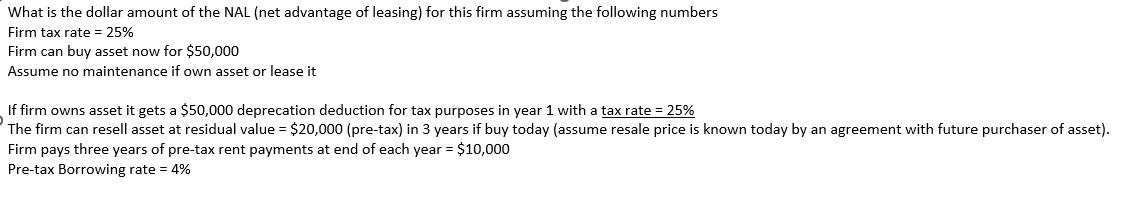

Question: What is the dollar amount of the NAL (net advantage of leasing) for this firm assuming the following numbers Firm tax rate = 25%

What is the dollar amount of the NAL (net advantage of leasing) for this firm assuming the following numbers Firm tax rate = 25% Firm can buy asset now for $50,000 Assume no maintenance if own asset or lease it If firm owns asset it gets a $50,000 deprecation deduction for tax purposes in year 1 with a tax rate = 25% The firm can resell asset at residual value = $20,000 (pre-tax) in 3 years if buy today (assume resale price is known today by an agreement with future purchaser of asset). Firm pays three years of pre-tax rent payments at end of each year = $10,000 Pre-tax Borrowing rate = 4%

Step by Step Solution

3.44 Rating (151 Votes )

There are 3 Steps involved in it

if assets buy Depreciation schedule Year 1 2 3 Opening value 50000 37500 28125 Depre... View full answer

Get step-by-step solutions from verified subject matter experts