Question: Case 5 (6 marks) John is 58 years old and has net rental income of $114,000. He is divorced and has been awarded custody of

Case 5 (6 marks) John is 58 years old and has net rental income of $114,000. He is divorced and has been awarded custody of his 21 year old disabled son. The son qualifies for the disability tax credit and has Net Income For Tax Purposes of $8,430. He is dependent on his father for support.

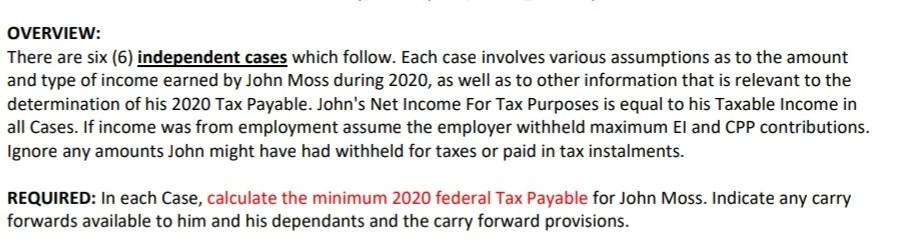

OVERVIEW: There are six (6) independent cases which follow. Each case involves various assumptions as to the amount and type of income earned by John Moss during 2020, as well as to other information that is relevant to the determination of his 2020 Tax Payable. John's Net Income For Tax Purposes is equal to his Taxable income in all Cases. If income was from employment assume the employer withheld maximum El and CPP contributions. Ignore any amounts John might have had withheld for taxes or paid in tax instalments. REQUIRED: In each Case, calculate the minimum 2020 federal Tax Payable for John Moss. Indicate any carry forwards available to him and his dependants and the carry forward provisions. OVERVIEW: There are six (6) independent cases which follow. Each case involves various assumptions as to the amount and type of income earned by John Moss during 2020, as well as to other information that is relevant to the determination of his 2020 Tax Payable. John's Net Income For Tax Purposes is equal to his Taxable income in all Cases. If income was from employment assume the employer withheld maximum El and CPP contributions. Ignore any amounts John might have had withheld for taxes or paid in tax instalments. REQUIRED: In each Case, calculate the minimum 2020 federal Tax Payable for John Moss. Indicate any carry forwards available to him and his dependants and the carry forward provisions

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts