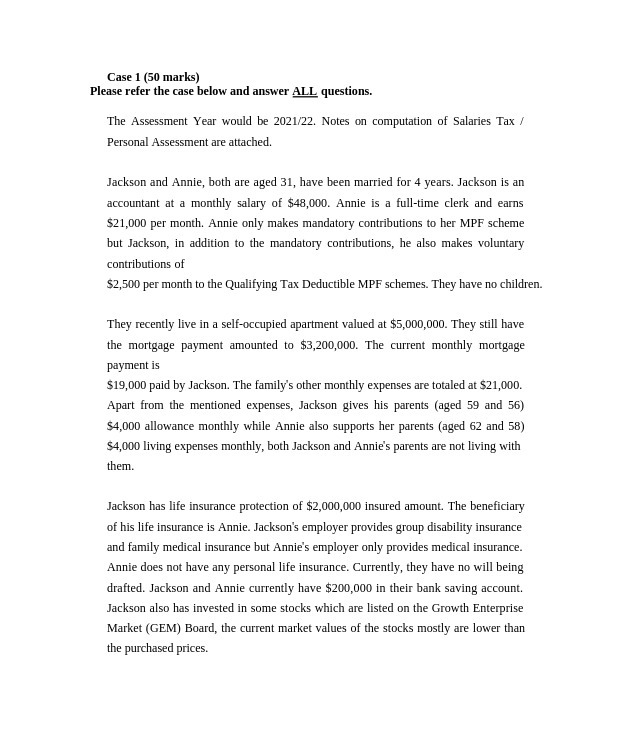

Question: Case 1 (50 marks) Please refer the case below and answer ALL questions. The Assessment Year would be 2021/22. Notes on computation of Salaries Tax

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock