Question: CASE 2.1 EVALUATING ACTUAL AND PLANNED PERFORMANCE. Returning to Sam's Golf Pro Shop in the chapter, Sam really wants to hone in on what part

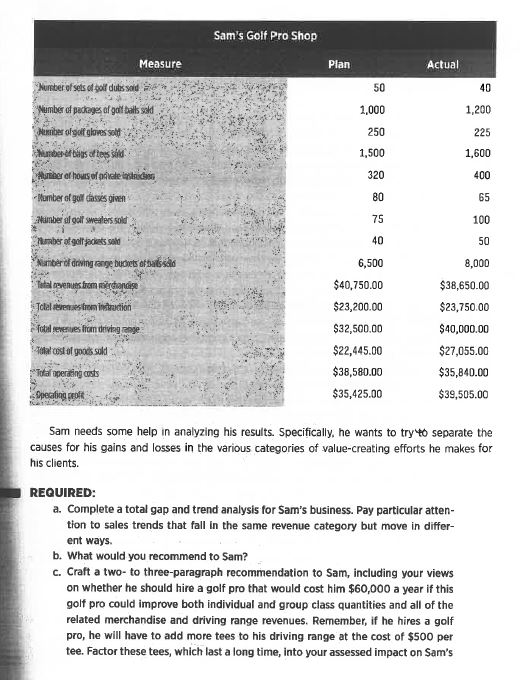

CASE 2.1 EVALUATING ACTUAL AND PLANNED PERFORMANCE. Returning to Sam's Golf Pro Shop in the chapter, Sam really wants to hone in on what part of his sales package is working and what is not. In talking about it, Sam notes, "The easiest solution would be to hire a golf pro and put in a few more tees on the driving range. But these are costs it won't be easy to justify if I don't get both individual and group classes going strong. I also have to use the push from these activities to make sure that I get more merchandise sales, because a pro shop with dusty, out-of-date merchandise won't help anyone out. I need a more comprehensive plan." To help do further analysis, Sam has pulled together actual unit sales in each of the categories of revenue (merchandise sales, instructional sales, driving range revenues) that he relies upon to make his business grow. These numbers are in the following table Sam's Golf Pro Shop Measure Plan Actual 40 Number of sets of oil dues said Member padages of all basso Member of golf gloves botas often 1,000 250 1,500 1,200 225 1,600 Horner of housell Humber of goll dasses given Munbe al golf sweaters sold bergoles sold Mariber of driving range bucets of Basco Total venues from werden die Total seves from induction Total severives from driving m e Total cost of goods sold Total operating costs peating profi l 6,500 $40,750.00 $23,200.00 $32,500.00 $22,445.00 $38,580.00 $35,425.00 8,000 $38,650.00 $23,750.00 $40,000.00 $27,055.00 $35,840.00 $39,505.00 Sam needs some help in analyzing his results. Specifically, he wants to try to separate the causes for his gains and losses in the various categories of value-creating efforts he makes for his clients. REQUIRED: a. Complete a total gap and trend analysis for Sam's business. Pay particular atten- tion to sales trends that fall in the same revenue category but move in differ- ent ways. b. What would you recommend to Sam? c. Craft a two-to three-paragraph recommendation to Sam, including your views on whether he should hire a golf pro that would cost him $60,000 a year if this golf pro could improve both individual and group class quantities and all of the related merchandise and driving range revenues. Remember, if he hires a golf pro, he will have to add more tees to his driving range at the cost of $500 per tee. Factor these tees, which last a long time, into your assessed impact on Sam's CASE 2.1 EVALUATING ACTUAL AND PLANNED PERFORMANCE. Returning to Sam's Golf Pro Shop in the chapter, Sam really wants to hone in on what part of his sales package is working and what is not. In talking about it, Sam notes, "The easiest solution would be to hire a golf pro and put in a few more tees on the driving range. But these are costs it won't be easy to justify if I don't get both individual and group classes going strong. I also have to use the push from these activities to make sure that I get more merchandise sales, because a pro shop with dusty, out-of-date merchandise won't help anyone out. I need a more comprehensive plan." To help do further analysis, Sam has pulled together actual unit sales in each of the categories of revenue (merchandise sales, instructional sales, driving range revenues) that he relies upon to make his business grow. These numbers are in the following table Sam's Golf Pro Shop Measure Plan Actual 40 Number of sets of oil dues said Member padages of all basso Member of golf gloves botas often 1,000 250 1,500 1,200 225 1,600 Horner of housell Humber of goll dasses given Munbe al golf sweaters sold bergoles sold Mariber of driving range bucets of Basco Total venues from werden die Total seves from induction Total severives from driving m e Total cost of goods sold Total operating costs peating profi l 6,500 $40,750.00 $23,200.00 $32,500.00 $22,445.00 $38,580.00 $35,425.00 8,000 $38,650.00 $23,750.00 $40,000.00 $27,055.00 $35,840.00 $39,505.00 Sam needs some help in analyzing his results. Specifically, he wants to try to separate the causes for his gains and losses in the various categories of value-creating efforts he makes for his clients. REQUIRED: a. Complete a total gap and trend analysis for Sam's business. Pay particular atten- tion to sales trends that fall in the same revenue category but move in differ- ent ways. b. What would you recommend to Sam? c. Craft a two-to three-paragraph recommendation to Sam, including your views on whether he should hire a golf pro that would cost him $60,000 a year if this golf pro could improve both individual and group class quantities and all of the related merchandise and driving range revenues. Remember, if he hires a golf pro, he will have to add more tees to his driving range at the cost of $500 per tee. Factor these tees, which last a long time, into your assessed impact on Sam's

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts