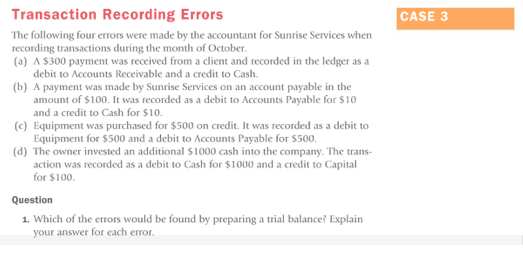

Question: CASE 3 Transaction Recording Errors The following four errors were made by the accountant for Sunrise Services when recording transactions during the month of October

CASE 3 Transaction Recording Errors The following four errors were made by the accountant for Sunrise Services when recording transactions during the month of October (a) A $300 payment was received from a client and recorded in the ledger as a debit to Accounts Receivable and a credit to Cash. (b) A payment was made by Sunrise Services on an account payable in the amount of $100. It was recorded as a debit to Accounts Payable for $10 and a credit to Cash for $10. (c) Equipment was purchased for $500 on credit. It was recorded as a debit to Equipment for $500 and a debit to Accounts Payable for $500 (d) The owner invested an additional $1000 cash into the company. The trans- action was recorded as a debit to Cash for $1000 and a credit to Capital for $100. Question 1. Which of the errors would be found by preparing a trial balance? Explain your answer for each error

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts