Question: Case 2 A Chinese company signed a contract with a US company to buy a batch of goods worthy $10000 will pay the bill on

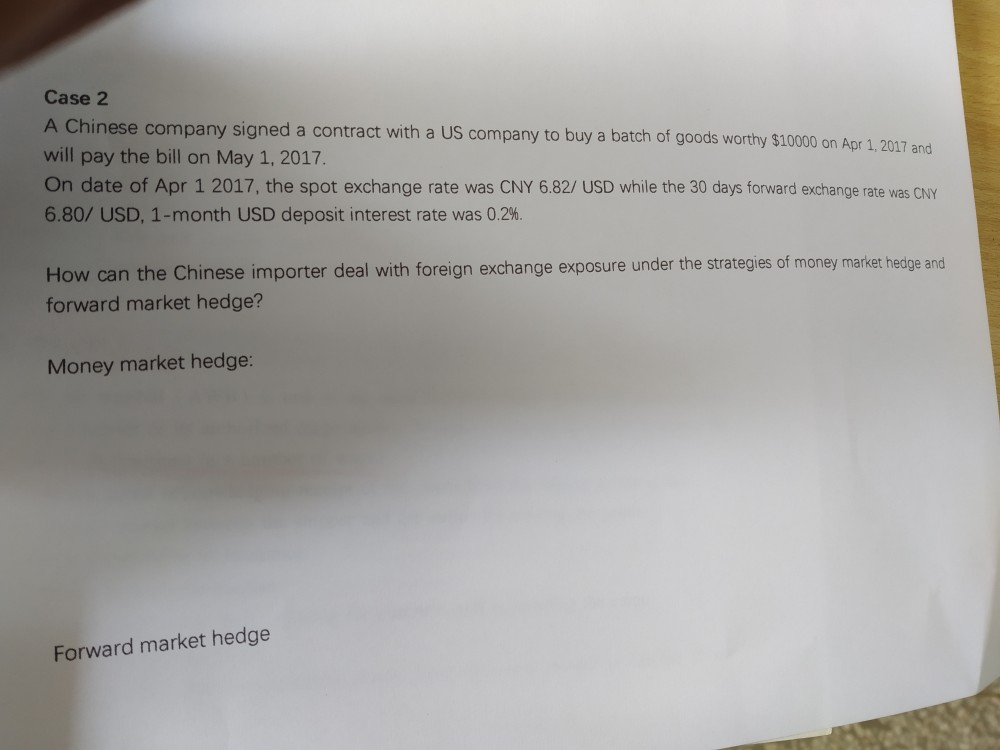

Case 2 A Chinese company signed a contract with a US company to buy a batch of goods worthy $10000 will pay the bill on May 1, 2017 On date of Apr 1 2017, the spot exchange rate was CNY 6.82/ USD while the 30 days forward exchange rate was CNY 6.80/ USD, 1-month USD deposit interest rate was 0.2%. on Apr 1, 2017 and How can the Chinese importer deal with foreign exchange exposure under the strategies of money market hedge and forward market hedge? Money market hedge: Forward market hedge Case 2 A Chinese company signed a contract with a US company to buy a batch of goods worthy $10000 will pay the bill on May 1, 2017 On date of Apr 1 2017, the spot exchange rate was CNY 6.82/ USD while the 30 days forward exchange rate was CNY 6.80/ USD, 1-month USD deposit interest rate was 0.2%. on Apr 1, 2017 and How can the Chinese importer deal with foreign exchange exposure under the strategies of money market hedge and forward market hedge? Money market hedge: Forward market hedge

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts