Question: Case 3-2 please Discuss when American Airlines should recognize the revenue from ticket sales to prop match revenues and expenses. erly Case 3-2 Adjustments for

Case 3-2 please

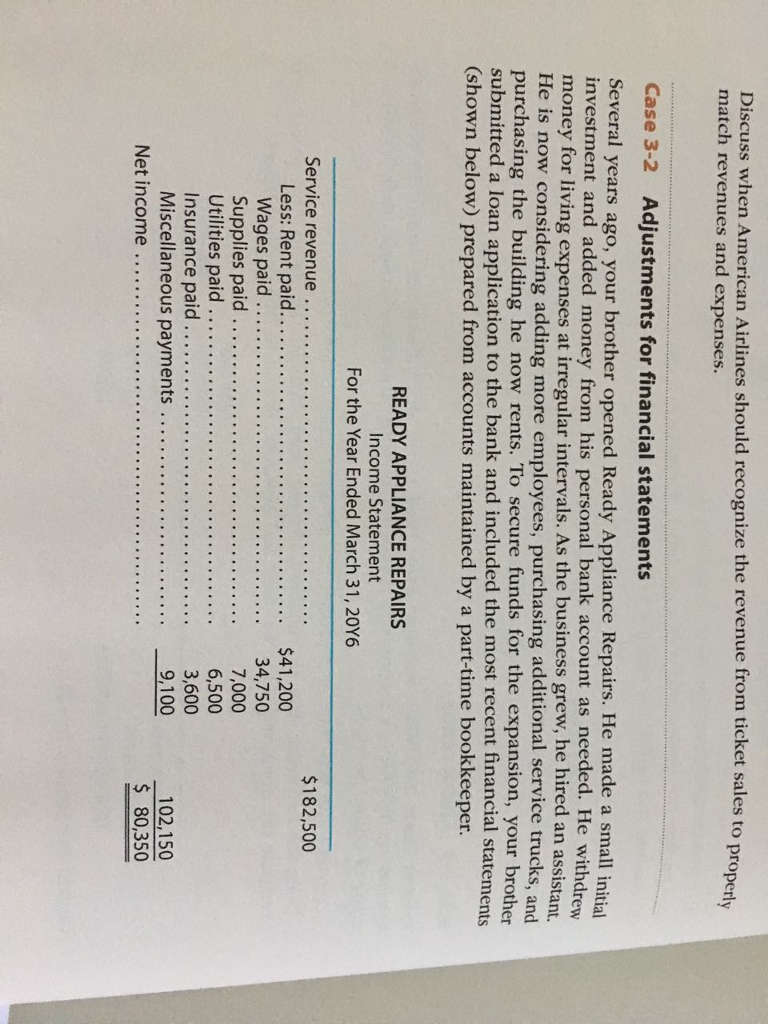

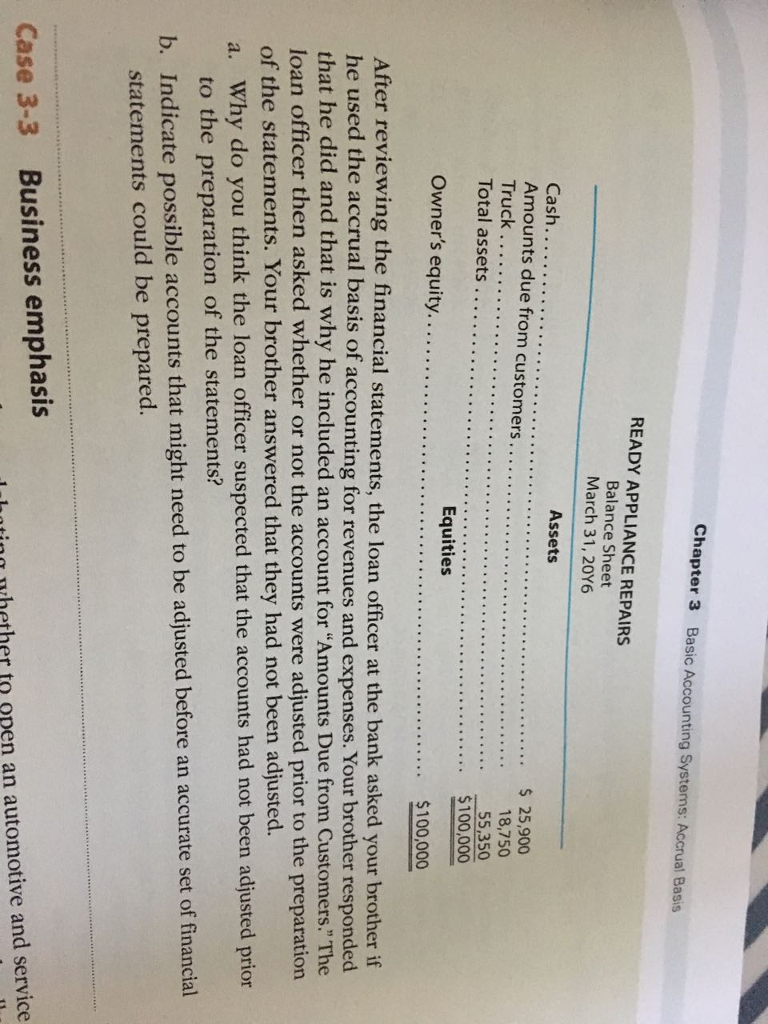

Discuss when American Airlines should recognize the revenue from ticket sales to prop match revenues and expenses. erly Case 3-2 Adjustments for financial statements Several years ago, your brother opened Ready Appliance Repairs. He made a small initial investment and added money from his personal bank account as needed. He withdrew money for living expenses at irregular intervals. As the business grew, he hired an assistant, He is now considering adding more employees, purchasing additional service trucks, and purchasing the building he now rents. To secure funds for the expansion, your brother submitted a loan application to the bank and included the most recent financial statements (shown below) prepared from accounts maintained by a part-time bookkeeper. READY APPLIANCE REPAIRS Income Statement For the Year Ended March 31, 20Y6 $182,500 $41,200 6,500 102,150 80,350 9,100

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts