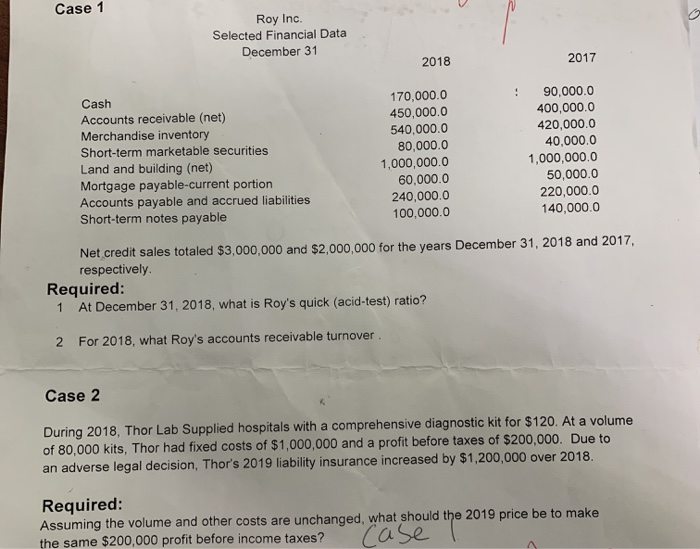

Question: Case 1 Roy Inc. Selected Financial Data December 31 2018 2017 Cash Accounts receivable (net) Merchandise inventory Short-term marketable securities Land and building (net) Mortgage

Case 1 Roy Inc. Selected Financial Data December 31 2018 2017 Cash Accounts receivable (net) Merchandise inventory Short-term marketable securities Land and building (net) Mortgage payable-current portion Accounts payable and accrued liabilities Short-term notes payable 170,000.0 450,000.0 540,000.0 80,000.0 1,000,000.0 60,000.0 240,000.0 100,000.0 90,000.0 400,000.0 420,000.0 40,000.0 1,000,000.0 50,000.0 220,000.0 140,000.0 Net credit sales totaled $3,000,000 and $2,000,000 for the years December 31, 2018 and 2017, respectively Required: 1 At December 31, 2018, what is Roy's quick (acid-test) ratio? 2 For 2018, what Roy's accounts receivable turnover. Case 2 During 2018, Thor Lab Supplied hospitals with a comprehensive diagnostic kit for $120. At a volume of 80,000 kits, Thor had fixed costs of $1,000,000 and a profit before taxes of $200,000. Due to an adverse legal decision, Thor's 2019 liability insurance increased by $1,200,000 over 2018. Required: Assuming the volume and other costs are unchanged, what should the 2019 price be to make the same $200,000 profit before income taxes? Case

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts