Question: CASE 2: SUFE INC. ISSUES BONDS ISSUANCE DATE 1ST APRIL 2021 - MATURING 1ST APRIL 2051 (A 30 YEAR BOND) ISSUED 1 M BONDS WITH

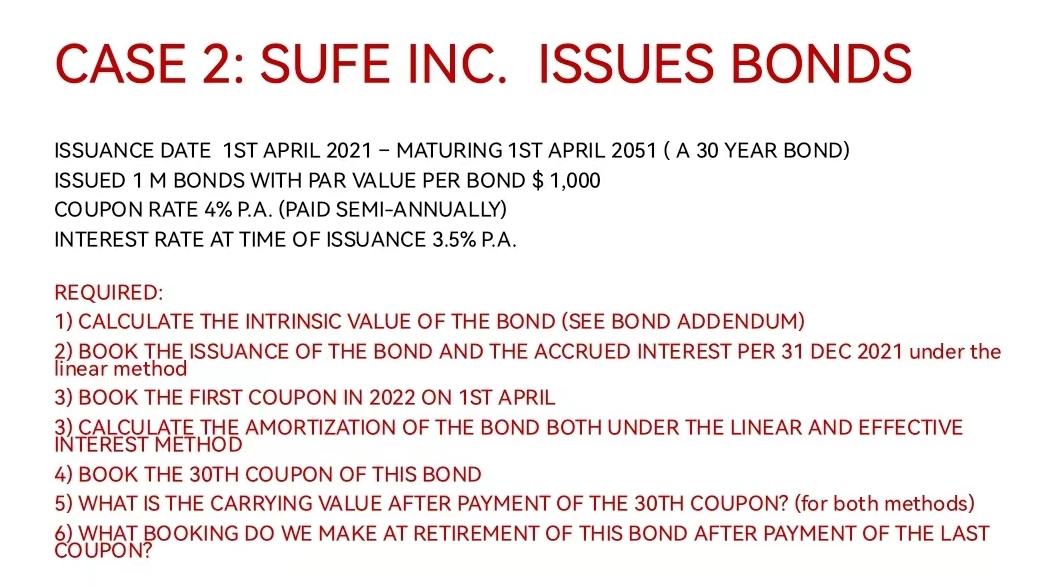

CASE 2: SUFE INC. ISSUES BONDS ISSUANCE DATE 1ST APRIL 2021 - MATURING 1ST APRIL 2051 (A 30 YEAR BOND) ISSUED 1 M BONDS WITH PAR VALUE PER BOND $ 1,000 COUPON RATE 4% P.A. (PAID SEMI-ANNUALLY) INTEREST RATE AT TIME OF ISSUANCE 3.5% P.A. REQUIRED: 1) CALCULATE THE INTRINSIC VALUE OF THE BOND (SEE BOND ADDENDUM) 2) BOOK THE ISSUANCE OF THE BOND AND THE ACCRUED INTEREST PER 31 DEC 2021 under the linear method 3) BOOK THE FIRST COUPON IN 2022 ON 1ST APRIL 3) CALCULATE THE AMORTIZATION OF THE BOND BOTH UNDER THE LINEAR AND EFFECTIVE INTEREST METHOD 4) BOOK THE 30TH COUPON OF THIS BOND 5) WHAT IS THE CARRYING VALUE AFTER PAYMENT OF THE 30TH COUPON? (for both methods) 6) WHAT BOOKING DO WE MAKE AT RETIREMENT OF THIS BOND AFTER PAYMENT OF THE LAST COUPON? CASE 2: SUFE INC. ISSUES BONDS ISSUANCE DATE 1ST APRIL 2021 - MATURING 1ST APRIL 2051 (A 30 YEAR BOND) ISSUED 1 M BONDS WITH PAR VALUE PER BOND $ 1,000 COUPON RATE 4% P.A. (PAID SEMI-ANNUALLY) INTEREST RATE AT TIME OF ISSUANCE 3.5% P.A. REQUIRED: 1) CALCULATE THE INTRINSIC VALUE OF THE BOND (SEE BOND ADDENDUM) 2) BOOK THE ISSUANCE OF THE BOND AND THE ACCRUED INTEREST PER 31 DEC 2021 under the linear method 3) BOOK THE FIRST COUPON IN 2022 ON 1ST APRIL 3) CALCULATE THE AMORTIZATION OF THE BOND BOTH UNDER THE LINEAR AND EFFECTIVE INTEREST METHOD 4) BOOK THE 30TH COUPON OF THIS BOND 5) WHAT IS THE CARRYING VALUE AFTER PAYMENT OF THE 30TH COUPON? (for both methods) 6) WHAT BOOKING DO WE MAKE AT RETIREMENT OF THIS BOND AFTER PAYMENT OF THE LAST COUPON

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts