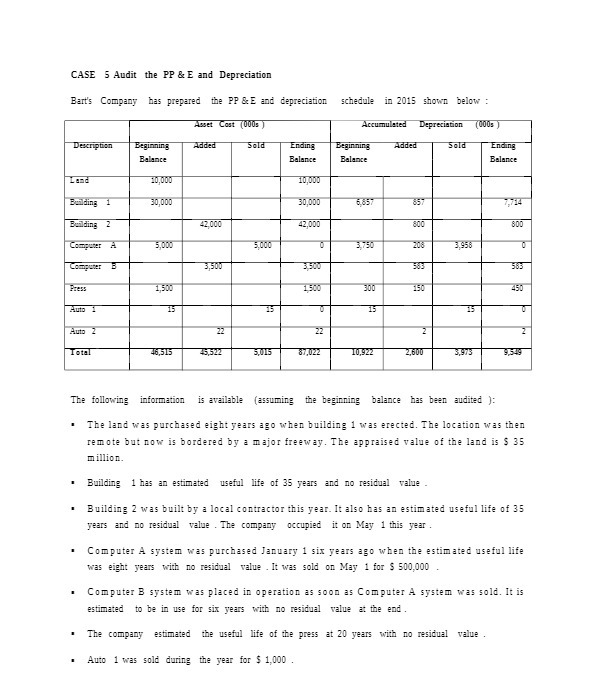

Question: CASE 5 Audit the PP & E and Depreciation Bart's Company has prepared the PP & E and depreciation schedule in 2015 shown below :

CASE 5 Audit the PP & E and Depreciation Bart's Company has prepared the PP & E and depreciation schedule in 2015 shown below : Asset Cost (000. ) Accumulated Depreciation (000s ) Description Beginning Added Sold Ending Beginning Added Sold Ending Balance Balance Balance Balance 10,00% 10,000 Building 1 30.000 30.000 Building 2 42.000 42,000 800 800 Computer A 5,00 3750 3.958 Computer 3,500 583 1,50 300 450 Auto 1 15 15 15 Auto 2 22 Total 45 527 87,UZZ 10,922 3,975 The following information is available (assuming the beginning balance has been audited ): The land was purchased eight years ago when building I was erected. The location was then remote but now is bordered by a major freeway. The appraised value of the land is $ 35 million. Building 1 has an estimated useful life of 35 years and no residual value Building 2 was built by a local contractor this year. It also has an estimated useful life of 35 years and no residual value . The company occupied it on May 1 this year Computer A system was purchased January 1 six years ago when the estimated useful life was eight years with no residual value . It was sold on May 1 for $ 500,000 . Computer B system was placed in operation as soon as Computer A system was sold. It is estimated to be in use for six years with no residual value at the end The company estimated the useful life of the press at 20 years with no residual value . . Auto 1 was sold during the year for $ 1,000

Step by Step Solution

There are 3 Steps involved in it

To audit the PPE and Depreciation for Barts Company lets verify the calculations given the provided data Step 1 Verify Depreciation for Each Asset Bui... View full answer

Get step-by-step solutions from verified subject matter experts