Question: case 2 question in comments box Case-1 (Marks-15) Sunrise Industries wishes to accumulate funds to provide a retirement annuity for its vice president of research,

case 2 question in comments box

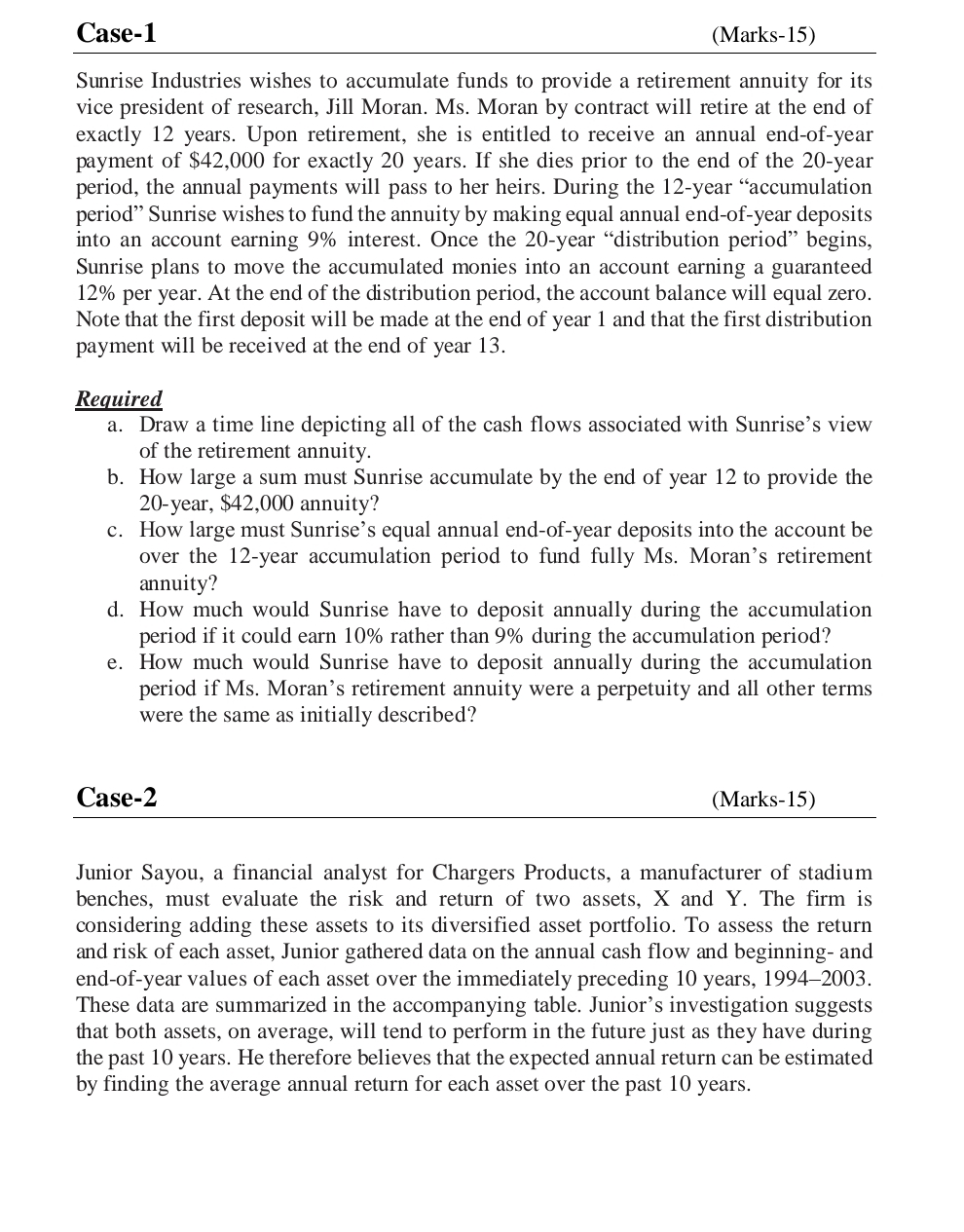

Case-1 (Marks-15) Sunrise Industries wishes to accumulate funds to provide a retirement annuity for its vice president of research, Jill Moran. Ms. Moran by contract will retire at the end of exactly 12 years. Upon retirement, she is entitled to receive an annual end-of-year payment of $42,000 for exactly 20 years. If she dies prior to the end of the 20-year period, the annual payments will pass to her heirs. During the 12-year \"accumulation period\" Sunrise wishes to fund the annuity by making equal annual end-of-year deposits into an account earning 9% interest. Once the 20-year \"distribution period\" begins, Sunrise plans to move the accumulated monies into an account earning a guaranteed 12% per year. At the end of the distribution period, the account balance will equal zero. Note that the first deposit will be made at the end of year 1 and that the first distribution payment will be received at the end of year 13. Reguired a. Draw a time line depicting all of the cash ows associated with Sunrise's view of the retirement annuity. b. How large a sum must Sunrise accumulate by the end of year 12 to provide the 20-year, $42,000 annuity? c. How large must Sunrise's equal annual end-of-year deposits into the account be over the 12-year accumulation period to fund fully Ms. Moran's retirement annuity? d. How much would Sunrise have to deposit annually during the accumulation period if it could earn 10% rather than 9% during the accumulation period? e. How much would Sunrise have to deposit annually during the accumulation period if Ms. Moran's retirement annuity were a perpetuity and all other terms were the same as initially described? Case-2 (Marks-15) Junior Sayou, a financial analyst for Chargers Products, a manufacturer of stadium benches, must evaluate the risk and return of two assets, X and Y. The firm is considering adding these assets to its diversified asset portfolio. To assess the return and risk of each asset, Junior gathered data on the annual cash flow and beginning- and end-ofyear values of each asset over the immediately preceding 10 years, 19942003. These data are summarized in the accompanying table. Junior's investigation suggests that both assets, on average, will tend to perform in the future just as they have during the past 10 years. He therefore believes that the expected annual return can be estimated by finding the average annual return for each asset over the past 10 years

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts