Question: Case 2: There had been a group discussion on various aspects related to accounting standards amongst a few fresh graduates. Each graduate had come up

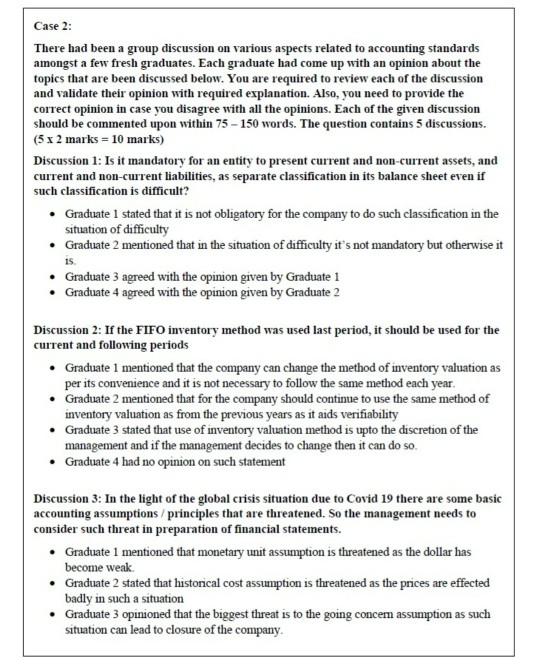

Case 2: There had been a group discussion on various aspects related to accounting standards amongst a few fresh graduates. Each graduate had come up with an opinion about the topics that are been discussed below. You are required to review each of the discussion and validate their opinion with required explanation. Also, you need to provide the correct opinion in case you disagree with all the opinions. Each of the given discussion should be commented upon within 75 - 150 words. The question contains 5 discussions. (5 x 2 marks = 10 marks) Discussion 1: Is it mandatory for an entity to present current and non-current assets, and current and non-current liabilities, as separate classification in its balance sheet even if such classification is difficult? Graduate 1 stated that it is not obligatory for the company to do such classification in the situation of difficulty Graduate 2 mentioned that in the situation of difficulty it's not mandatory but otherwise it Graduate 3 agreed with the opinion given by Graduate 1 Graduate 4 agreed with the opinion given by Graduate 2 15 Discussion 2: If the FIFO inventory method was used last period, it should be used for the current and following periods Graduate 1 mentioned that the company can change the method of inventory valuation as per its convenience and it is not necessary to follow the same method each year. Graduate 2 mentioned that for the company should continue to use the same method of inventory valuation as from the previous years as it aids verifiability Graduate 3 stated that use of inventory valuation method is upto the discretion of the management and if the management decides to change then it can do so Graduate 4 had no opinion on such statement Discussion 3: In the light of the global crisis situation due to Covid 19 there are some basic accounting assumptions / principles that are threatened. So the management needs to consider such threat in preparation of financial statements. Graduate 1 mentioned that monetary unit assumption is threatened as the dollar has become weak Graduate 2 stated that historical cost assumption is threatened as the prices are effected badly in such a situation Graduate 3 opinioned that the biggest threat is to the going concem assumption as such situation can lead to closure of the company

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts