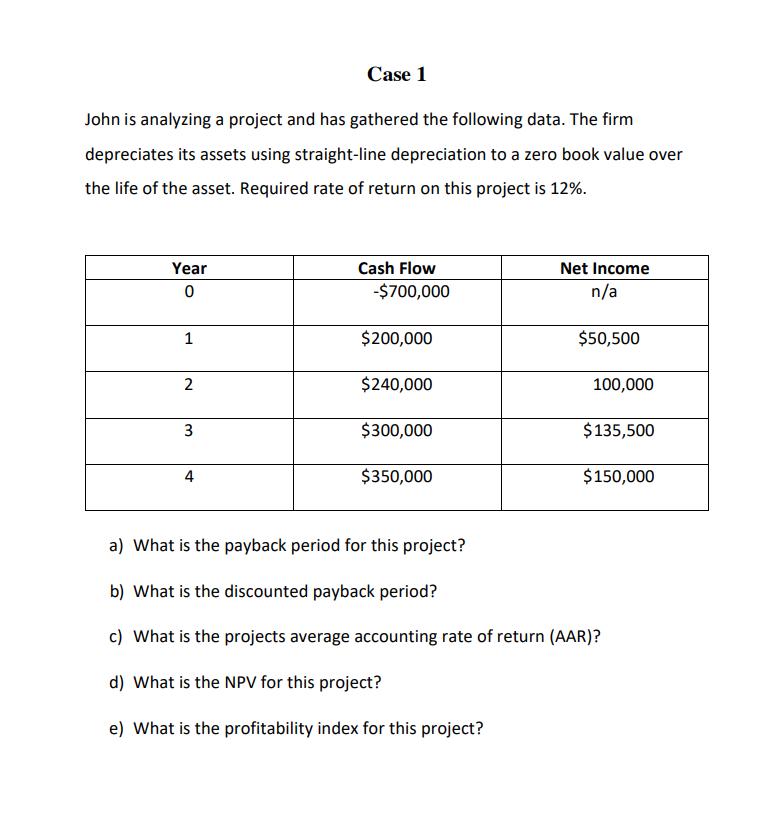

Question: Case 1 John is analyzing a project and has gathered the following data. The firm depreciates its assets using straight-line depreciation to a zero book

Case 1 John is analyzing a project and has gathered the following data. The firm depreciates its assets using straight-line depreciation to a zero book value over the life of the asset. Required rate of return on this project is 12%. Year 0 Cash Flow -$700,000 Net Income n/a 1 $200,000 $50,500 2 $240,000 100,000 3 $300,000 $135,500 4 $350,000 $ 150,000 a) What is the payback period for this project? b) What is the discounted payback period? c) What is the projects average accounting rate of return (AAR)? d) What is the NPV for this project? e) What is the profitability index for this project

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts