Question: Case #1: Valuing a firm using FCFF Model (20 marks) You have been asked to value Eman Industries, a sports equipment manufacturer and have come

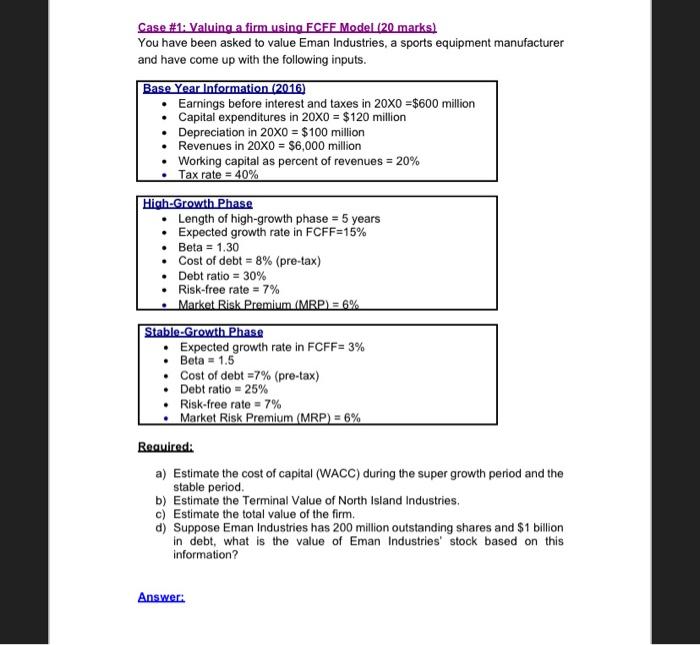

Case #1: Valuing a firm using FCFF Model (20 marks) You have been asked to value Eman Industries, a sports equipment manufacturer and have come up with the following inputs. Base Year Information (2016) Earnings before interest and taxes in 20X0 =$600 million Capital expenditures in 20X0 = $120 million Depreciation in 20x0 = $100 million Revenues in 20X0 = $6,000 million Working capital as percent of revenues = 20% Tax rate = 40% High-Growth Phase Length of high-growth phase = 5 years Expected growth rate in FCFF=15% Beta = 1.30 Cost of debt = 8% (pre-tax) Debt ratio = 30% Risk-free rate = 7% Market Risk Premium (MRP) = 6% Stable-Growth Phase Expected growth rate in FCFF= 3% Beta = 1.5 Cost of debt =7% (pre-tax) Debt ratio = 25% Risk-free rate = 7% Market Risk Premium (MRP) = 6% Required: a) Estimate the cost of capital (WACC) during the super growth period and the stable period b) Estimate the Terminal Value of North Island Industries, c) Estimate the total value of the firm. d) Suppose Eman Industries has 200 million outstanding shares and $1 billion in debt, what is the value of Eman Industries' stock based on this information

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts