Question: CASE 3.1 Intel Corporation and Inventory Write-downs Both the International Financial Reporting Standards (IFRS) and U.S. Generally Accepted Accounting Principles (GAAP) require that inventory be

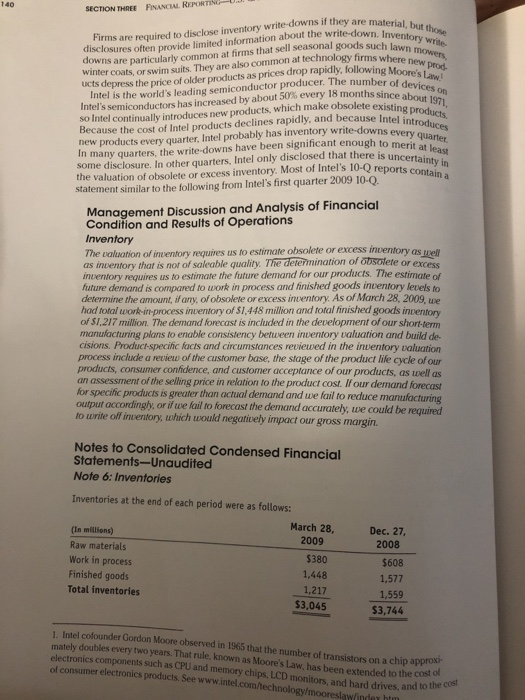

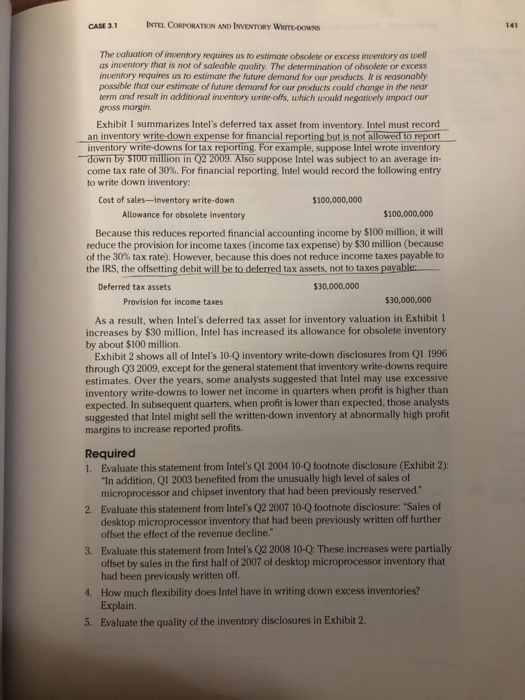

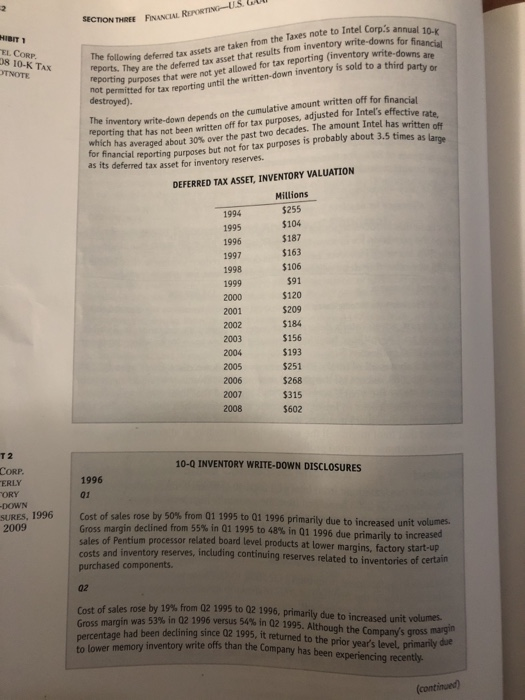

CASE 3.1 Intel Corporation and Inventory Write-downs Both the International Financial Reporting Standards (IFRS) and U.S. Generally Accepted Accounting Principles (GAAP) require that inventory be valued at the lower of cost or some measure of what that inventory can be sold for in the market. Under U.S. GAAP, the rule is usually called lower of cost or market, under IFRS it is called lower of cost or net realisoble vave . ventory cost includes the purcha e price, import duties, shipping costs, and simi- lar items. It also includes conversion costs such as direct labor and an allocation of Indirect labor and both variable and fixed production overhead In many instances, the cost of inventories may not be recoverable. Electronics man- ufacturers, such as Dell and Palm, purchased large inventories of chips that were in short supply. When chip manufacturers drastically reduced the price on those chips. Dell and Palm wrote down their inventories. Similarly, when demand for Intel's prod- ucts decline, Intel must write down its inventories. Firms also write down damaged goods, and the fashion industry will write down goods toward the end of a season. when items may sell for less than their cost. Under IFRS, inventories must be written down to lower of cost or "net realisable value" (IAS 2, par. 28), where net realisable value is defined as Net realisable value refers to the net amount that an entity expects to realize from the sale of inventory in the ordinary course of business. Fair value reflects the amount for which the same inventory could be exchanged between knowledgeable and willing buyers and sellers in the marketplace. The former is an entity-specific value; the latter is not. Net realizable value for inventories may not equal fair value less costs to sel (IAS 2, par. 7) Suppose a retailer using IFRS buys a television from its supplier for $325 and ex- pects to sell the television for $425. A week later the supplier drops the price to $275 and in response, the retailer drops its retail price to $375. If the retailer's selling cost is $35, its net realizable value will be $340 ($375 selling price, less $35 selling cost). Its $340 net realizable value is greater than its $325 cost, so the retailer would continue to value the item at its $325 original cost. Here is a typical IFRS inventory disclosure from The Swatch Group's 2008 annual report Inventories are stated at the lower of cost and net realizable value. Cost is determined using the weighted average price method. Some conmpanies, panticulkarty those in the Pro- duction segment, value their inventories using the standard cost method. As these costs are regularly rewiewed and adjusted, this method approximates the results of the weighted average price method. The valuation of spare parts for customer service is confned to those units that are considered ikely to be used, based on historical demand Net realizable value is the estimated selling price in the ordinary course of business, ess estimated costs of completion and the applicable variable selling expenses Under US. GAAP, inventory is written down to the lower of cost or market, but the market is subject to both a celing and a floor. The ceiling is net realizable value, and the floor is net realizable value less.a normal profit margin. In most cases, the differ- ences between U.S. GAAP and IFRS lower of cost or market rules are minimal. SECTION THREE FINANCIAL. REPOR but th disclosures often provide limited information about the write-dw dow write-down. Inventory write firms where new prod Prod Firms are required to disclose inventory write-downs if they are mat ns are particularly common at firms that sell seasonal goods sucl winter coats, or swim suits. They are also common at tech ucts depress the price of older products as prices drop rapidly, following Moo Intel is the world's leading semiconductor producer. The number of Intel's semiconductors has increased by about 50% every 18 months since ab so Intel continually introduces new products, which make obsolete existing7 Because the cost of Intel products declines rapidly, and because Intel new products every quarter, Intel probably has inventory write-downs ever In many quarters, the write-downs have been significant enough to meri uarer some disclosure. In other quarters, Intel only disclosed that there is unce the valuation of obsolete or excess inventory. Most of Intel's 10-Q reports i statement similar to the following from Intels first quarter 2009 10-Q Management Discussion and Analysis of Financial Condition and Results of Operations Inventory The valuation of inventory requires us to estimate obsolete or excess inventory as well as inventory that is not of saleable quality. The determination of otsotete or excess inventory requires us to estimate the future demand for our products. The estimate of future demand is compared to work in process and finished goods inventory levels o determine the amount, if any, of obsolete or excess inventory. As of March 28, 2009, we had total work-in-process inventory of S1,448 million and total finished goods inventory of SI,217 million. The demand forecast is included in the development of our short-term manufacturing plans to enable consistency betuween inventory valuation and build de cisions. Product-specific facts and circumstances reviewed in the inventory valuation process include a review of the customer base, the stage of the product lile cycle of our products, consumer confidence, and customer acceptance of our products, as well as an assessment of the selling price in relation to the product cost. If our demand forecast for specific products is greater than actual demand and we fail to reduce manufacturing output accordingly, or if we fail to forecast the demand accurately, to write off inventory, which would negatively impact our gross margin we could be required Notes to Consolidated Condensed Financial Statements-Unaudited Note 6: Inventories Inventories at the end of each period were as follows: (In millions) Raw materials Work in process Finished goods Total inventories March 28, 2009 $380 1,448 1,217 Dec. 27 2008 $608 1,577 1,559 $3,744 $3,045 1, Intel colounder Gordon Moore observed in 1965 that the number of transistors on a chip approxi mately doubles every two years. That rule, known as Moore's Law, has been extended to the cost ol electronics components such as CPU and memory chips, LCD monitors, and hard drives, and to tihe of consumer electronics products. See www.intel.com/technology/mooreslawindex h CASE 3.1 INTEL CORPORATON AND INVENTORY whmoowNS 141 The valuation of inventory requires us to estimate obsolete or excess inventory as wel as inventory that is not of saleable quality. The determination of obsolete or excess inventory requires us to estimate the future demand for our products. It is reasonably possible that our estimate of future demand or our products could change in the near term and result in additional inventory write-offs, which would negatively impact our gross margn Exhibit 1 summarizes Intel's deferred tax asset from inventory. Intel must record an inventory write-down expense for financial reporting but is not allowed to report inventory write-downs for tax reporting. For example, suppose Intel wrote inventory down by S100 million in Q2 2009. Also suppose Intel was subject to an average in- come tax rate of 30%. For financial reporting, Intel would record the following entry to write down inventory Cost of sales-inventory write-down $100,000,000 Allowance for obsolete inventory $100,000,000 Because this reduces reported financial accounting income by $100 million, it will reduce the provision for income taxes (income tax expense) by $30 million (because of the 30% tax rate). However, because this does not reduce income taxes payable to the IRS, the offsetting debit will be to deferred t tax assets, not to taxes Deferred tax assets 30,000,000 Provision for income taxes $30,000,000 As a result, when Intel's deferred tax asset for inventory valuation in Exhibit 1 increases by $30 million, Intel has increased its allowance for obsolete inventory by about $100 million. Exhibit 2 shows all of Intel's 10-Q inventory write-down disclosures from Q1 1996 through Q3 2009, except for the general statement that inventory write-downs require estimates. Over the years, some analysts suggested that Intel may use excessive inventory write-downs to lower net income in quarters when profit is higher than expected. In subsequent quarters, when profit is lower than expected, those analysts suggested that Intel might sell the written-down inventory at abnormally high profit margins to increase reported profits. Required 1. Evaluate this statement from Intel's Q1 2004 10-Q footnote disclosure (Exhibit 2): In addition, Q1 2003 benefited from the unusually high level of sales of microprocessor and chipset inventory that had been previously reserved. Evaluate this statement from Intel's Q2 2007 10-Q footnote disclosure: "Sales of desktop microprocessor inventory that had been previously written off further offset the effect of the revenue decline." 2. Evaluate this statement from Intel's Q2 2008 10-Q: These increases were partially offset by sales in the first half of 2007 of desktop microprocessor inventory that had been previously written off How much flexibility does Intel have in writing down excess inventories? Explain. 3. 4. 5. Evaluate the quality of the inventory disclosures in Exhibit 2 143 CASE 3.1 INTEL CORPORATON AND INVENTORY W rTE-Downs EXHIBIT 2- 1997 03 INTEL. CORP QUARTERLY Cost of sales declined by 5% from Q1 1996 to Q1 1997 due to shifts in product mix and factory efficiencies due to increased volume. Costs for 01 of 1996 also included unusually high inventory reserves, including reserves related to inventories of certain purchased components. more favorable product mix and the reduced costs discussed above WRITE-DOWN DISCLOSURES, 1996 TO Q3, 2009 Gross margin increased from 48% in Q1 1996 to 64% in Q1 1997 due to the 1998 02 Cost of sales increased by 29% from Q2 1997 to Q2 1998 due to the shift in product mix to the Pentium(R) II processor, reflecting the cost of purchased components for the Single E Contact ("SEC") cartridge, higher unit volumes, and higher fixed costs. In addition, in 02 1998 reductions in product costs on the highest volume processors ca written down to the new lower costs. Gross margin decreased to 49% in 0219 in 02 1997 primarily due to the inventory write-downs and higher fixed costs dge used inventories to be 98 from 61% lower processor prices, the impact of the SEC cartridge, the 1999 02 Cost of sales decreased by 8% in Q2 1999 compared to Q2 1998 primarily due to lower unit costs for microprocessors in 02 1999 partially offset by higher unit sales volumes. In addition, cost of sales in Q2 1998 included unusually high inventory write-downs. The lower unit costs in 02 1999 were achieved primarily through redesigned microprocessor pr with lower-cost packaging, including packaging using fewer purchased components, as as factory efficiencies and lower purchase prices on the purchased components. The gross margin percentage increased to 59% in Q2 1999, up from 49% in Q2 1998. The improvement in gross margin was primarily a result of lower unit costs in the Intel Architecture Business Group operating segment in 02 1999, as well as the absence of the unusually high inventory write-downs recognized in 02 1998, partially offiet by the impact of lower prices in 02 1999. 03 Cost of sales decreased by 3% in the first mine months of 1999 compared to the first nine months of 1998. In the Intel Architecture Business Group operating segment, lower unit costs for microprocessors in the first nine months of 1999 and the absence in 1999 of the unusually high inventory write-downs recognized in the first nine months of 1998 were partially offset by higher unit sales volumes in the first nine months of 1999. 2001 01 Although the total cost of sales increased 8% in Q1 2001 compared to Q1 2000, the cost of within the Intel Architecture Group operating segment decreased slightly for the same iod. The decrease was primarily due to lower sales volume as well as lower unit costs of per micro costs related as a result of lower cost packaging, partially offset by increased start-up to 300-millimeter wafer manufacturing and 0.13-micron process technology. the "all other" category for segment reporting, higher costs due to higher sales volume of flash memory and the impact of higher inventory reserves in the flash memory and networking and communications businesses more than offset the decreased costs from the Intel Architecture Group. TON AND INVENTORY WRITE-DOWNS EXHIBIT 2- continued INTEL CORP 02 The operating loss increased to $143 miltion in 02 2003 from a $127 million loss in Q2 2002 QUA primarily due to the mix shift to lower-margin wired Ethernet connections. In the current competitive environment, sales of wireless Ethernet connections sold in conjunction with processors and chipsets comprising the Intel Centrino mobile technology also increased the operating loss. These negative impacts were partially offset by lower inventory write-downs, TO Q3, 200 as well as lower operating expenses in 02 2003 as we continued our efforts to streamline operations and refocus on our core strategic areas INVENTORY WRITE-DOW DISCLOSURE 2004 01 Operating income increased $1.1 billion, or 58%, in Q1 2004 compared to Q1 2003. The increase was primarily due to the impact of higher revenue and lower unit costs for microprocessors. These increases were partially offset by a $162 million charge in Q1 2004 relating to a settlement agreement with Intergraph Corporation. In addition, Q1 2003 benefited from the unusually high level of sales of microprocessor and chipset inventory that had been previously reserved. 02 The operating loss decreased to $126 million in 02 2004, from a loss of $255 million in 02 2003. Higher revenue, as wel as the absence of costs incurred in 02 2003 for underutilized factory capacity for flash memory products, improved the operating results. In addition, due to improved demand, sales of flash memory product inventory that had been previously reserved contributed to the lower operating loss. These improvements were partially offset by higher costs for flash memory products as we sold higher density products, as well as the impact of higher inventory write-offs primarily for certain applications and cellular processors. 03 Operating income decreased $109 million, or 4%, in Q3 2004 compared to Q3 2003. The decrease was primarily due to higher operating expenses as well as higher inventory write downs, partially offset by higher revenue from sales of microprocessors (see "Operating Expenses" below for further discussion on operating expense fluctuations). 2006 01 Operating income decreased $1.0 billion, or 42%, in Q1 2006 compared to Q1 2005, The significant decrease was primarily due to lower microprocessor revenue, the impact of increased write-downs of chipset inventory and higher operating expenses. These decreases were partially offset by approximately $190 million of lower start-up costs in 01 2006 02 decreased $250 million, or 11%, in the first half of 2006 compared to the Operating income irst half of 2005. The decline was primarily caused by an increase in operating expenses, and lesser extent, higher write-down of inventory. A majority of the decline was offset by to a the effects of higher revenue, and to a lesser extent, by approximately $170 million of lower start-up costs in the first half of 2006. (continued) CASE 3.1 Intel Corporation and Inventory Write-downs Both the International Financial Reporting Standards (IFRS) and U.S. Generally Accepted Accounting Principles (GAAP) require that inventory be valued at the lower of cost or some measure of what that inventory can be sold for in the market. Under U.S. GAAP, the rule is usually called lower of cost or market, under IFRS it is called lower of cost or net realisoble vave . ventory cost includes the purcha e price, import duties, shipping costs, and simi- lar items. It also includes conversion costs such as direct labor and an allocation of Indirect labor and both variable and fixed production overhead In many instances, the cost of inventories may not be recoverable. Electronics man- ufacturers, such as Dell and Palm, purchased large inventories of chips that were in short supply. When chip manufacturers drastically reduced the price on those chips. Dell and Palm wrote down their inventories. Similarly, when demand for Intel's prod- ucts decline, Intel must write down its inventories. Firms also write down damaged goods, and the fashion industry will write down goods toward the end of a season. when items may sell for less than their cost. Under IFRS, inventories must be written down to lower of cost or "net realisable value" (IAS 2, par. 28), where net realisable value is defined as Net realisable value refers to the net amount that an entity expects to realize from the sale of inventory in the ordinary course of business. Fair value reflects the amount for which the same inventory could be exchanged between knowledgeable and willing buyers and sellers in the marketplace. The former is an entity-specific value; the latter is not. Net realizable value for inventories may not equal fair value less costs to sel (IAS 2, par. 7) Suppose a retailer using IFRS buys a television from its supplier for $325 and ex- pects to sell the television for $425. A week later the supplier drops the price to $275 and in response, the retailer drops its retail price to $375. If the retailer's selling cost is $35, its net realizable value will be $340 ($375 selling price, less $35 selling cost). Its $340 net realizable value is greater than its $325 cost, so the retailer would continue to value the item at its $325 original cost. Here is a typical IFRS inventory disclosure from The Swatch Group's 2008 annual report Inventories are stated at the lower of cost and net realizable value. Cost is determined using the weighted average price method. Some conmpanies, panticulkarty those in the Pro- duction segment, value their inventories using the standard cost method. As these costs are regularly rewiewed and adjusted, this method approximates the results of the weighted average price method. The valuation of spare parts for customer service is confned to those units that are considered ikely to be used, based on historical demand Net realizable value is the estimated selling price in the ordinary course of business, ess estimated costs of completion and the applicable variable selling expenses Under US. GAAP, inventory is written down to the lower of cost or market, but the market is subject to both a celing and a floor. The ceiling is net realizable value, and the floor is net realizable value less.a normal profit margin. In most cases, the differ- ences between U.S. GAAP and IFRS lower of cost or market rules are minimal. SECTION THREE FINANCIAL. REPOR but th disclosures often provide limited information about the write-dw dow write-down. Inventory write firms where new prod Prod Firms are required to disclose inventory write-downs if they are mat ns are particularly common at firms that sell seasonal goods sucl winter coats, or swim suits. They are also common at tech ucts depress the price of older products as prices drop rapidly, following Moo Intel is the world's leading semiconductor producer. The number of Intel's semiconductors has increased by about 50% every 18 months since ab so Intel continually introduces new products, which make obsolete existing7 Because the cost of Intel products declines rapidly, and because Intel new products every quarter, Intel probably has inventory write-downs ever In many quarters, the write-downs have been significant enough to meri uarer some disclosure. In other quarters, Intel only disclosed that there is unce the valuation of obsolete or excess inventory. Most of Intel's 10-Q reports i statement similar to the following from Intels first quarter 2009 10-Q Management Discussion and Analysis of Financial Condition and Results of Operations Inventory The valuation of inventory requires us to estimate obsolete or excess inventory as well as inventory that is not of saleable quality. The determination of otsotete or excess inventory requires us to estimate the future demand for our products. The estimate of future demand is compared to work in process and finished goods inventory levels o determine the amount, if any, of obsolete or excess inventory. As of March 28, 2009, we had total work-in-process inventory of S1,448 million and total finished goods inventory of SI,217 million. The demand forecast is included in the development of our short-term manufacturing plans to enable consistency betuween inventory valuation and build de cisions. Product-specific facts and circumstances reviewed in the inventory valuation process include a review of the customer base, the stage of the product lile cycle of our products, consumer confidence, and customer acceptance of our products, as well as an assessment of the selling price in relation to the product cost. If our demand forecast for specific products is greater than actual demand and we fail to reduce manufacturing output accordingly, or if we fail to forecast the demand accurately, to write off inventory, which would negatively impact our gross margin we could be required Notes to Consolidated Condensed Financial Statements-Unaudited Note 6: Inventories Inventories at the end of each period were as follows: (In millions) Raw materials Work in process Finished goods Total inventories March 28, 2009 $380 1,448 1,217 Dec. 27 2008 $608 1,577 1,559 $3,744 $3,045 1, Intel colounder Gordon Moore observed in 1965 that the number of transistors on a chip approxi mately doubles every two years. That rule, known as Moore's Law, has been extended to the cost ol electronics components such as CPU and memory chips, LCD monitors, and hard drives, and to tihe of consumer electronics products. See www.intel.com/technology/mooreslawindex h CASE 3.1 INTEL CORPORATON AND INVENTORY whmoowNS 141 The valuation of inventory requires us to estimate obsolete or excess inventory as wel as inventory that is not of saleable quality. The determination of obsolete or excess inventory requires us to estimate the future demand for our products. It is reasonably possible that our estimate of future demand or our products could change in the near term and result in additional inventory write-offs, which would negatively impact our gross margn Exhibit 1 summarizes Intel's deferred tax asset from inventory. Intel must record an inventory write-down expense for financial reporting but is not allowed to report inventory write-downs for tax reporting. For example, suppose Intel wrote inventory down by S100 million in Q2 2009. Also suppose Intel was subject to an average in- come tax rate of 30%. For financial reporting, Intel would record the following entry to write down inventory Cost of sales-inventory write-down $100,000,000 Allowance for obsolete inventory $100,000,000 Because this reduces reported financial accounting income by $100 million, it will reduce the provision for income taxes (income tax expense) by $30 million (because of the 30% tax rate). However, because this does not reduce income taxes payable to the IRS, the offsetting debit will be to deferred t tax assets, not to taxes Deferred tax assets 30,000,000 Provision for income taxes $30,000,000 As a result, when Intel's deferred tax asset for inventory valuation in Exhibit 1 increases by $30 million, Intel has increased its allowance for obsolete inventory by about $100 million. Exhibit 2 shows all of Intel's 10-Q inventory write-down disclosures from Q1 1996 through Q3 2009, except for the general statement that inventory write-downs require estimates. Over the years, some analysts suggested that Intel may use excessive inventory write-downs to lower net income in quarters when profit is higher than expected. In subsequent quarters, when profit is lower than expected, those analysts suggested that Intel might sell the written-down inventory at abnormally high profit margins to increase reported profits. Required 1. Evaluate this statement from Intel's Q1 2004 10-Q footnote disclosure (Exhibit 2): In addition, Q1 2003 benefited from the unusually high level of sales of microprocessor and chipset inventory that had been previously reserved. Evaluate this statement from Intel's Q2 2007 10-Q footnote disclosure: "Sales of desktop microprocessor inventory that had been previously written off further offset the effect of the revenue decline." 2. Evaluate this statement from Intel's Q2 2008 10-Q: These increases were partially offset by sales in the first half of 2007 of desktop microprocessor inventory that had been previously written off How much flexibility does Intel have in writing down excess inventories? Explain. 3. 4. 5. Evaluate the quality of the inventory disclosures in Exhibit 2 143 CASE 3.1 INTEL CORPORATON AND INVENTORY W rTE-Downs EXHIBIT 2- 1997 03 INTEL. CORP QUARTERLY Cost of sales declined by 5% from Q1 1996 to Q1 1997 due to shifts in product mix and factory efficiencies due to increased volume. Costs for 01 of 1996 also included unusually high inventory reserves, including reserves related to inventories of certain purchased components. more favorable product mix and the reduced costs discussed above WRITE-DOWN DISCLOSURES, 1996 TO Q3, 2009 Gross margin increased from 48% in Q1 1996 to 64% in Q1 1997 due to the 1998 02 Cost of sales increased by 29% from Q2 1997 to Q2 1998 due to the shift in product mix to the Pentium(R) II processor, reflecting the cost of purchased components for the Single E Contact ("SEC") cartridge, higher unit volumes, and higher fixed costs. In addition, in 02 1998 reductions in product costs on the highest volume processors ca written down to the new lower costs. Gross margin decreased to 49% in 0219 in 02 1997 primarily due to the inventory write-downs and higher fixed costs dge used inventories to be 98 from 61% lower processor prices, the impact of the SEC cartridge, the 1999 02 Cost of sales decreased by 8% in Q2 1999 compared to Q2 1998 primarily due to lower unit costs for microprocessors in 02 1999 partially offset by higher unit sales volumes. In addition, cost of sales in Q2 1998 included unusually high inventory write-downs. The lower unit costs in 02 1999 were achieved primarily through redesigned microprocessor pr with lower-cost packaging, including packaging using fewer purchased components, as as factory efficiencies and lower purchase prices on the purchased components. The gross margin percentage increased to 59% in Q2 1999, up from 49% in Q2 1998. The improvement in gross margin was primarily a result of lower unit costs in the Intel Architecture Business Group operating segment in 02 1999, as well as the absence of the unusually high inventory write-downs recognized in 02 1998, partially offiet by the impact of lower prices in 02 1999. 03 Cost of sales decreased by 3% in the first mine months of 1999 compared to the first nine months of 1998. In the Intel Architecture Business Group operating segment, lower unit costs for microprocessors in the first nine months of 1999 and the absence in 1999 of the unusually high inventory write-downs recognized in the first nine months of 1998 were partially offset by higher unit sales volumes in the first nine months of 1999. 2001 01 Although the total cost of sales increased 8% in Q1 2001 compared to Q1 2000, the cost of within the Intel Architecture Group operating segment decreased slightly for the same iod. The decrease was primarily due to lower sales volume as well as lower unit costs of per micro costs related as a result of lower cost packaging, partially offset by increased start-up to 300-millimeter wafer manufacturing and 0.13-micron process technology. the "all other" category for segment reporting, higher costs due to higher sales volume of flash memory and the impact of higher inventory reserves in the flash memory and networking and communications businesses more than offset the decreased costs from the Intel Architecture Group. TON AND INVENTORY WRITE-DOWNS EXHIBIT 2- continued INTEL CORP 02 The operating loss increased to $143 miltion in 02 2003 from a $127 million loss in Q2 2002 QUA primarily due to the mix shift to lower-margin wired Ethernet connections. In the current competitive environment, sales of wireless Ethernet connections sold in conjunction with processors and chipsets comprising the Intel Centrino mobile technology also increased the operating loss. These negative impacts were partially offset by lower inventory write-downs, TO Q3, 200 as well as lower operating expenses in 02 2003 as we continued our efforts to streamline operations and refocus on our core strategic areas INVENTORY WRITE-DOW DISCLOSURE 2004 01 Operating income increased $1.1 billion, or 58%, in Q1 2004 compared to Q1 2003. The increase was primarily due to the impact of higher revenue and lower unit costs for microprocessors. These increases were partially offset by a $162 million charge in Q1 2004 relating to a settlement agreement with Intergraph Corporation. In addition, Q1 2003 benefited from the unusually high level of sales of microprocessor and chipset inventory that had been previously reserved. 02 The operating loss decreased to $126 million in 02 2004, from a loss of $255 million in 02 2003. Higher revenue, as wel as the absence of costs incurred in 02 2003 for underutilized factory capacity for flash memory products, improved the operating results. In addition, due to improved demand, sales of flash memory product inventory that had been previously reserved contributed to the lower operating loss. These improvements were partially offset by higher costs for flash memory products as we sold higher density products, as well as the impact of higher inventory write-offs primarily for certain applications and cellular processors. 03 Operating income decreased $109 million, or 4%, in Q3 2004 compared to Q3 2003. The decrease was primarily due to higher operating expenses as well as higher inventory write downs, partially offset by higher revenue from sales of microprocessors (see "Operating Expenses" below for further discussion on operating expense fluctuations). 2006 01 Operating income decreased $1.0 billion, or 42%, in Q1 2006 compared to Q1 2005, The significant decrease was primarily due to lower microprocessor revenue, the impact of increased write-downs of chipset inventory and higher operating expenses. These decreases were partially offset by approximately $190 million of lower start-up costs in 01 2006 02 decreased $250 million, or 11%, in the first half of 2006 compared to the Operating income irst half of 2005. The decline was primarily caused by an increase in operating expenses, and lesser extent, higher write-down of inventory. A majority of the decline was offset by to a the effects of higher revenue, and to a lesser extent, by approximately $170 million of lower start-up costs in the first half of 2006. (continued)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts