Question: Case 5 - Exercise 2 Abernethy and Chapman Internal Control Evaluation Client: Prepared by: Date: Exhibit 5-2 is a portion of the audit program that

Case 5 - Exercise 2

Case 5 - Exercise 2

Abernethy and Chapman

Internal Control Evaluation

Client:

Prepared by:

Date:

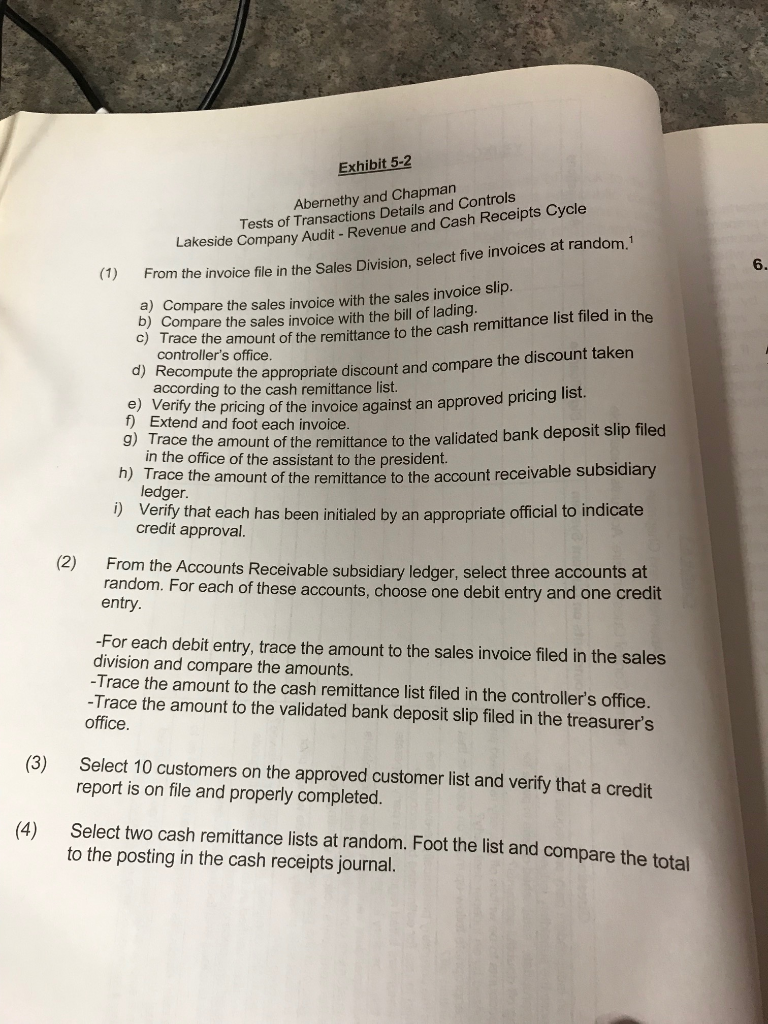

Exhibit 5-2 is a portion of the audit program that Mitchell designed to test the operating efficiency of controls in the revenue and cash receipts cycle. For each individual test, indicate the anticipated results if the control procedure is working properly. Also, if the control is not functioning properly, list the potential problems that exist. Use the following format for your response:

| Step | Anticipated Results | Potential Problem(s) |

| 1-A | The total listed on the sales invoice should agree with the total on the sales invoice slip. In addition, evidence should be present to indicate that a Lakeside employee has already made this same comparison. | If the invoices do not agree, the possibility is raised that fictitious or misstated sales are being recorded. Lack of tangible evidence (e.g., initials) that the matching procedure has been carried out would indicate that the employees are not complying with the requirements of the system. |

| 1-B | ||

| 1-C | ||

| 1-D | ||

| 1-E | ||

| 1-F | ||

| 1-G | ||

| 1-H | ||

| 1-I | ||

| 2-A | ||

| 2-B | ||

| 2-C | ||

| 3 | ||

| 4 |

Exhibit Abernethy and Chapman Tests of Transactions Details and Controls Lakeside Company Audit - Revenue and Cash Receipts Cycle From the invoice file in the Sales Division, select five invoices at random.1 a) Compare the sales invoice with the sales invoice slip. b) Compare the sales invoice with the bill of lading. 6. c) Trace the a ace the amount of the remittance to the cash remittance list filed in the controller's office. a) Recompute the appropriate discount and compare the discount taken e) Ver according to the cash remittance list. . rity the pricing of the invoice against an approved pricing list f) Extend and foot each invoice g) Trace th e amount of the remittance to the validated bank deposit slip filed in the office of the assistant to the president. h) Trace the amount of the remittance to the account receivable subsidiary ledger )Verify that each has been initialed by an appropriate official to indicate credit approval (2) From the Accounts Receivable subsidiary ledger, select three accounts at random. For each of these accounts, choose one debit entry and one credit entry. -For each debit entry, trace the amount to the sales invoice filed in the sales division and compare the amounts. Trace the amount to the cash remittance list filed in the controller's office. -Trace the amount to the validated bank deposit slip filed in the treasurer's office. (3) Select 10 customers on the approved customer list and verify that a credit report is on file and properly completed. Select two cash remittance lists at random. Foot the list and compare the total to the posting in the cash receipts journal. (4) Exhibit Abernethy and Chapman Tests of Transactions Details and Controls Lakeside Company Audit - Revenue and Cash Receipts Cycle From the invoice file in the Sales Division, select five invoices at random.1 a) Compare the sales invoice with the sales invoice slip. b) Compare the sales invoice with the bill of lading. 6. c) Trace the a ace the amount of the remittance to the cash remittance list filed in the controller's office. a) Recompute the appropriate discount and compare the discount taken e) Ver according to the cash remittance list. . rity the pricing of the invoice against an approved pricing list f) Extend and foot each invoice g) Trace th e amount of the remittance to the validated bank deposit slip filed in the office of the assistant to the president. h) Trace the amount of the remittance to the account receivable subsidiary ledger )Verify that each has been initialed by an appropriate official to indicate credit approval (2) From the Accounts Receivable subsidiary ledger, select three accounts at random. For each of these accounts, choose one debit entry and one credit entry. -For each debit entry, trace the amount to the sales invoice filed in the sales division and compare the amounts. Trace the amount to the cash remittance list filed in the controller's office. -Trace the amount to the validated bank deposit slip filed in the treasurer's office. (3) Select 10 customers on the approved customer list and verify that a credit report is on file and properly completed. Select two cash remittance lists at random. Foot the list and compare the total to the posting in the cash receipts journal. (4)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts