Question: Case 2. (Show all your works, including all computational procedures and details) Gangnam Style Inc (GSI) is a large fashion retailer targeting young customers. Currently,

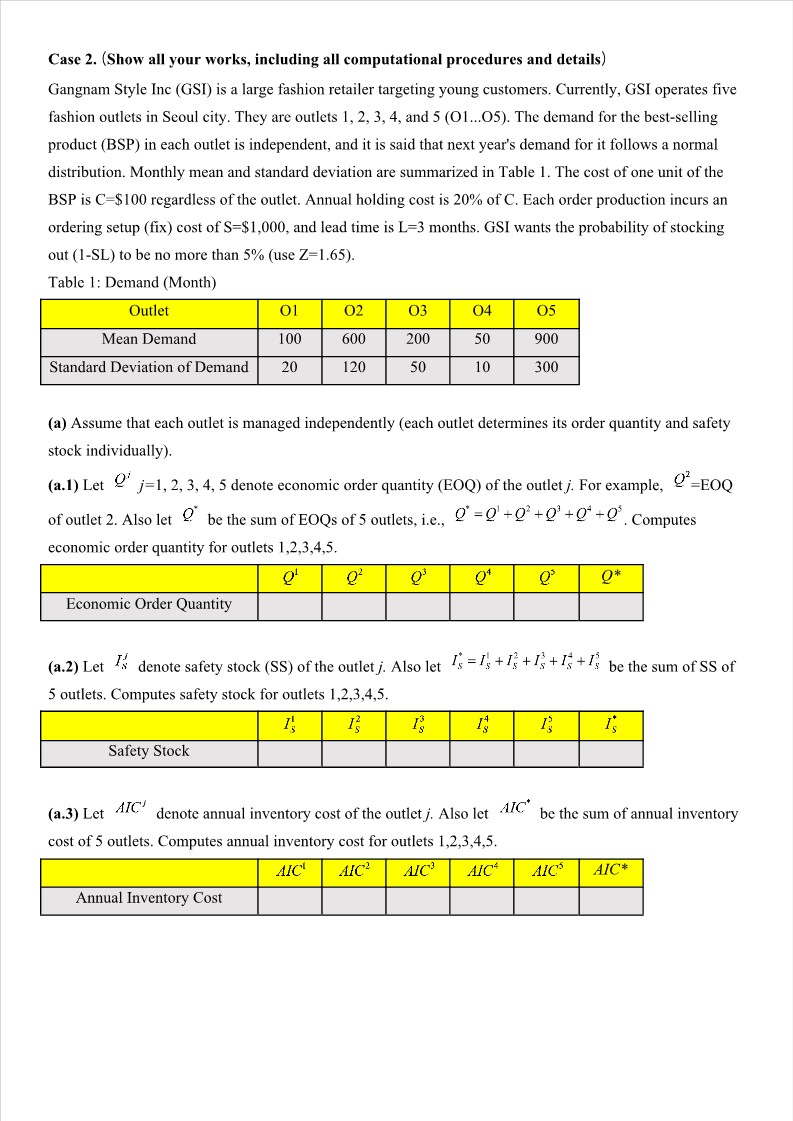

Case 2. (Show all your works, including all computational procedures and details) Gangnam Style Inc (GSI) is a large fashion retailer targeting young customers. Currently, GSI operates five fashion outlets in Seoul city. They are outlets 1,2,3,4, and 5 (O1...O5). The demand for the best-selling product (BSP) in each outlet is independent, and it is said that next year's demand for it follows a normal distribution. Monthly mean and standard deviation are summarized in Table 1 . The cost of one unit of the BSP is C=$100 regardless of the outlet. Annual holding cost is 20% of C. Each order production incurs an ordering setup (fix) cost of S=$1,000, and lead time is L=3 months. GSI wants the probability of stocking out (1-SL) to be no more than 5% (use Z=1.65 ). Table 1: Demand (Month) (a) Assume that each outlet is managed independently (each outlet determines its order quantity and safety stock individually). (a.1) Let Qij=1,2,3,4,5 denote economic order quantity (EOQ) of the outlet j. For example, Q2=EOQ of outlet 2. Also let Q be the sum of EOQs of 5 outlets, i.e., Q=Q1+Q2+Q3+Q4+Q5. Computes economic order quantity for outlets 1,2,3,4,5. (a.2) Let Isj denote safety stock (SS) of the outlet j. Also let Is=Is1+Is2+IS3+IS4+Is5 be the sum of SS of 5 outlets. Computes safety stock for outlets 1,2,3,4,5. (a.3) Let AICj denote annual inventory cost of the outlet j. Also let AIC be the sum of annual inventory cost of 5 outlets. Computes annual inventory cost for outlets 1,2,3,4,5. (b) A few years ago, according to GSI's prediction, the anticipated demand for each outlet was the same, and GSI placed inventory orders of 250 units for each outlet. However, it was ultimately revealed after the end of the sales season that Outlet 2 achieved tremendous success (demand for BSP was 800), while the other outlets sold only 200 units each. The company doesn't know which outlets will succeed or fail next year (monthly demands and standard deviations for the next year are given in Table 1). However, from the company's perspective, they want to avoid repeating the same mistakes as much as possible. As a result, they decide to centralize their inventory control system. The headquarter will pooling all inventories and store them in a centralized warehouse. Cost per product is C=$100. Annual holding cost is 20% of C. Each order production incurs an ordering setup (fix) cost of S=$1,000, and lead time is L=3 months. GSI wants the probability of stocking out (1-SL) to be no more than 5% (use Z=1.65 ). (b.1) Compute the economic order quantity for the centralized warehouse: Qc= ? (b.2) Compute safety stock for the centralized warehouse: IsC= ? (b.3) Computes annual inventory cost for the centralized inventory system: AICC= ? (c) Compare AIC in (a.3) with AICC in (b.3) and explain what effects cause the cost difference (Please consider how inventory centralization, which is being discussed in this problem, is related to Discussion Problems 1 and 2)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts