Question: Case 3 Ruth, aged 5 0 , has come to see you, a financial planner, to ask for advice regarding her estate planning. Ruth is

Case

Ruth, aged has come to see you, a financial planner, to ask for advice regarding her estate planning. Ruth is a widow and mother of one child, Emma, aged Emma, a single mother of one daughter, is financially independent and lives in a rental apartment.

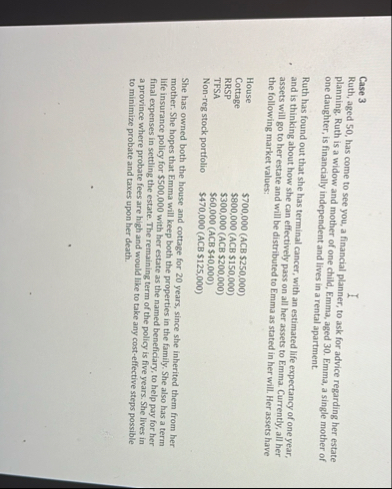

Ruth has found out that she has terminal cancer, with an estimated life expectancy of one year, and is thinking about how she can effectively pass on all her assets to Emma. Currently, all her assets will go to her estate and will be distributed to Emma as stated in her will. Her assets have the following market values:

House

Cottage

RRSP

TFSA

Nonreg stock portfolio

$ ACB $

$ ACB $

$ ACB $

$ ACB $

$ ACB $

She has owned both the house and cottage for years, since she inherited them from her mother. She hopes that Emma will keep both the properties in the family. She also has a term life insurance policy for $ with her estate as the named beneficiary, to help pay for her final expenses in settling the estate. The remaining term of the policy is five years. She lives in a province where probate fees are high and would like to take any costeffective steps possible to minimize probate and taxes upon her death.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock