Question: CASE 3 (20 points) The company is considering a five-year project that will require 500,000 for new manufacturing equipment that will be depreciated straight-line to

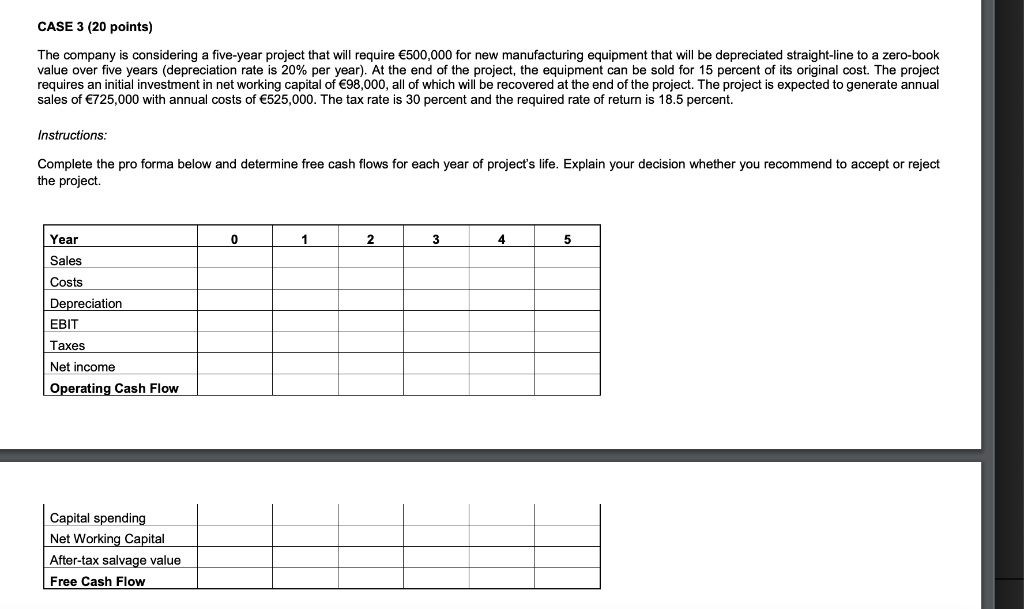

CASE 3 (20 points) The company is considering a five-year project that will require 500,000 for new manufacturing equipment that will be depreciated straight-line to zero-book value over five years (depreciation rate is 20% per year). At the end of the project, the equipment can be sold for 15 percent of its original cost. The project requires an initial investment in net working capital of 98,000, all of which will be recovered at the end of the project. The project is expected to generate annual sales of 725,000 with annual costs of 525,000. The tax rate is 30 percent and the required rate of return is 18.5 percent. Instructions: Complete the pro forma below and determine free cash flows for each year of project's life. Explain your decision whether you recommend to accept or reject the project. Year 0 1 2 3 4 5 Sales Costs Depreciation EBIT Taxes Net income Operating Cash Flow Capital spending Net Working Capital After-tax salvage value Free Cash Flow

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts