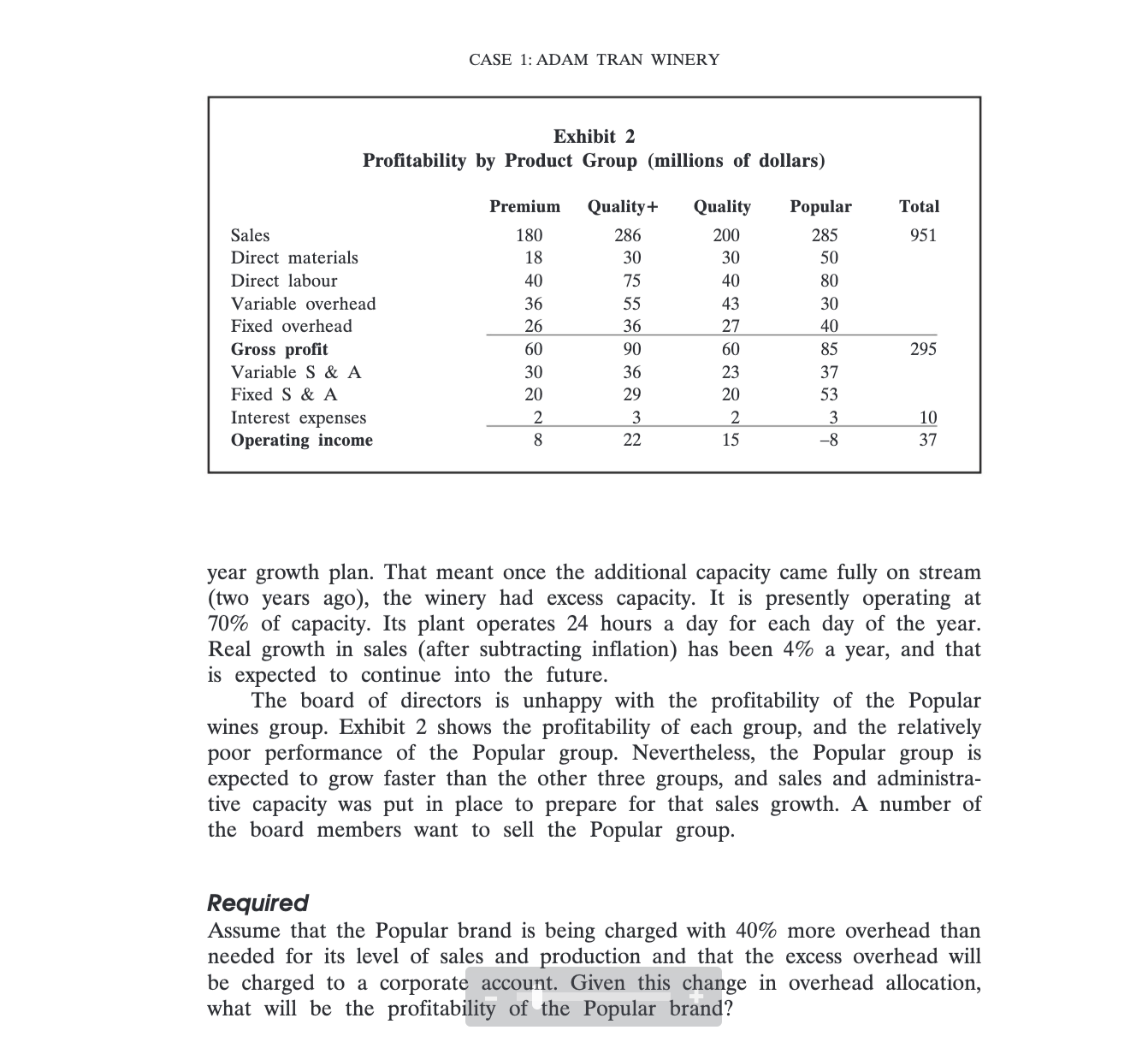

Question: CASE 1: ADAM TRAN WlNERY Exhibit 2 Protability by Product Group (millions of dollars) Premium Quality+ Quality Popular Sales 180 286 200 285 Direct materials

CASE 1: ADAM TRAN WlNERY Exhibit 2 Protability by Product Group (millions of dollars) Premium Quality+ Quality Popular Sales 180 286 200 285 Direct materials 18 30 30 50 Direct labour 40 75 40 80 Variable overhead 36 55 43 30 Fixed overhead 26 36 27 40 Gross prot 60 90 60 85 Variable S & A 30 36 23 37 Fixed S & A 20 29 20 53 Interest expenses 2 3 2 3 Operating income 8 22 15 $ year growth plan. That meant once the additional capacity came fully on stream (two years ago), the winery had excess capacity. It is presently operating at 70% of capacity. Its plant operates 24 hours a day for each day of the year. Real growth in sales (after subtracting ination) has been 4% a year, and that is expected to continue into the future. The board of directors is unhappy with the protability of the Popular wines group. Exhibit 2 shows the profitability of each group, and the relatively poor performance of the Popular group. Nevertheless, the Popular group is expected to grow faster than the other three groups, and sales and administra- tive capacity was put in place to prepare for that sales growth. A number of the board members want to sell the Popular group. Required Assume that the Popular brand is being charged with 40% more overhead than needed for its level of sales and production and that the excess overhead will be charged to a corporate account. Given this change in overhead allocation, what will be the profitability of the Popular brand

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts