Question: Case #2 Basic Concepts: The Time Value of Money (30 points possible) Part 1: Barry and Samantha Harris - Retirement Savings (15 points) Barry and

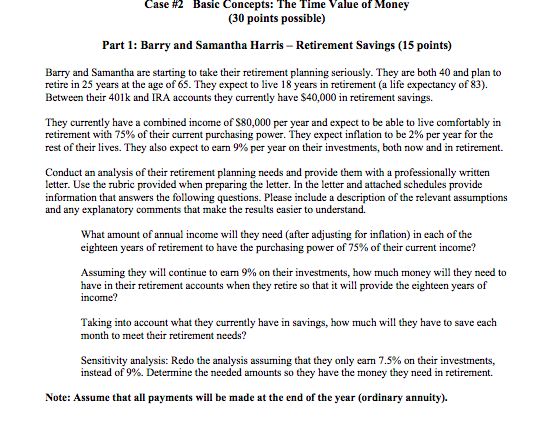

Case #2 Basic Concepts: The Time Value of Money (30 points possible) Part 1: Barry and Samantha Harris - Retirement Savings (15 points) Barry and Samantha are starting to take their retirement planning seriously. They are both 40 and plan to retire in 25 years at the age of 65. They expect to live 18 years in retirement (a life expectancy of 83). Between their 401k and IRA accounts they currently have $40,000 in retirement savings. They currently have a combined income of $80,000 per year and expect to be able to live comfortably in retirement with 75% of their current purchasing power. They expect inflation to be 2% per year for the rest of their lives. They also expect to earn 9% per year on their investments, both now and in retirement Conduct an analysis of their retirement planning needs and provide them with a professionally written letter. Use the rubric provided when preparing the letter. In the letter and attached schedules provide information that answers the following questions. Please include a description of the relevant assumptions and any explanatory comments that make the results easier to understand. What amount of annual income will they need (after adjusting for inflation) in each of the eighteen years of retirement to have the purchasing power of 75% of their current income? Assuming they will continue to earn 9% on their investments, how much money will they need to have in their retirement accounts when they retire so that it will provide the eighteen years of income? Taking into account what they currently have in savings, how much will they have to save each month to meet their retirement needs? Sensitivity analysis: Redo the analysis assuming that they only earn 7.5% on their investments, instead of 9%. Determine the needed amounts so they have the money they need in retirement Note: Assume that all payments will be made at the end of the year (ordinary annuity). Case #2 Basic Concepts: The Time Value of Money (30 points possible) Part 1: Barry and Samantha Harris - Retirement Savings (15 points) Barry and Samantha are starting to take their retirement planning seriously. They are both 40 and plan to retire in 25 years at the age of 65. They expect to live 18 years in retirement (a life expectancy of 83). Between their 401k and IRA accounts they currently have $40,000 in retirement savings. They currently have a combined income of $80,000 per year and expect to be able to live comfortably in retirement with 75% of their current purchasing power. They expect inflation to be 2% per year for the rest of their lives. They also expect to earn 9% per year on their investments, both now and in retirement Conduct an analysis of their retirement planning needs and provide them with a professionally written letter. Use the rubric provided when preparing the letter. In the letter and attached schedules provide information that answers the following questions. Please include a description of the relevant assumptions and any explanatory comments that make the results easier to understand. What amount of annual income will they need (after adjusting for inflation) in each of the eighteen years of retirement to have the purchasing power of 75% of their current income? Assuming they will continue to earn 9% on their investments, how much money will they need to have in their retirement accounts when they retire so that it will provide the eighteen years of income? Taking into account what they currently have in savings, how much will they have to save each month to meet their retirement needs? Sensitivity analysis: Redo the analysis assuming that they only earn 7.5% on their investments, instead of 9%. Determine the needed amounts so they have the money they need in retirement Note: Assume that all payments will be made at the end of the year (ordinary annuity)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts