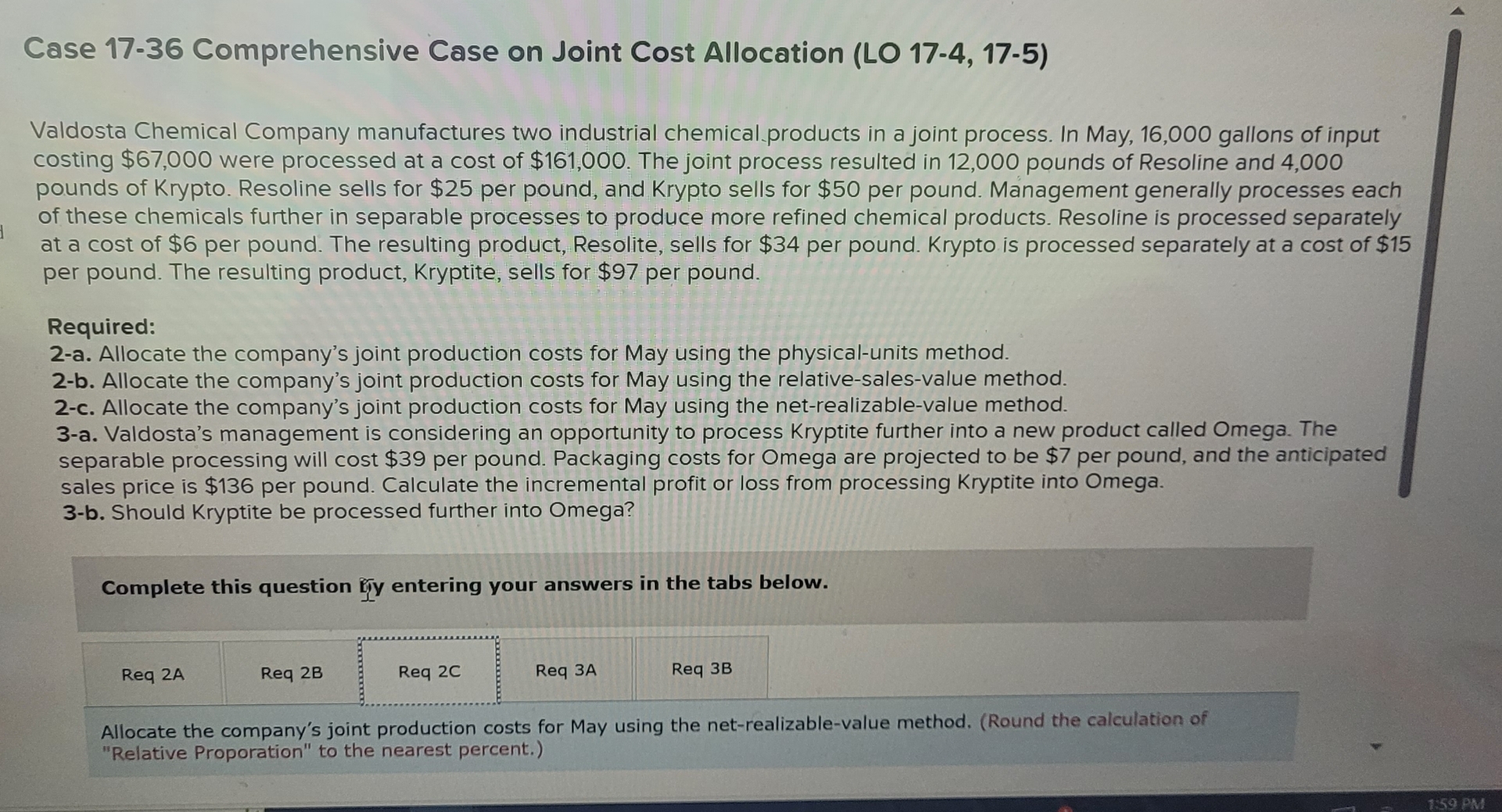

Question: Case 1 7 - 3 6 Comprehensive Case on Joint Cost Allocation ( LO 1 7 - 4 , 1 7 - 5 ) Valdosta

Case Comprehensive Case on Joint Cost Allocation LO

Valdosta Chemical Company manufactures two industrial chemical.products in a joint process. In May, gallons of input costing $ were processed at a cost of $ The joint process resulted in pounds of Resoline and pounds of Krypto. Resoline sells for $ per pound, and Krypto sells for $ per pound. Management generally processes each of these chemicals further in separable processes to produce more refined chemical products. Resoline is processed separately at a cost of $ per pound. The resulting product, Resolite, sells for $ per pound. Krypto is processed separately at a cost of $ per pound. The resulting product, Kryptite, sells for $ per pound.

Required:

c Allocate the company's joint production costs for May using the netrealizablevalue method.

Complete this question by entering your answers in the tabs below.

Req C

Allocate the company's joint production costs for May using the netrealizablevalue method. Round the calculation of "Relative Proporation" to the nearest percent.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock