Question: CASE 3 - 2 Analyzing and Interpreting Liabilities Refer to the annual report of Campbell Soup Company in Appendix A . Campbell Soup Required: a

CASE

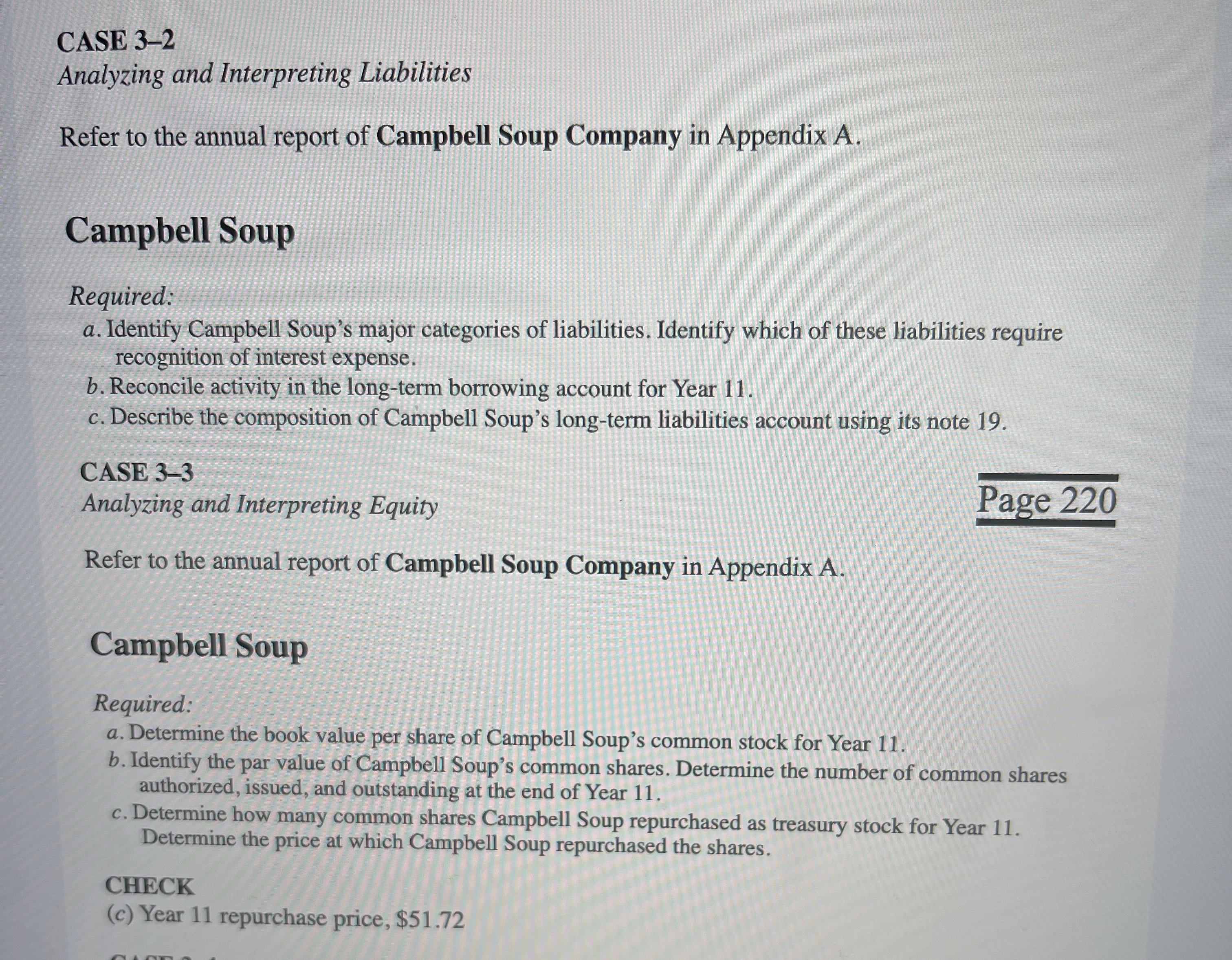

Analyzing and Interpreting Liabilities

Refer to the annual report of Campbell Soup Company in Appendix A

Campbell Soup

Required:

a Identify Campbell Soup's major categories of liabilities. Identify which of these liabilities require recognition of interest expense.

b Reconcile activity in the longterm borrowing account for Year

c Describe the composition of Campbell Soup's longterm liabilities account using its note

CASE

Analyzing and Interpreting Equity

Page

Refer to the annual report of Campbell Soup Company in Appendix A

Campbell Soup

Required:

a Determine the book value per share of Campbell Soup's common stock for Year

b Identify the par value of Campbell Soup's common shares. Determine the number of common shares authorized, issued, and outstanding at the end of Year

c Determine how many common shares Campbell Soup repurchased as treasury stock for Year Determine the price at which Campbell Soup repurchased the shares.

CHECK

c Year repurchase price, $

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock