Question: Case # 2 The contribution format income statement for the Atlantic division of Grant and Dwyer for the most recent period is given below:

Case #

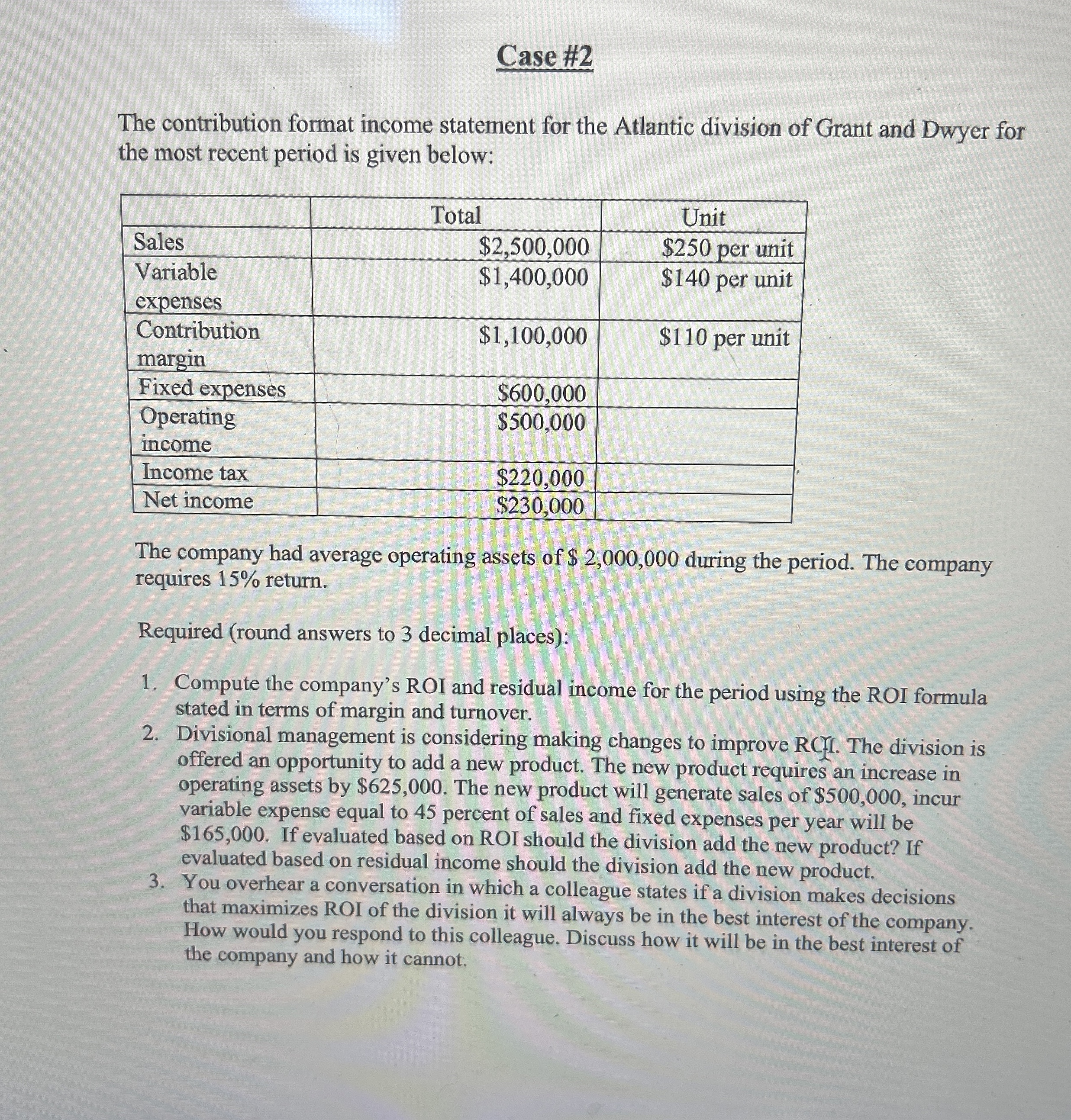

The contribution format income statement for the Atlantic division of Grant and Dwyer for the most recent period is given below:

tableTotal,UnitSales$$ per unittableVariableexpenses$$ per unittableContributionmargin$$ per unitFixed expenses,$tableOperatingincome$Income tax,$Net income,$

The company had average operating assets of $ during the period. The company requires return.

Required round answers to decimal places:

Compute the company's ROI and residual income for the period using the ROI formula stated in terms of margin and turnover.

Divisional management is considering making changes to improve RCYI. The division is offered an opportunity to add a new product. The new product requires an increase in operating assets by $ The new product will generate sales of $ incur variable expense equal to percent of sales and fixed expenses per year will be $ If evaluated based on ROI should the division add the new product? If evaluated based on residual income should the division add the new product.

You overhear a conversation in which a colleague states if a division makes decisions that maximizes ROI of the division it will always be in the best interest of the company. How would you respond to this colleague. Discuss how it will be in the best interest of the company and how it cannot.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock