Question: CASE 3 ( continued ) The project team has estimated the following for unit sales, selling price, variable cost per unit, and cash fixed operating

CASE continued

The project team has estimated the following for unit sales,

selling price, variable cost per unit, and cash fixed operating

expenses for the bestcase, worstcase, basecase scenar

ios as follows:

a Estimate the cash flows for the investment under the listed

basecase assumptions. Calculate the project NPV for

these cash flows.

b Evaluate the NPV of the investment under the worstcase

assumptions.

c Evaluate the NPV of the investment under the bestcase

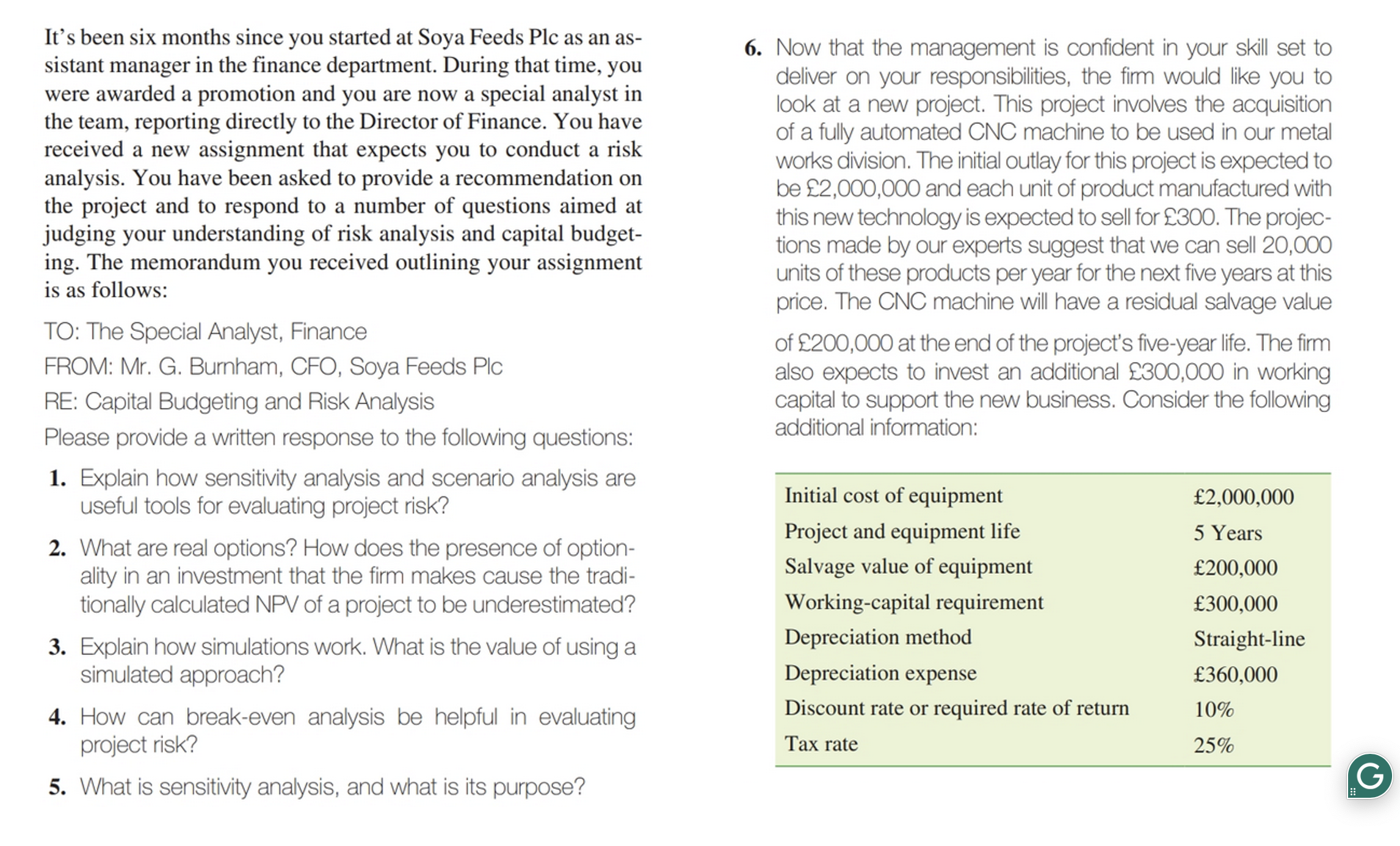

assumptions.It's been six months since you started at Soya Feeds Plc as an as

sistant manager in the finance department. During that time, you

were awarded a promotion and you are now a special analyst in

the team, reporting directly to the Director of Finance. You have

received a new assignment that expects you to conduct a risk

analysis. You have been asked to provide a recommendation on

the project and to respond to a number of questions aimed at

judging your understanding of risk analysis and capital budget

ing. The memorandum you received outlining your assignment

is as follows:

TO: The Special Analyst, Finance

FROM: Mr G Burnham, CFO, Soya Feeds Plc

RE: Capital Budgeting and Risk Analysis

Please provide a written response to the following questions:

Explain how sensitivity analysis and scenario analysis are

useful tools for evaluating project risk?

What are real options? How does the presence of option

ality in an investment that the firm makes cause the tradi

tionally calculated NPV of a project to be underestimated?

Explain how simulations work. What is the value of using a

simulated approach?

How can breakeven analysis be helpful in evaluating

project risk

What is sensitivity analysis, and what is its purpose?

Now that the management is confident in your skill set to

deliver on your responsibilities, the fimm would like you to

look at a new project. This project involves the acquisition

of a fully automated CNC machine to be used in our metal

works division. The initial outlay for this project is expected to

be and each unit of product manufactured with

this new technology is expected to sell for The projec

tions made by our experts suggest that we can sell

units of these products per year for the next five years at this

price. The CNC machine will have a residual salvage value

of at the end of the project's fiveyear life. The firm

also expects to invest an additional in working

capital to support the new business. Consider the following

additional information:

CASE continued

The project team has estimated the following for unit sales,

selling price, variable cost per unit, and cash fixed operating

expenses for the bestcase, worstcase, basecase scenar

ios as follows:

a Estimate the cash flows for the investment under the listed

basecase assumptions. Calculate the project NPV for

these cash flows.

b Evaluate the NPV of the investment under the worstcase

assumptions.

c Evaluate the NPV of the investment under the bestcase

assumptions.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock