Question: Case #3 White Inc. operates three separate manufacturing divisions that operate autonomously. Information for each division for 2020 was as follows: Sales Contribution margin Operating

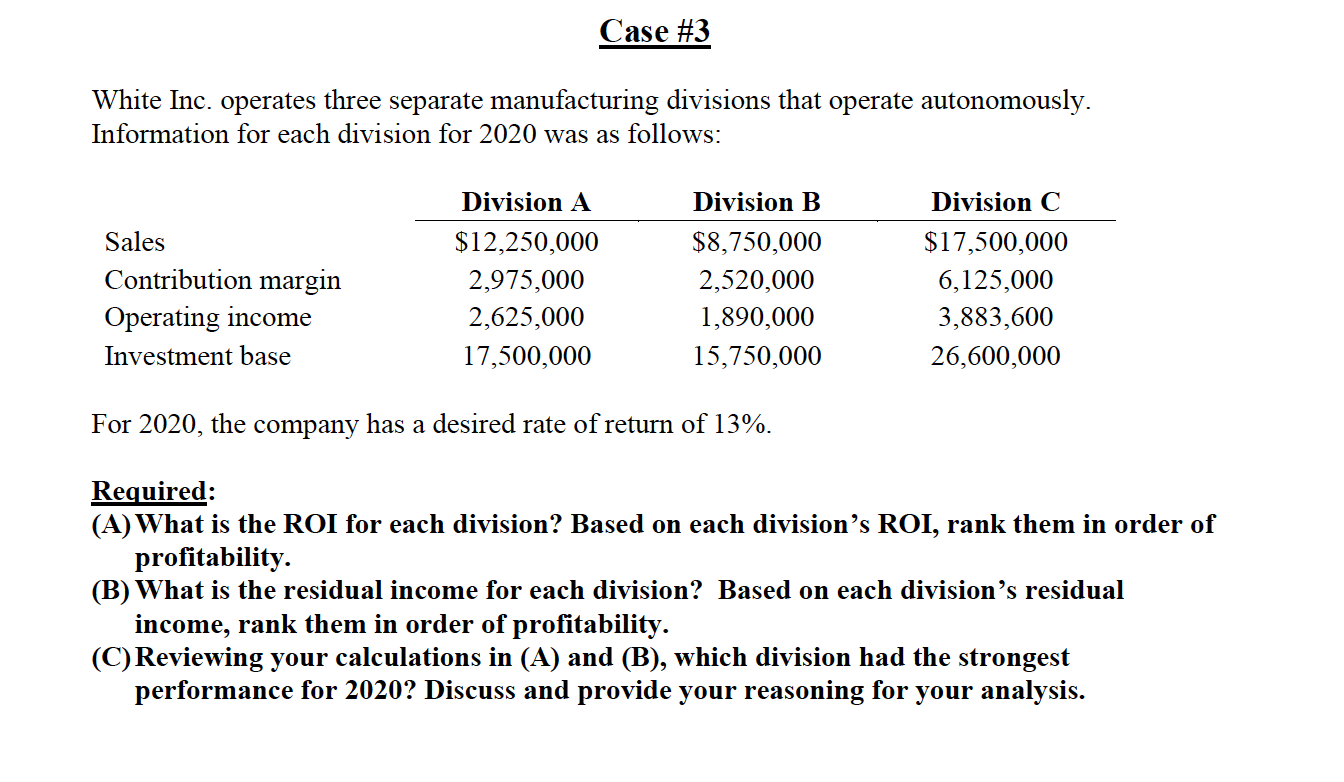

Case #3 White Inc. operates three separate manufacturing divisions that operate autonomously. Information for each division for 2020 was as follows: Sales Contribution margin Operating income Investment base Division A $12,250,000 2,975,000 2,625,000 17,500,000 Division B $8,750,000 2,520,000 1,890,000 15,750,000 Division C $17,500,000 6,125,000 3,883,600 26,600,000 For 2020, the company has a desired rate of return of 13%. Required: (A) What is the ROI for each division? Based on each division's ROI, rank them in order of profitability. (B) What is the residual income for each division? Based on each division's residual income, rank them in order of profitability. (C)Reviewing your calculations in (A) and (B), which division had the strongest performance for 2020? Discuss and provide your reasoning for your analysis

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts