Question: Case 16-2 (How do I solve for this?) Francesca's Holding corporation is a specialty retailer that operates boutiques throughout the United States under Francesca's trademark.

Case 16-2 (How do I solve for this?)

Francesca's Holding corporation is a specialty retailer that operates boutiques throughout the United States under Francesca's trademark. Access the financial statements and related disclosure notes of Francesca for the fiscal year ended February 1, 2020, From EDGAR database website.

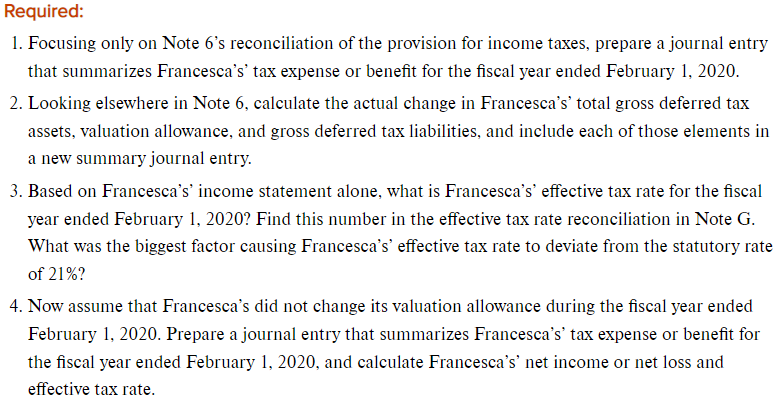

Required: 1. Focusing only on Note 6's reconciliation of the provision for income taxes, prepare a journal entry that summarizes Francesca's' tax expense or benefit for the fiscal year ended February 1, 2020. 2. Looking elsewhere in Note 6, calculate the actual change in Francesca's' total gross deferred tax assets, valuation allowance, and gross deferred tax liabilities, and include each of those elements in a new summary journal entry. 3. Based on Francesca's' income statement alone, what is Francesca's' effective tax rate for the fiscal year ended February 1, 2020? Find this number in the effective tax rate reconciliation in Note G. What was the biggest factor causing Francesca's' effective tax rate to deviate from the statutory rate of 21% ? 4. Now assume that Francesca's did not change its valuation allowance during the fiscal year ended February 1, 2020. Prepare a journal entry that summarizes Francesca's' tax expense or benefit for the fiscal year ended February 1, 2020, and calculate Francesca's' net income or net loss and effective tax rate

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts