Question: Case 4.2 Applied Material Comprehensive Analysis Case Using the Financial Statement Analysis Template You will be using the Financial Statement Analysis Template that you started

Case 4.2 Applied Material Comprehensive Analysis Case Using the Financial Statement Analysis Template

You will be using the Financial Statement Analysis Template that you started on in Case 1.2 so you need to locate that on your computer. You will also be using the 2013 Form 10-K for Applied Materials which you can locate at this link: Applied Materials 2013 10-K

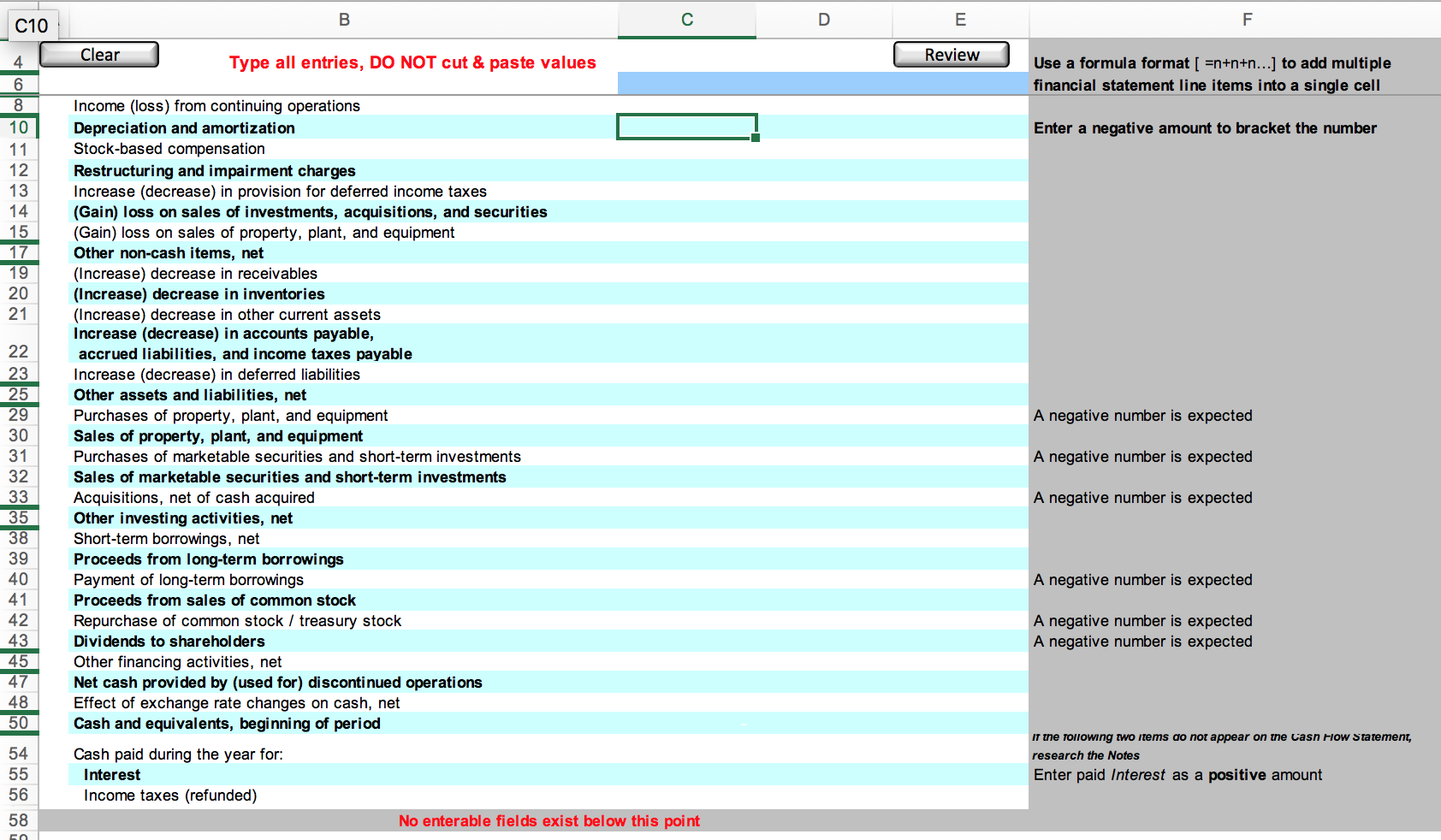

(a) Input the data from the Applied Materials cash flow statement. When you have finished inputting the data, review the cash flow statement to make sure there are no red blocks indicating that your numbers do not match the cover sheet information you input from the Chapter 1 problem. There will be blanks on the cash flow statement and some lines will require you to add two lines together. At the bottom, you must finish the whole statement including the beginning cash balances. The summary analysis of the cash flow statements will automatically be created for you and you can find it by clicking on the tab at the bottom called summary of cash flows. You will be answering fill-in-the-blank questions using the cash flow statement and the summary.

(b) Using the cash flow statements, summary analysis and the Management Discussion & Analysis section of the Form 10-K, you will answer questions regarding the ability of Applied Materials to generate cash flows and the appropriateness of the use of cash flows.

case 1.2

C10 4 L Clear Type all entries, DO NOT cut & paste values Review Use a formula format [ =n+n+n...) to add multiple financial statement line items into a single cell 6 8 101 11 . Enter a negative amount to bracket the number 12 13 14 15 17 19 20 22 Income (loss) from continuing operations Depreciation and amortization Stock-based compensation Restructuring and impairment charges Increase (decrease) in provision for deferred income taxes (Gain) loss on sales of investments, acquisitions, and securities (Gain) loss on sales of property, plant, and equipment Other non-cash items, net (Increase) decrease in receivables (Increase) decrease in inventories (Increase) decrease in other current assets Increase (decrease) in accounts payable, accrued liabilities, and income taxes payable Increase (decrease) in deferred liabilities Other assets and liabilities, net Purchases of property, plant, and equipment Sales of property, plant, and equipment Purchases of marketable securities and short-term investments Sales of marketable securities and short-term investments Acquisitions, net of cash acquired Other investing activities, net Short-term borrowings, net Proceeds from long-term borrowings Payment of long-term borrowings Proceeds from sales of common stock Repurchase of common stock/ treasury stock Dividends to shareholders Other financing activities, net Net cash provided by (used for) discontinued operations Effect of exchange rate changes on cash, net Cash and equivalents, beginning of period A negative number is expected 31 A negative number is expected 32 33 A negative number is expected 35 38 39 40 A negative number is expected 41 42 43 45 47 A negative number is expected A negative number is expected 48 50 54 If the following two items do not appear on the Cash Flow Statement, research the Notes Enter paid Interest as a positive amount Cash paid during the year for: Interest Income taxes (refunded) 55 58 No enterable fields exist below this point 50 C10 4 L Clear Type all entries, DO NOT cut & paste values Review Use a formula format [ =n+n+n...) to add multiple financial statement line items into a single cell 6 8 101 11 . Enter a negative amount to bracket the number 12 13 14 15 17 19 20 22 Income (loss) from continuing operations Depreciation and amortization Stock-based compensation Restructuring and impairment charges Increase (decrease) in provision for deferred income taxes (Gain) loss on sales of investments, acquisitions, and securities (Gain) loss on sales of property, plant, and equipment Other non-cash items, net (Increase) decrease in receivables (Increase) decrease in inventories (Increase) decrease in other current assets Increase (decrease) in accounts payable, accrued liabilities, and income taxes payable Increase (decrease) in deferred liabilities Other assets and liabilities, net Purchases of property, plant, and equipment Sales of property, plant, and equipment Purchases of marketable securities and short-term investments Sales of marketable securities and short-term investments Acquisitions, net of cash acquired Other investing activities, net Short-term borrowings, net Proceeds from long-term borrowings Payment of long-term borrowings Proceeds from sales of common stock Repurchase of common stock/ treasury stock Dividends to shareholders Other financing activities, net Net cash provided by (used for) discontinued operations Effect of exchange rate changes on cash, net Cash and equivalents, beginning of period A negative number is expected 31 A negative number is expected 32 33 A negative number is expected 35 38 39 40 A negative number is expected 41 42 43 45 47 A negative number is expected A negative number is expected 48 50 54 If the following two items do not appear on the Cash Flow Statement, research the Notes Enter paid Interest as a positive amount Cash paid during the year for: Interest Income taxes (refunded) 55 58 No enterable fields exist below this point 50

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts