Question: Case 2 Case 2: Jackson, age 35, and Peggy, age 34, are married and file a joint income tax return for 2021. Their salaries for

Case 2

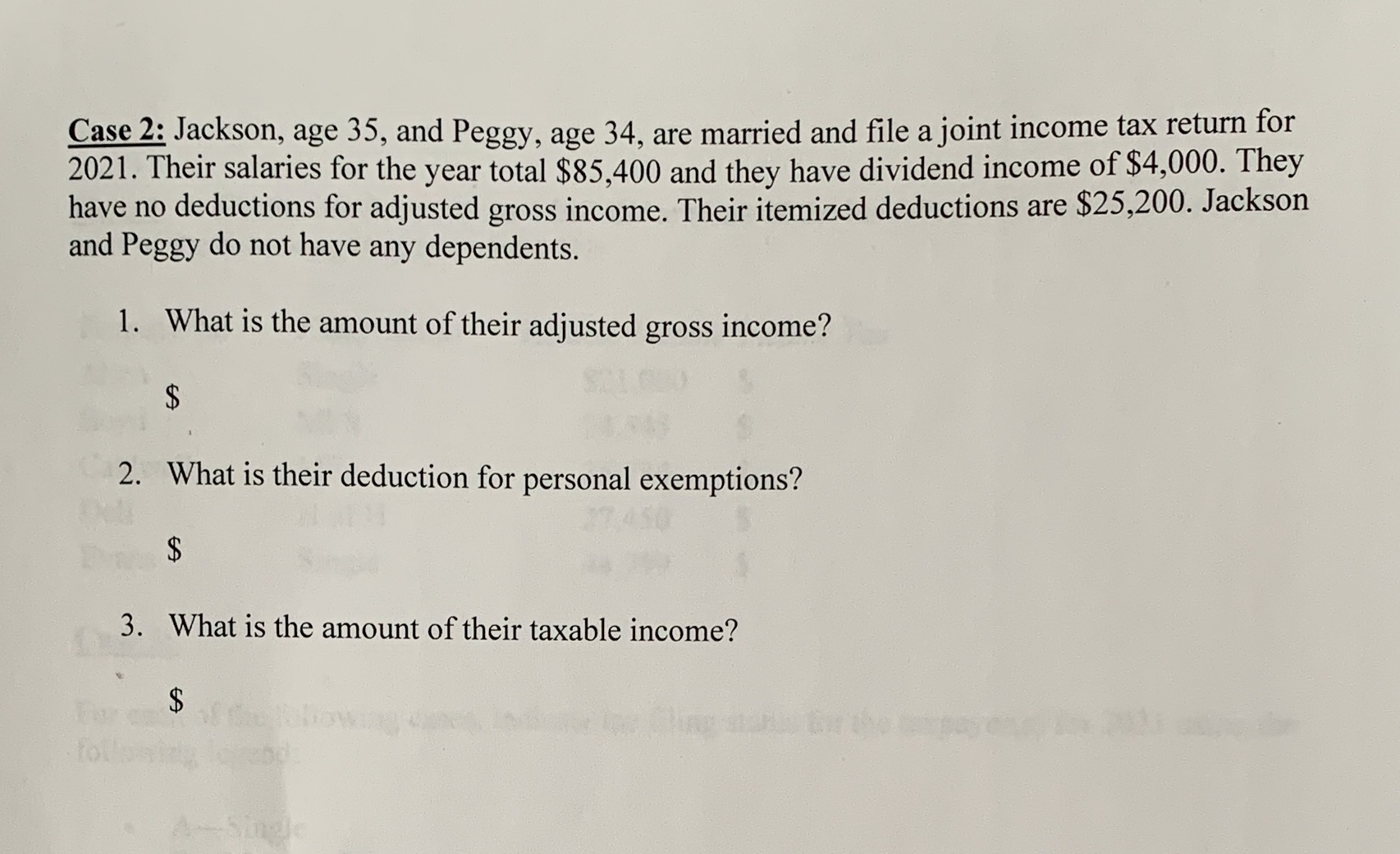

Case 2: Jackson, age 35, and Peggy, age 34, are married and file a joint income tax return for 2021. Their salaries for the year total $85,400 and they have dividend income of $4,000. They have no deductions for adjusted gross income. Their itemized deductions are $25,200. Jackson and Peggy do not have any dependents. 1. What is the amount of their adjusted gross income? EA 2. What is their deduction for personal exemptions? EA 3. What is the amount of their taxable income? $

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock