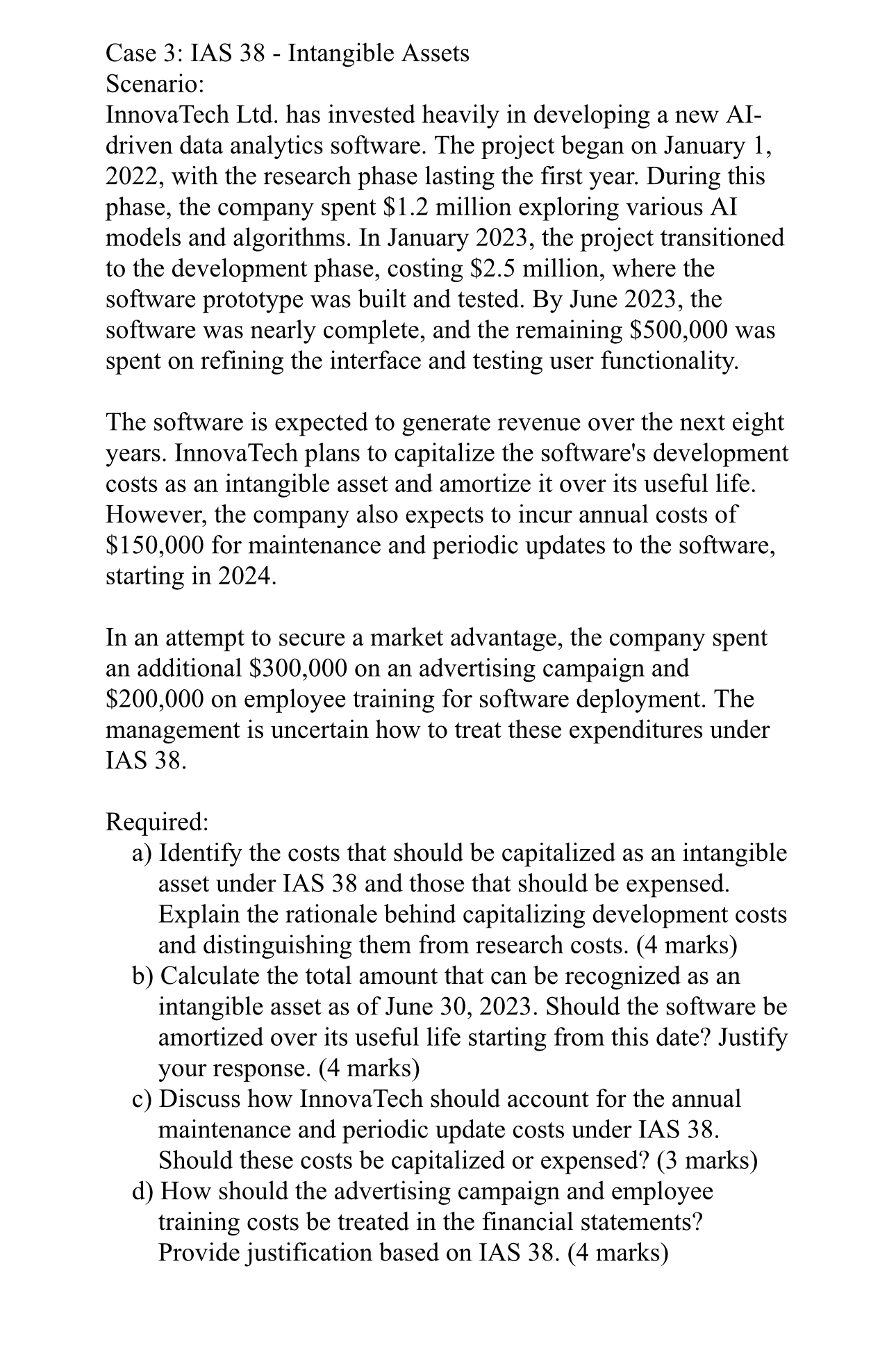

Question: Case 3 : IAS 3 8 - Intangible Assets Scenario: InnovaTech Ltd . has invested heavily in developing a new AI - driven data analytics

Case : IAS Intangible Assets

Scenario:

InnovaTech Ltd has invested heavily in developing a new AI

driven data analytics software. The project began on January

with the research phase lasting the first year. During this

phase, the company spent $ million exploring various AI

models and algorithms. In January the project transitioned

to the development phase, costing $ million, where the

software prototype was built and tested. By June the

software was nearly complete, and the remaining $ was

spent on refining the interface and testing user functionality.

The software is expected to generate revenue over the next eight

years. InnovaTech plans to capitalize the software's development

costs as an intangible asset and amortize it over its useful life.

However, the company also expects to incur annual costs of

$ for maintenance and periodic updates to the software,

starting in

In an attempt to secure a market advantage, the company spent

an additional $ on an advertising campaign and

$ on employee training for software deployment. The

management is uncertain how to treat these expenditures under

IAS

Required:

a Identify the costs that should be capitalized as an intangible

asset under IAS and those that should be expensed.

Explain the rationale behind capitalizing development costs

and distinguishing them from research costs. marks

b Calculate the total amount that can be recognized as an

intangible asset as of June Should the software be

amortized over its useful life starting from this date? Justify

your response. marks

c Discuss how InnovaTech should account for the annual

maintenance and periodic update costs under IAS

Should these costs be capitalized or expensed? marks

d How should the advertising campaign and employee

training costs be treated in the financial statements?

Provide justification based on IAS marks

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock