Question: Case 5: Classify the following lease . . On January 1, 2021, Sans Serif Publishers leased printing equipment from First LeaseCorp. First LeaseCorp purchased the

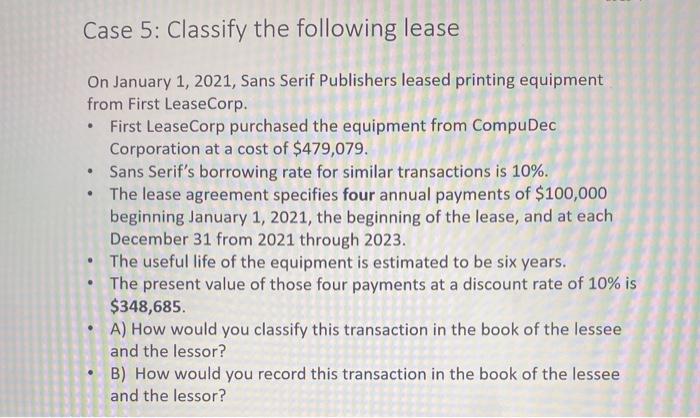

Case 5: Classify the following lease . . On January 1, 2021, Sans Serif Publishers leased printing equipment from First LeaseCorp. First LeaseCorp purchased the equipment from CompuDec Corporation at a cost of $479,079. Sans Serif's borrowing rate for similar transactions is 10%. The lease agreement specifies four annual payments of $100,000 beginning January 1, 2021, the beginning of the lease, and at each December 31 from 2021 through 2023. The useful life of the equipment is estimated to be six years. The present value of those four payments at a discount rate of 10% is $348,685 A) How would you classify this transaction in the book of the lessee and the lessor? B) How would you record this transaction in the book of the lessee and the lessor

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts