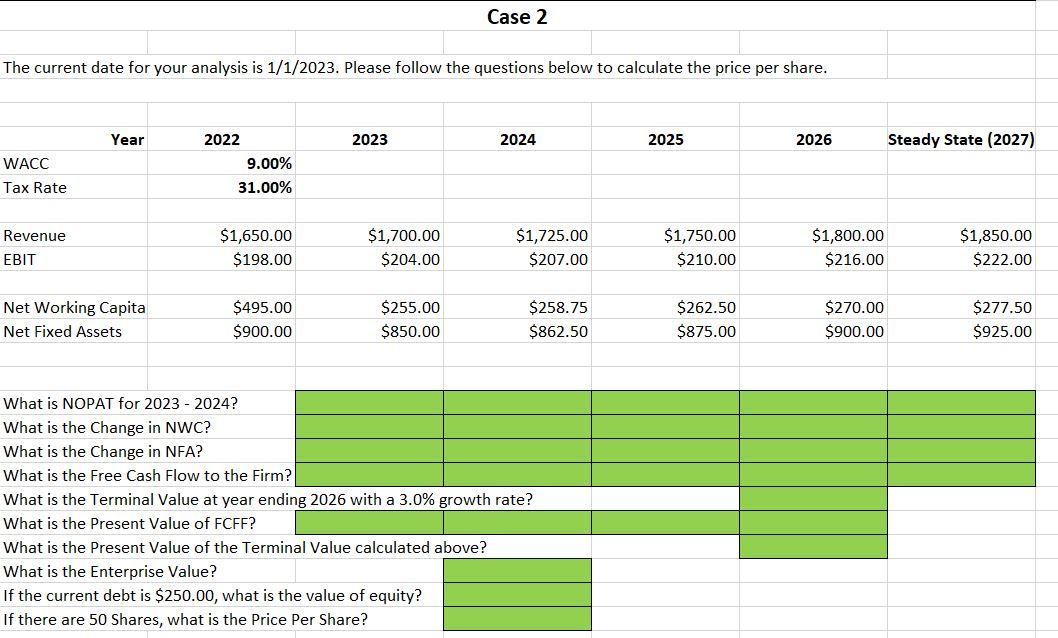

Question: Case 2 The current date for your analysis is 1/1/2023. Please follow the questions below to calculate the price per share. Year 2022 2023 2024

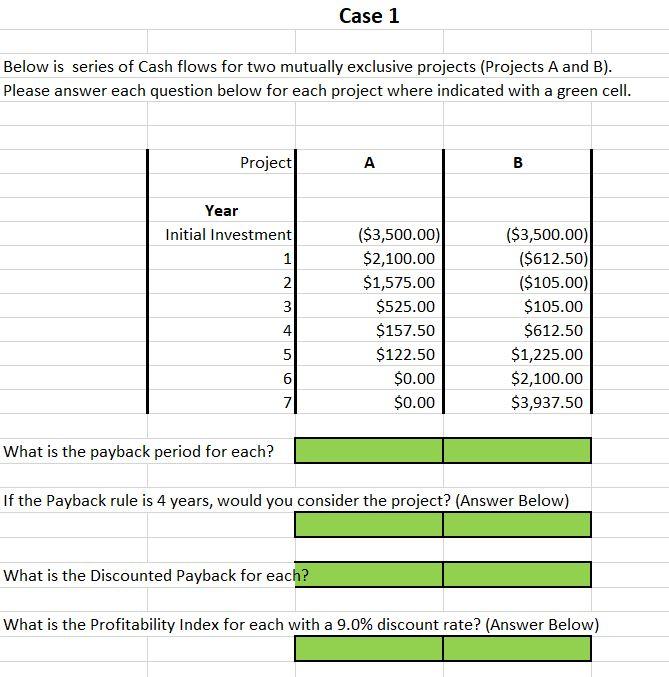

Case 2 The current date for your analysis is 1/1/2023. Please follow the questions below to calculate the price per share. Year 2022 2023 2024 2025 2026 Steady State (2027) WACC 9.00% 31.00% Tax Rate Revenue $1,650.00 $198.00 $1,700.00 $204.00 $1,725.00 $207.00 $1,750.00 $210.00 $1,800.00 $216.00 $1,850.00 $222.00 EBIT Net Working Capita Net Fixed Assets $495.00 $900.00 $255.00 $850.00 $258.75 $862.50 $262.50 $875.00 $270.00 $900.00 $277.50 $925.00 What is NOPAT for 2023 - 2024? What is the Change in NWC? What is the Change in NFA? What is the Free Cash Flow to the Firm? What is the Terminal Value at year ending 2026 with a 3.0% growth rate? What is the Present Value of FCFF? What is the Present Value of the Terminal Value calculated above? What is the Enterprise Value? If the current debt is $250.00, what is the value of equity? If there are 50 Shares, what is the Price Per Share? Case 1 Below is series of Cash flows for two mutually exclusive projects (Projects A and B). Please answer each question below for each project where indicated with a green cell. Project A 00 B Year Initial Investment 1 N ($3,500.00) $2,100.00 $1,575.00 $525.00 $157.50 $122.50 $0.00 $0.00 3 4 5 6 7 ($3,500.00) ($612.50) ($105.00) $105.00 $612.50 $1,225.00 $2,100.00 $3,937.50 What is the payback period for each? If the Payback rule is 4 years, would you consider the project? (Answer Below) What is the Discounted Payback for each? What is the Profitability Index for each with a 9.0% discount rate? (Answer Below) If the minimum rate of return is 9.0%, would you consider the Project? (Answer Below) Considering only the IRR, which project would you choose (A or B)? (Answer Below) What is the Net Present Value with a discount rate of 9.0%? (Answer Below) Considering everything above, which project do you choose? All other things equal, which project do you choose with discount rate of 12.0? (Answer Below)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts