Question: Case 2 Question 2 (20 marks) Suppose the financial manager of Honda Motor suggests either issuing bonds or shares to raise capital for the development

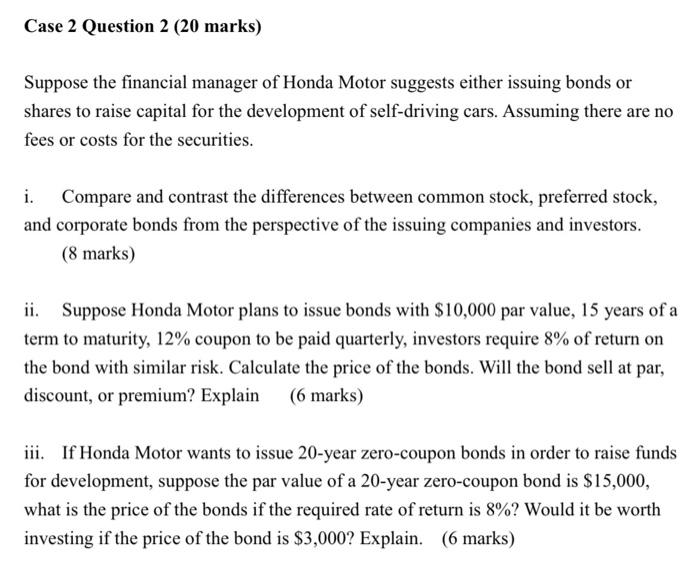

Case 2 Question 2 (20 marks) Suppose the financial manager of Honda Motor suggests either issuing bonds or shares to raise capital for the development of self-driving cars. Assuming there are no fees or costs for the securities. i. Compare and contrast the differences between common stock, preferred stock, and corporate bonds from the perspective of the issuing companies and investors. (8 marks) ii. Suppose Honda Motor plans to issue bonds with $10,000 par value, 15 years of a term to maturity, 12% coupon to be paid quarterly, investors require 8% of return on the bond with similar risk. Calculate the price of the bonds. Will the bond sell at par, discount, or premium? Explain (6 marks) iii. If Honda Motor wants to issue 20-year zero-coupon bonds in order to raise funds for development, suppose the par value of a 20-year zero-coupon bond is $15,000, what is the price of the bonds if the required rate of return is 8%? Would it be worth investing if the price of the bond is $3,000? Explain. (6 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts