Question: CASE 4 (20 points) Consider the following situations: 1. Your company has been offered credit terms of 5/20, net 90 days. What will be the

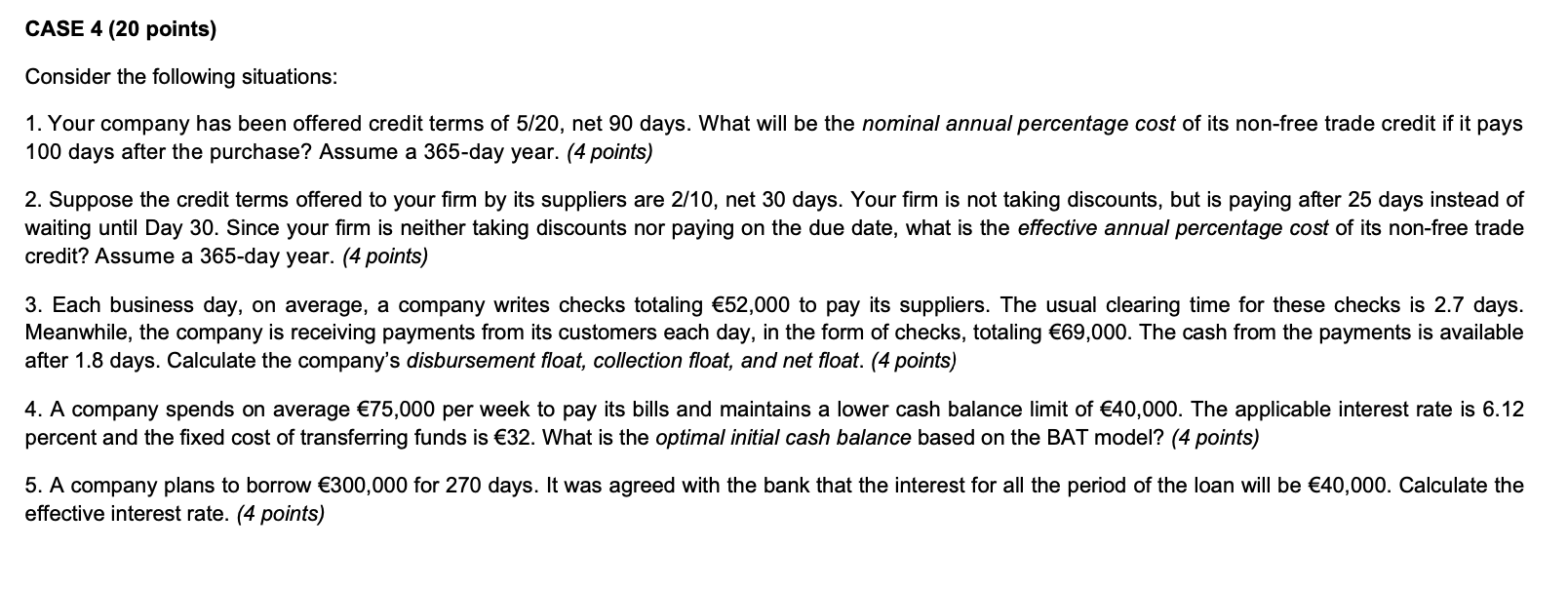

CASE 4 (20 points) Consider the following situations: 1. Your company has been offered credit terms of 5/20, net 90 days. What will be the nominal annual percentage cost of its non-free trade credit if it pays 100 days after the purchase? Assume a 365-day year. (4 points) 2. Suppose the credit terms offered to your firm by its suppliers are 2/10, net 30 days. Your firm is not taking discounts, but is paying after 25 days instead of waiting until Day 30. Since your firm is neither taking discounts nor paying on the due date, what is the effective annual percentage cost of its non-free trade credit? Assume a 365-day year. (4 points) 3. Each business day, on average, a company writes checks totaling 52,000 to pay its suppliers. The usual clearing time for these checks is 2.7 days. Meanwhile, the company is receiving payments from its customers each day, in the form of checks, totaling 69,000. The cash from the payments is available after 1.8 days. Calculate the company's disbursement float, collection float, and net float. (4 points) 4. A company spends on average 75,000 per week to pay its bills and maintains a lower cash balance limit of 40,000. The applicable interest rate is 6.12 percent and the fixed cost of transferring funds is 32. What is the optimal initial cash balance based on the BAT model? (4 points) 5. A company plans to borrow 300,000 for 270 days. It was agreed with the bank that the interest for all the period of the loan will be 40,000. Calculate the effective interest rate. (4 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts