Question: Case 4. Bonds. (30 points = 5 x 6 points) a. A corporate treasurer decides to purchase a 20-year Treasury bonds with a 4 percent

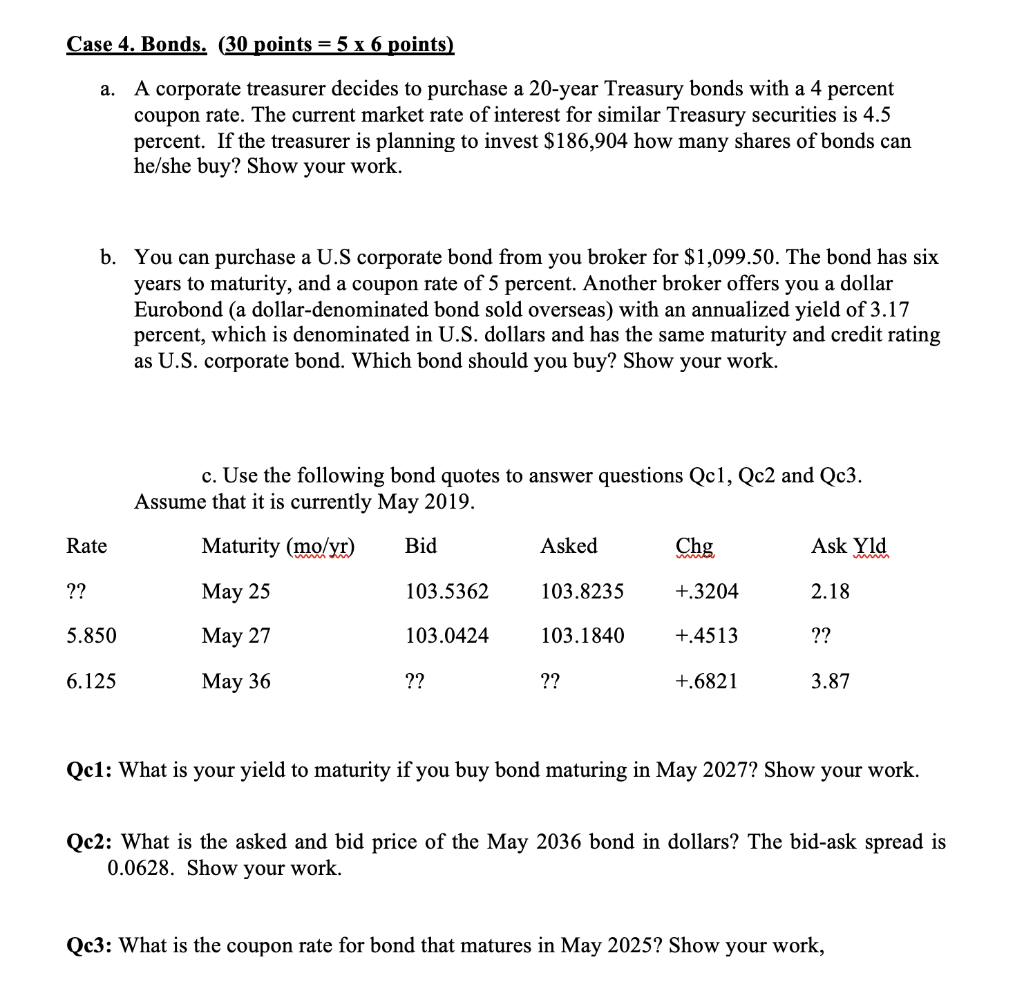

Case 4. Bonds. (30 points = 5 x 6 points) a. A corporate treasurer decides to purchase a 20-year Treasury bonds with a 4 percent coupon rate. The current market rate of interest for similar Treasury securities is 4.5 percent. If the treasurer is planning to invest $186,904 how many shares of bonds can he/she buy? Show your work. b. You can purchase a U.S corporate bond from you broker for $1,099.50. The bond has six years to maturity, and a coupon rate of 5 percent. Another broker offers you a dollar Eurobond (a dollar-denominated bond sold overseas) with an annualized yield of 3.17 percent, which is denominated in U.S. dollars and has the same maturity and credit rating as U.S. corporate bond. Which bond should you buy? Show your work. c. Use the following bond quotes to answer questions Qc1, c2 and Qc3. Assume that it is currently May 2019. Rate Maturity (mo/yr) Bid Asked Chg Ask Yld ?? May 25 103.5362 103.8235 +.3204 2.18 5.850 May 27 103.0424 103.1840 +.4513 ?? 6.125 May 36 ?? ?? +.6821 3.87 Qc1: What is your yield to maturity if you buy bond maturing in May 2027? Show your work. Qc2: What is the asked and bid price of the May 2036 bond in dollars? The bid-ask spread is 0.0628. Show your work. Qc3: What is the coupon rate for bond that matures in May 2025? Show your work

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts